It’s all about the BaaS. No treble.

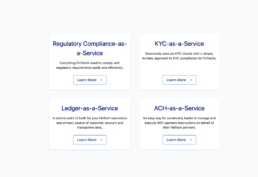

Whether you’re a seasoned Banking-as-a-Service (BaaS) veteran or considering BaaS for the first time, our FinTech-as-a-Service platform provides the tools to streamline reconciliation, compliance risk and operations, while protecting your banking license. Explore what our platform can do for you.

Dream big. We’ll bring fuel.

Our marketplace approach helps expand the supply of prospective banks to compete for your business, while our FinTech-as-a-Service platform allows you to choose the tools and services you need to minimize risk, remain compliant and increase operational efficiency.

Synctera News & Social

Synctera raises $15M to help companies launch embedded banking products in Canada – TechCrunch

Synctera signs on Marqeta and Mastercard as new partners and launch Card API and adds new Community Bank – Synctera Blog

Synctera Raises $33M Series A, Accelerates Growth Following Record Demand From Community Banks and FinTechs – Synctera Team

Synctera Aims $33M Series A At Developing Banking-as-a-Service – Crunchbase

Synctera [fintech marketplace]

Synctera brings community banks

and FinTechs together.

One part marketplace. One part Fintech-as-a-Service platform. Synctera gives you everything you need to stand up a successful partnership, freeing up time to focus on what you do best. By streamlining day-to-day reconciliation, regulatory compliance and operational processes, we unlock growth opportunities, increase efficiency, minimize compliance risk and accelerate speed to market.

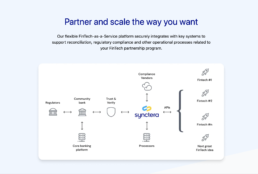

THE SYNCTERA PLATFORM

The flexible FinTech-as-a-Service platform securely integrates with key systems to support reconciliation, regulatory compliance and other operational processes related to your FinTech partnership program.

ClientSyncteraLinkSynctera.com