Global bank and tech platform Kapital announced they have closed an oversubscribed $40 million Series B equity financing round and $125 million debt raise. Tribe Capital led the Series B, with participation from Cervin Ventures, Tru Arrow, MS&AD Ventures, Alumni Ventures among others.

ALSO READ:

Thriving in a desert: Kapital’s evolution building fintech in a capital-scarce world – Tribe Capital

Since announcing a $23 million Series A funding round and $45 million debt facility in May 2023, Kapital has continued to grow rapidly, fueled by its acquisition of Banco Autofin Mexico S.A. in September 2023. With these developments, Kapital is building a vertically integrated tech platform stretching beyond its current reach of loans, credit cards, invoicing and expense management – into payroll and benefits services, as well as treasury accounts.

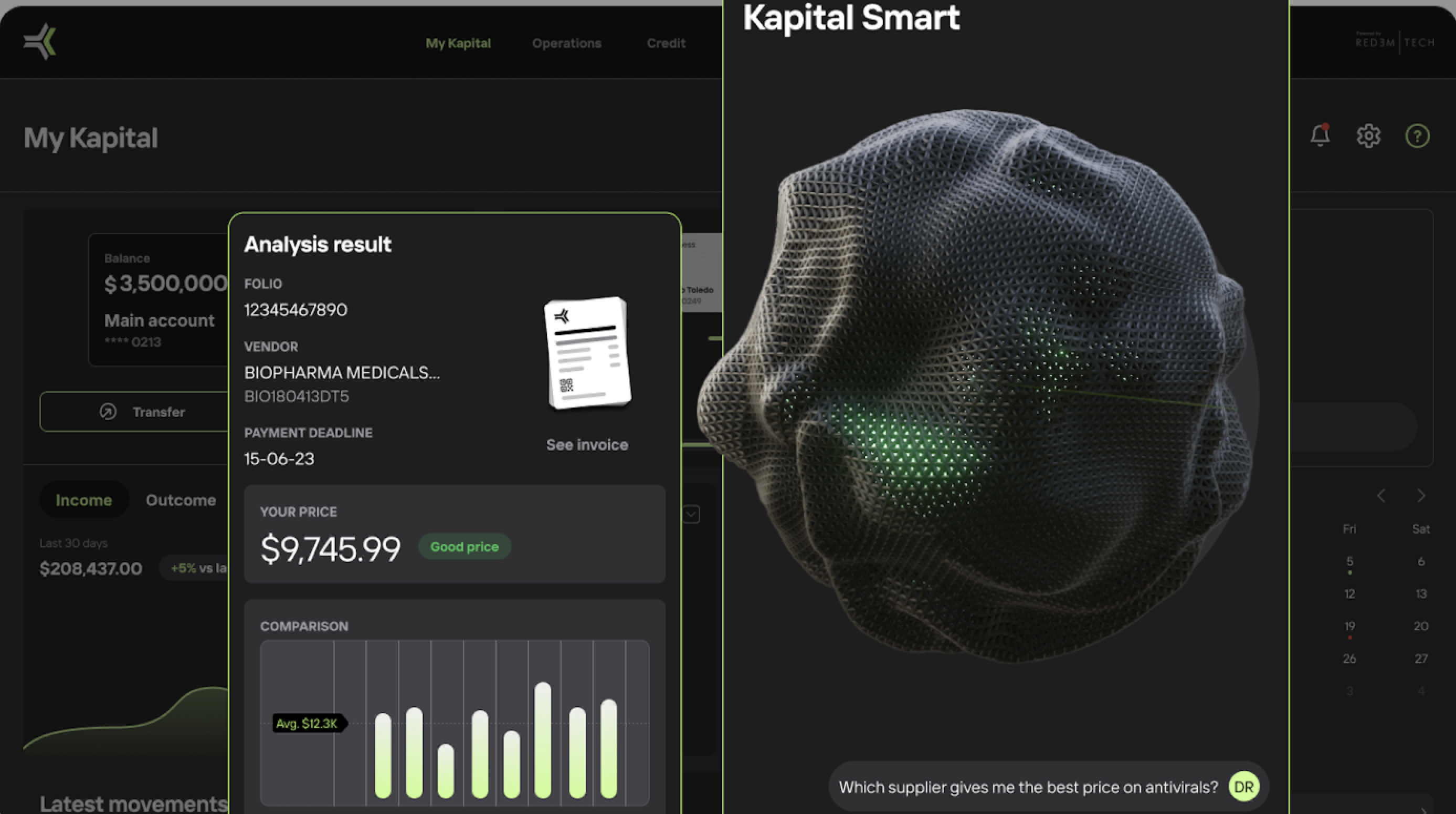

Kapital leverages data and artificial intelligence (AI) to provide SMEs with sophisticated enterprise technology that rivals what is typically only available for large corporations via ERPs. With a Kapital account, SMEs can see and manage their business cash flows in real-time dashboards.

Kapital will use the funds to invest further in its R&D and tech platform to strengthen its cross-border offering and grow its product suite to provide insights for its customers. For example, it is using predictive analytics to benchmark how these businesses can improve margins by selecting different vendors. Kapital already uses AI to underwrite loans to SMEs. SMEs represent 90% of businesses worldwide per the World Bank1, yet in Mexico they represent only 10.5% of the total bank credit available for businesses (OECD2).

“Our recent funding round will propel us forward as we embark on an exciting expansion across Latin America and beyond. Over 80,000 customers already entrust us with the financial health of their businesses, and we are introducing more AI-driven products while pushing into new markets,” said Rene Saul, Kapital’s CEO and Co-Founder. “We are grateful for the confidence our customers and our investors have shown in us, and we are excited for Kapital’s bright future ahead.”

“Kapital is punching way above its weight,” said Arjun Sethi, Chairman and CIO at Tribe Capital. “So many financial platforms raise billions before achieving this level of success: They’ve not only achieved venture-scale growth in a fraction of the time, but they’ve also done so profitably. And they’re just getting started: Kapital is in Latin America today, but the potential of the platform and the company’s growth aspirations are very much global. I can’t wait to see them grow from $100 million run rate revenue to $1 billion of revenue over the coming years.”

About Kapital

Kapital is a global bank and tech platform that is leveraging AI to disrupt the way that small and medium size enterprises operate. Today it serves 80,000 clients in Mexico, Colombia and Peru, bringing them best-in-class enterprise tech that is typically available only to large companies, at a fraction of the cost. Kapital’s vertically-integrated platform gives SMEs real-time visibility into their business operations and cash flows, while empowering seamless management of loans, payroll, benefits and invoicing. Learn more at https://www.kapital.mx/

1 World Bank SME Finance

2 30. Mexico | Financing SMEs and Entrepreneurs 2022 : An OECD Scoreboard | OECD iLibrary (oecd-ilibrary.org)