Corelight cybersecurity closes $75 Million Series D Funding with Energy Impact Partners, H.I.G. Growth Partners, CrowdStrike and Capital One Ventures

We are thrilled to announce joining Corelight's Series D round and disruptive cybersecurity innovation journey with world-class investors Energy Impact Partners, H.I.G. Growth Partners, CrowdStrike, Gaingels and Capital One Ventures.

Also Read:

Corelight secures $75M Series D to bolster its network defense offering - TechCrunch

Follow Corelight on Twitter | LinkedIn | Youtube

Corelight, provider of the industry’s first open network detection and response (NDR) platform, today announced it has raised $75 million in Series D investment led by Energy Impact Partners (EIP).

Previous investors Accel, General Catalyst, Insight Partners and Osage University Partners also joined the round, as well as new investor H.I.G. Growth Partners, and strategic investment from Capital One Ventures, CrowdStrike Falcon Fund, and Gaingels. Corelight has raised a total of $160 million to date, with this latest round fueling acceleration of both global market presence and development of new data and cloud offerings.

Corelight is the fastest-growing NDR platform, serving defenders in some of the world’s largest financial institutions, retail and healthcare organizations, critical infrastructure providers, and government agencies. Building on more than 20 years of open source development and community-driven insight, Corelight provides security teams with the world’s best network evidence so they can close investigations quickly, even when incidents go back years.

“This latest investment is a powerful affirmation not only of the network detection and response category, but also of our open-source heritage, data-centric approach, and commitment to customer success,” said Brian Dye, CEO of Corelight. “I am grateful for our investors’ partnership as we help organizations around the world move to a data-driven security strategy.”

Lead investor EIP is a global investment platform backed by a large coalition of forward-looking utilities and industrial partners and focused on investing in cybersecurity, digital transformation, utility infrastructure and the broader energy transition.

“EIP’s focus on critical infrastructure providers is highly aligned with both our mission and market traction,” said Dye. “Helping these institutions defend against increasingly sophisticated attackers is essential given their role in society and the economy.”

“Corelight’s strong NDR technology, rooted in open source, has had a significant impact across industries and is rapidly becoming the de-facto standard for sophisticated defenders,” said Shawn Cherian, partner at EIP. “We look forward to supporting them as they expand their existing footprint within the sustainable energy, manufacturing and other critical infrastructure sectors.”

New investor H.I.G. Growth Partners is the dedicated growth capital investment affiliate of H.I.G. Capital and focuses on certain high-growth sectors where it has extensive in-house expertise such as technology, healthcare, internet and media, consumer products, and technology-enabled financial and business services.

“Corelight helps some of the world’s most advanced companies protect and secure their networks from cyber threats,” said Scott Hilleboe, managing director at H.I.G. Growth Partners. “By leveraging Zeek, the industry’s leading open-source data platform, Corelight is uniquely positioned to help security operations teams become more efficient in threat inspection, response, and remediation. We have been incredibly impressed by the company’s exceptional growth and are excited to partner with a world-class organization.”

Strategic investments signal solid support for Corelight’s Open NDR strategy and the company’s commitment to diversity

“These strategic investors mirror our strategy, market focus, and values as an organization,” said Dye. “Each brings a unique perspective that will improve our ability to deliver data-centric security.”

The CrowdStrike Falcon Fund focuses on both early-stage and strategic investments in companies that are building solutions that integrate with the CrowdStrike Falcon® platform.

“Corelight and CrowdStrike’s strong shared commitment to data-centric security makes this a strong fit within the Falcon Fund portfolio,” said Michael Sentonas, CTO at CrowdStrike. “We are excited to support Corelight’s continued innovation in the NDR category and the growth of their new data and cloud offerings. As cyber threats increase in number and complexity, the importance of solutions like Corelight have never been greater, providing increased visibility and comprehensive data that allows organizations to identify vulnerabilities and resolve security issues faster.”

Capital One Ventures is a strategic investor, funding startups that are driving the future of data, technology and financial services, including cybersecurity companies.

“We root our decisions on which companies we invest in based on the impact we believe those companies will have on their customers,” said Jay Emmanuel, partner at Capital One Ventures. “Partnering with Corelight in this round is a natural extension of the work we have been doing with open source NDR tools and the investments we have been making in strong cyber security solutions. We are thrilled to work with Corelight on new opportunities.”

Gaingels is the leading investment syndicate in support of and representing the LGBTQ+ community and allies in the venture capital space. Gaingels invests in companies with LGBTQ+ founders and C-suite leaders at all stages of growth, as well as in other high-growth companies resolved on building more inclusive teams.

“As the largest investor network focused on supporting and investing in the best venture-backed companies that embrace and value diverse leadership, including LGBTQ+, Gaingels is proud to be participating in this financing round with Corelight,” said Lorenzo Thione, managing director of Gaingels. “Our team is resolved on helping the company grow and scale while strengthening its prospects of success by building a culture that reflects the diversity of its executive teams, staff and customers.”

Corelight is continuing to invest in hiring diverse talent across all levels of the business around the globe. More information on job openings can be found on the Corelight careers page.

About Corelight

Corelight provides security teams with network evidence so they can protect the world’s most critical organizations and companies. Corelight’s global customers include Fortune 500 companies, major government agencies, and large research universities. The company has received investment support from Accel, General Catalyst, Insight Partners and Osage University Partners. Based in San Francisco, Corelight is an open-core security company founded by the creators of Zeek, the widely-used network security technology. For more information, www.corelight.com.

About Energy Impact Partners

Energy Impact Partners (EIP) is a global investment platform leading the transition to a sustainable energy future. EIP brings together entrepreneurs and the world's most forward-looking energy and industrial companies to advance innovation. With over $2.0 billion in assets under management, EIP invests globally across venture, growth, credit and infrastructure – and has a team of more than 50 professionals based in its offices in New York, San Francisco, Palm Beach, London, Cologne, and soon Oslo. For more information, visit www.energyimpactpartners.com.

About H.I.G. Growth Partners

H.I.G. Growth Partners is the dedicated growth capital investment affiliate of H.I.G. Capital, a leading global alternative investment firm with $45 billion of equity capital under management. H.I.G. Growth seeks to make both majority and minority investments in strong, growth-oriented businesses located throughout North America, Europe and Latin America. H.I.G. Growth Partners considers investments across all industries but focuses on certain high-growth sectors where it has extensive in-house expertise such as technology, healthcare, internet and media, consumer products and technology-enabled financial and business services. H.I.G. Growth strives to work closely with its management teams to serve as an experienced resource, providing broad-based strategic, operational, recruiting, and financial management services from a vast in-house team and a substantial network of third-party relationships. For more information, please refer to the H.I.G. website at www.HIGgrowth.com.

Octane digital lending closes $52M series D at a $900M valuation with Progressive, Valar & Citi Ventures

We are excited to announce our joining the Octane series D round with Gaingels. The company serves a large underserved market for consumers who are passionate about recreation and the great outdoors. Its a vast market that's ripe for Octane to disrupt lead its digital transformation.

ALSO READ

Series D Is Earmarked to Scale Octane's Buying Solution for Major Recreational Purchases

Octane Lending Inc. (Octane), the industry leader in digital products supporting consumers, dealerships, and OEMs throughout the buying journey for major recreational purchases, today announced it has raised $52 million in Series D funding. Progressive Investment Company, Inc., a member of the Progressive Insurance ® group, led the round, with participation from existing investors Valar Ventures, Upper90, Contour Venture Partners, Citi Ventures, Third Prime and Parkwood as well as new investors Gaingels and ALIVE. This brings the company's valuation to over $900 million with over $192 million in total equity funding raised to date.

The new round of financing will further Octane's mission to connect people with their passion. Octane is the only fintech in its verticals that enables transactions from start to finish, including editorial content, consumer prequalification tools, instant full-spectrum financing and digital deal closing. Octane is growing quickly because it makes purchases faster and simpler for consumers and dealers. The new capital will be used to scale Octane's buying solution for consumers shopping for powersports vehicles online, grow its family of 3,800 dealership partners and 40 OEM and brand partners—which include BRP, Suzuki, and Triumph Motorcycles—and expand to adjacent markets.

"We're thrilled to embark on the next phase of growth backed by Progressive Insurance and our existing partners, who wholeheartedly believe in our mission of connecting people with their passion," said CEO Jason Guss. "We are winning in the market because we offer a faster lending experience that also covers more consumers than competitors, and we engage shoppers earlier in the process to streamline transactions."

Octane makes major recreational purchases seamless by adding value at each stage in the buying journey. Octane does this by inspiring and informing enthusiasts through media brands such as Cycle World and UTV Driver, acquired in 2020 along with five other titles, prequalifying consumers instantly on dealer and OEM websites and helping consumers find a dealership for a simple closing experience. Partnerships with select OEMs enable Octane to offer loans with promotional rates through its in-house lender, Roadrunner Financial.

"We're excited for the opportunity to invest in Octane," said Andrew Quigg, Chief Strategy Officer at Progressive Insurance. "Technology and consumers' needs continue to evolve and Octane's point-of-sale loan origination platform provides benefits to consumers and dealerships in a specialty segment of the lending market. We like to partner with innovative, forward-thinking companies and believe that our investment in Octane aligns very well with this strategy."

When embedded on partnered dealership and OEM websites, Octane's prequalification product has a customer Net Promoter Score of 90 and has increased conversion rates by as much as 7X. Meanwhile, Octane's point-of-sale offerings enable finance managers at dealerships to close installment loans in as few as five minutes. Octane expects to originate over $1 billion in the next 12 months, has doubled revenue annually for three years, and is net-income and cash-flow positive.

About Octane:

Octane offers instant financing to fuel your lifestyle. Octane dramatically simplifies and accelerates the transaction process for large recreational purchases such as motorcycles, ATVs, and zero-turn lawn mowers with automated underwriting, innovative credit products, and financing, through our in-house lender Roadrunner Financial. Octane reaches millions of enthusiasts through editorial brands like Cycle World and UTV Driver and helps consumers buy their favorite products by prequalifying them on dealer and OEM websites. Octane is revolutionizing lending in underserved verticals that account for tens of billions of dollars in annual transactions.

Octane is a remote-first workplace with offices in NY and Dallas. It has grown its team by 50% in the last year, from 213 to 336 employees, and continues to actively recruit top talent. To learn more about career opportunities and view openings, please visit the careers page on www.octane.co.

Contact: Justine Fuchs, Octane@n6a.com

SOURCE Octane Lending Inc.

Argentine fintech Ualá closes $350M series D at a $2.45B valuation in SoftBank, Tencent-led round

The venture capital dollars keep flowing into Latin America as disruptive innovation drives global digital transformation around the globe. We're investing in disruptors in LATAM and other global markets who are building the digital infrastructure. We are excited to join the Uala round and journey as they scale into being the fintech platform for LATAM and the United States Latina America population.

Today, Argentine personal finance management app Ualá announced it has raised $350 million in a Series D round at a post-money valuation of $2.45 billion.

ALSO READ:

Argentina's cashless king targets Latin America's unbanked millions - Reuters

Argentine FinTech Ualá Attains $2.45B Valuation After Investment Round - PYMNTS

Argentina's Uala expands to Mexico as pandemic fuels need for digital payments - Reuters

Latin America Sees Booming Digital Banking Sector with Brazil at the Lead - Fintech News

Argentina's Uala buys Billionaire Eurnekian's Digital Bank - Bloomberg

Tencent, SoftBank-led funding pushes Argentina's Uala to $2.45 bln valuation

(Reuters) - China's online giant, Tencent Holdings Ltd (0700.HK), and SoftBank Group Corp's (9984.T) Latin America-focused fund led an investment round for Argentine firm Uala which took its valuation to $2.45 billion, the fintech company said on Friday.

The $350 million investment comes several months after Uala announced its expansion into Mexico, as it tries to capitalize on the interest around the fast-growing fintech industry in Latin America.

Launched in October 2017, Uala offers a Mastercard branded prepaid card and an app that allows users access to a number of financial services including sending and receiving money, online shopping, withdrawing cash at ATMs and requesting loans.

The digital banking startup, founded by Harvard University graduate Pierpaolo Barbieri, has a headcount of 1,000, and aims to raise it to 1,500 by the end of the year. In an interview in May, Barbieri said Uala could eventually expand into Peru, Paraguay, Colombia, Chile, United States and Europe.

In June, the company said it had issued more than three million Mastercard branded prepaid cards in Argentina. Uala is also trying to expand through the acquisition of rival Wilobank, the first fully digital bank approved by the central bank in Argentina.

Investment giant SoftBank has doubled down on its bets in South America, with the Japanese conglomerate investing in startups including Mexico's Clip and Brazil's Creditas. read more

Nubank, the Brazilian digital bank backed by Warren Buffett's Berkshire Hathaway (BRKa.N), is also gearing up for a U.S. listing that could be one of the biggest market debuts of a South American company. read more

Uala's latest round included existing investors Goldman Sachs (GS.N), venture capital firms Ribbit Capital and Greyhound Capital and billionaire George Soros' investment firm, Soros Fund Management.

New investors D1 Capital Partners and 166 2nd, a fund created by WeWork (BOWX.O) co-founder Adam Neumann, also participated in the round.

Craft Aerospace’s eVTOL aircraft could upend local air travel

Air taxis may still be pie in the sky, but there’s more than one way to move the air travel industry forward. Craft Aerospace, with $3.5M in funding, aims to do so with a totally new vertical takeoff and landing aircraft that it believes could make city-to-city hops simpler, faster, cheaper and greener.

The aircraft — which, to be clear, is still in small-scale prototype form — uses a new VTOL technique that redirects the flow of air from its engines using flaps rather than turning them (like the well-known, infamously unstable Osprey), making for a much more robust and controllable experience.

Co-founder James Dorris believes that this fast, stable VTOL craft is the key that unlocks a new kind of regional air travel, eschewing major airports for minor ones or even heliports. Anyone that’s ever had to take a flight that lasts under an hour knows that three times longer is spent in security lines, gate walks and, of course, getting to and from these necessarily distant major airports.

“We’re not talking about flying wealthy people to the mall — there are major inefficiencies in major corridors,” Dorris told TechCrunch. “The key to shortening that delay is picking people up in cities and dropping them off in cities. So for these short hops, we need to combine the advantages of fixed-wing aircraft and VTOL.”

The technique they arrived at is what’s called a “blown wing” or “deflected slipstream.” It looks a bit like something you’d see on the cover of a vintage science fiction rag, but the unusual geometry and numerous rotors serve a purpose.

The basic principle of a blown wing has been explored before now but never done on a production aircraft. You simply place a set of (obviously extremely robust) flaps directly behind the thrust, where they can be tilted down and into the exhaust stream, directing the airflow downward. This causes the craft to rise upward, then forward, and as it gets enough airspeed it can retract the flaps, letting the engines operate normally and driving the craft forward to produce ordinary lift.

>> READ MORE

Crypto asset platform Onramp Invest closes $6M seed round to accelerate growth and financial advisor adoption

We are excited to be a part of OnRamp Invest's journey and join the seed round to accelerate their disrupting the digital asset markets and becoming the Plaid of digital asset management.

Coinbase Ventures, Gemini join $6 million seed round for crypto platform Onramp Invest - The Block

Onramp Invest is an iPaaS (integration platform as a service) technology company providing access to cryptoassets for registered investment advisors. Our comprehensive cryptoasset management solution will enable advisors to help their clients safely, confidently, and intelligently invest in the new age all within their existing workflows and billing models.

The infusion of capital will enable the integration platform as a service (iPaaS) company to expand its crypto assets platform to registered investment advisers.

“I am extremely excited that we were able to participate in Onramp’s seed round alongside other top tier FinTech and crypto asset investors”

Onramp is known for providing three things to RIAs -- education, access, and tools (EAT). From viewing held-away cryptoassets to enabling advisers to trade on behalf of their clients to accessing educational resources about cryptoassets at Onramp Academy, Onramp is passionate about educating financial advisers and their clients about cryptoassets by outlining the framework of crypto networks, providing advisers with client-ready materials, and conducting deep-dive research for continuing education.

“I am extremely excited that we were able to participate in Onramp’s seed round alongside other top tier FinTech and cryptoasset investors,” said Chad Fox, Managing Partner, Fox Ventures. “We have such conviction in Tyrone and the team’s ability to connect the legacy FinTech sector to the entire cryptoasset ecosystem that we made a commitment six times larger than our standard check size. This is a testament to what this team is capable of and I look forward to supporting them as they continue to build infrastructure that connects and makes cryptoassets accessible.”

Reflecting on what receiving this fundraising means, Tyrone Ross, Jr., Onramp Invest Chief Executive Officer, said, “Black founders historically get left out of these types of funding opportunities. I want to thank all of our seed fundraising participants for blessing our company with this great opportunity to demystify cryptoassets and for me to inspire little Black boys and show them that they can be a startup CEO too. And I appreciate our early adopters and supporters who have helped us to launch Onramp and encouraged us to stay true to our mission to innovate.”

Onramp celebrates its first year in business today, August 3. Since the platform’s official launch at the end of May, it has provided fast, direct access to cryptoassets for RIAs; easy adviser client onboarding via Gemini, a crypto exchange and custodian, and Prime Trust; a simple adviser enrollment so they can quickly begin buying bitcoin and ETH for their clients; links to 10 different sources so advisers can see held-away assets; and high-quality educational materials for all cryptoassets comfort levels through Onramp Academy.

Onramp has made some exciting recent additions to its team including the appointment of Akin Sawyerr to its Chief Innovation Officer. Additionally, Justin Castelli, CFP®, was recently elevated to Chief of Staff; Torie Happe was promoted to Head of Business Development; and Caitlin Cook was advanced to Vice President of Operations at Onramp Academy.

For those interested in learning more, please visit onrampinvest.com or academy.onrampinvest.com for more information.

Data Streaming Platform Narrative Launches Data Shops

"Shopify for Data" Earns Customer Praise for Innovative and Accessible Data Monetization Solution

“Narrative Data Shops is an important part of our data monetization strategy, providing options that go well beyond traditional listings on data marketplaces today. With our proprietary first-party data asset of over 250 million opted-in consumer profiles, this relationship provides us with the ability to build an entirely new revenue stream – while allowing us to retain full control of our licensing terms and who gets access to our data shop.” – Brian Hogan, President, Data Solutions, Fluent, Inc.

Following the recent success of a limited early access program for its users, Narrative, the Data Streaming Platform that makes it easy to buy, sell and win, today launched Data Shops, the company’s latest innovative solution that makes it easy for any business in any industry to launch their own branded data e-commerce experience without spending significant time and resources.

“E-commerce has become a common part of our lives,” said Nick Jordan, Founder and CEO of Narrative. “It’s never been easier to buy almost anything at any time. Yet the buying and selling of data have remained a convoluted process that often takes months. Narrative Data Shops is a category maker – a truly transformational offering in the marketplace that is being enthusiastically embraced by customers as the ‘Shopify for Data.’ It’s an end-to-end solution for standing up a data business, from the top of the sales and marketing funnel through to transactions and delivery.”

Narrative Data Shops: The “Shopify for Data”

Data Shops makes data monetization accessible to all businesses and all types of data—from healthcare to financial services to marketing. The suite of apps enables businesses to package, sell, and deliver data via a customized e-commerce storefront. Even with zero coding or design experience, a user can have a customized digital shop up and running in an hour or less. The Data Shops collection of apps includes:

- Dataset Manager to automatically transform raw data into standardized datasets for easy packaging and discoverability, no coding experience necessary.

- Seller Studio to package your data into custom data products and manage licensing terms and access rules.

- Shop Builder to create a custom-branded e-commerce storefront.

Customers Praise Narrative Data Shops

Customers who recently participated in the company’s Early Access Program are praising Data Shops for meeting a critical need in the marketplace and applauding the revenue opportunities that it opens up for users:

“Narrative Data Shops has made it easy for us to spin up an e-commerce store that showcases AdImpact’s advertising intelligence data. The team has been outstanding in providing us with logistical support — from warehousing data to delivering it to our media, agency, political, and platform buyers. Data Shops is a turnkey, end-to-end data monetization experience that opens up an entirely new channel for us to deliver real-time linear, CTV, and digital ad spend data to customers.” – Dwight Green, Chief Business Officer, AdImpact

“AnalyticsIQ is excited to be a founding customer of Narrative Data Shops. Data users are only as good as the data they are aware of and can access. With Data Shops, we can more easily connect users with a variety of quality data they may not have otherwise found, giving them the ability to identify the right data for their analytic mission and to us, that is both exciting and important.” – Dave Kelly, CEO, AnalyticsIQ

“PurpleLab is driving innovation in the healthcare data industry by re-architecting how real-world data is understood and accessed. We aim to deliver on a standard of access in minutes, and insight instantly. While our database structures and flexibility are foundational to enabling life science organizations to better understand markets and analyze outcomes at speed, digital marketplaces have struggled to meet this velocity, hidebound as they are by older data structures and business rules that restrict how buyers and sellers can collaborate. Narrative Data Shops is the first solution we’ve found with the same commitment to frictionless marketplaces that provides data on the client’s terms, and easy iteration of new product types to identify unmet demand.” – Mark Brosso, CEO, PurpleLab

Cabana raises $10M series A for a new travel van experience

We are thrilled to join Cabana's series A financing and journey to disrupt the way we vacation, with an entirely new travel van experience.

Also Read:

Exclusive: Cabana Raises $10M Series A For Luxe Travel Van Rentals - Crunchbase News

Cabana, a startup that turns vans into bookable mobile hotels, raised $10 million in a Series A round led by Craft Ventures and Goldcrest Capital.

VCs back ‘vanlife’ as Seattle travel startup Cabana raises $10M for its camper rental service - GeekWire

Seattle-based startup Cabana is riding interest in “vanlife” travel and just landed $10 million to fuel the growth of its service that brings together camping, car sharing, and boutique hotel luxuries.

Original Cabana.Life post [here]

One year ago, we set out to pave the way for a new travel experience. What if you could bring your hotel with you? How much stress would be avoided if you could book your hotel and car in one reservation? How would it change travel if you had the ability to make and change plans on the fly without canceling reservations? And, could we really design a campervan that is as good or better than a hotel room?

Today, we’re celebrating a year of doing just that, with new financing under our belt. We’re thrilled to announce the close of our $10M Series A funding round, led by Craft Ventures and Goldcrest Capital, that will allow us to further improve the Cabana experience and bring that experience to travelers in new cities. Launch, Castor Ventures, Gaingels, Nordic Eye, and other key angels and syndicates joined the round as well.

With new financing and investors come new mentors for cultivating Cabana’s culture and service. Paul English, co-founder of Kayak, is excited about the prospects of Cabana. “Cabana is leading the thinking behind how Americans will vacation today and in the future. Their custom ‘hotel on wheels’ gives travelers the best of both worlds, a comfortable modern stay and the freedom of the road,” Paul explains. “It’s the best experience to get a taste of both the city and its surrounding outdoor beauty.”

More Vans and More Cities

In our first year, we expanded our fleet in our homebase of Seattle, and we launched our second market in Los Angeles. With new funding, we’ll be adding over 100 new vehicles to our fleet.

Guests have already spent over 6.7K nights out on the road with Cabana, and vanlife is continuing to gain momentum. “Cabana’s growth during the pandemic proves the increasing consumer shift away from traditional modes of travel,” explains David Sacks, co-founder and general partner of Craft. “We look forward to seeing Cabana expand into new markets and enhance its superior fleet of upscale, affordable mobile hotels.”

In addition to expanding in Seattle and LA, you’ll see us in new cities shortly! We’ve noticed you in our Instagram comments asking when we’ll be in San Francisco, Portland, Salt Lake City, Denver, and so on… and we can’t wait for the day everyone can walk down the street and hop in a Cabana. To be the first to know where we’re going next, sign up for our emails.

Family Fun

Getting your feedback over the past year has been invaluable, and our team is already making changes big and small to make your next Cabana trip even better.

One of our most exciting upcoming additions to the fleet is a four-passenger van. We’re excited to help your go-to travel team hit the road, whether it be your best friends for a West Coast wine tour or your kids for the classic national park camping trip, leveled up.

Easier, Smarter Trip Planning

Did you know that nearly 70% of our guests have never rented a campervan or RV before? We are honored that so many travelers trust us for their first trip, and we plan to continue removing barriers of entry in van travel.

When we heard that some guests had trouble knowing where to stay overnight, we launched Cabana Concierge to help plan your route, your overnight stops, and your activities along the way. Our trip planners have created over 200 unique itineraries and have helped guests find safe dispersed camping, one-of-a-kind scenic sites, and everything in between. We’ll continue to personalize our planning to fit every type of traveler, from the schedulers to the spontaneous.

Passionate People

We wouldn’t have had the amazing year we’ve had if it wasn’t for the hard working, creative, never-say-no team of Cabana employees. We’re excited to bring on more talented individuals for the projects we’ve been dreaming about. In fact, we’re hiring now!

Platform Partners

As we expand to new cities, we’re coming up with new ways to do business, too. Working with platform partners will allow us to expand more quickly and help guests explore even more ground. Interested in becoming a partner? Contact us here.

Creating Exceptional Experiences

As excited as we are for all of the ways Cabana is about to grow, at the end of the day it’s all about you. Your time is valuable –– especially your vacation time! We’re so thankful for everyone who has chosen Cabana to make the most of theirs and given their feedback to help us improve. Our team is full of ideas of how to continue to make Cabana the most special, most seamless way to travel.

As we embark on our second year, we look forward to seeing you all on the road!

Synctera Raises $33M Series A to meet demand for their Banking-as-a-Service from community banks and fintechs

Also Read

Synctera Aims $33M Series A At Developing Banking-as-a-Service - Crunchbase

Synctera Signs on CheckAlt and Socure as Latest Partners to Continue Building Out FinTech-as-a-Service Offerings - Team Synctera

Synctera Signs on New Community Bank and FinTech, Enlists Julie Solomon, Ph.D., as Company’s First Chief Revenue Officer - Team Synctera

Follow Synctera On -> Twitter | LinkedIn | ProductHunt

The partnership banking solution also announces its commitment to the Cap Table Coalition aimed at increasing traditionally marginalized representation in the venture capital ecosystem.

SAN FRANCISCO (June 2, 2021)--Synctera, a new platform for partnership banking at scale, today announced a $33M Series A round led by Fin VC. The Series A included follow-on investments from Lightspeed Venture Partners, Diagram Ventures, Portage Ventures, SciFi Ventures, and Scribble ventures as well as several new strategic investors, including Mastercard, Omri Dahan (Former Chief Revenue Officer, Marqeta), Nuno Sebastiao (Chairman and CEO, Feedzai), Tim Sheehan (Co-Founder and CEO, Greenlight), Tom Williams, Johnny Ayers (CEO, Socure) and more.

Synctera’s Series A quickly follows its seed funding round from December 2020, which was led by Lightspeed Venture Partners and Diagram Ventures, and brings Synctera to $46.5M in funding to date.

Synctera enables community banks and FinTechs to create new growth opportunities by forging scalable partnerships without the hassle. For banks, Synctera streamlines day-to-day reconciliation, operations and regulatory compliance, while allowing FinTechs to launch faster with more choice via a one-stop-shop API. With Synctera, community banks can focus on serving their communities and local customers, while Synctera matches them with a FinTech to help both partners scale and grow.

"Since launch, Synctera has formed one of the best teams in the industry. Bringing on a group of investors with deep industry expertise will help us meet rapidly increasing demand in our next stage of growth," said Peter Hazlehurst, CEO and co-founder of Synctera. “For this next chapter—and to put action behind Synctera’s values—we pledge to reserve 10% of this round and all future rounds to diverse investors, allowing for more representation and collaboration to further innovate the industry.”

Demand for Synctera’s solution has been immense since its launch last year, especially as the embedded finance and Banking-as-a-Service (BaaS) fintech sectors have grown exponentially. The Series A funding will help Synctera meet this demand head-on by expanding its software engineering team to rapidly accelerate the development of its product roadmap, ramping up sales and marketing to build and capture market demand, and prepare for a future international expansion.

“As soon as we met Peter, Kris, and Dominik and learned about their vision for the market, we were immediately sold,” said Logan Allin, Managing General Partner and Founder at Fin VC. “The specific focus on community banks and the world-class tech behind the platform really convinced us that they’re building a category winner that will underpin financial services of the future.”

Fin VC has a deep history of investing in some of the world’s most transformative FinTechs, like Figure, Pipe, and SoFi.

Synctera is also announcing its commitment to the Cap Table Coalition alongside other high-growth startups by allocating 10% of all funding rounds to traditionally marginalized investors. Gaingels, Neythri Futures Fund, Plexo Capital and over 20 angels participated in Synctera’s series A as a part of the coalition. By committing to the pledge, Synctera hopes that other founders and companies will join the coalition.

"It's an honor to partner with founders and entrepreneurs who stand by their values and actively create the changes they want to see," said Qiana Patterson, General Partner at Tamaa Capital and manager of Synctera's Special Purpose Vehicle (SPV). "After coordinating Finix's SPV earlier this year, the number of startups seeking to replicate the work was overwhelming, and Synctera was first in line. By providing space for underrepresented investors on its cap table, Synctera is creating a game-changing opportunity for access and wealth creation."

“As the largest investor network focused on supporting and investing in the best venture-backed companies that embrace and value diverse leadership, including LGBTQ+, Gaingels is proud of participating in Synctera’s financing,” said Gaingels Managing Director Lorenzo Thione. “We are resolved to help the company grow and scale, while building a truly inclusive company and leading the fintech sector with its commitment to DEI, as reflected in this pledge.”

As Synctera continues to build out its FinTech-as-a-Service offering, the company also continues to onboard customers, such as its latest customers Lineage Bank, a new community bank, and Ellevest, a new FinTech collaborating with Coastal Community Bank, which onboarded in May 2021. The company is also rapidly growing internally, and is actively hiring for roles across engineering, product and sales. Synctera plans to grow its team to over 150 by the end of the year.

Community partner banks and FinTechs are encouraged to reach out via Synctera’s website to learn more about how to work together. For more information, please visit www.synctera.com.

For visual assets, founder bios and headshots, FAQ and more, please access the media kit here.

ABOUT SYNCTERA

Synctera is building a partnership banking marketplace connecting community banks with FinTech platforms. The platform reduces risk, ensures compliance and speeds launches to market for FinTechs and banks alike, Synctera creates meaningful connections between community banks seeking more customers and FinTech platforms that need a licensed partner to operate in the US. Launched in 2020, the company was co-founded by CEO Peter Hazlehurst, former head of Uber Money, head of Google Wallet and CPO at Yodlee, as well as CTO, Kris Hansen and Head of Product, Dominik Weisserth. For more information, please visit www.synctera.com.

ABOUT FIN VC

Fin Venture Capital is focused on Enterprise SaaS FinTech companies and specific theses within six sub-sectors: Embedded Finance, Asset Management/Capital Markets, CFO Tech Stack, InsureTech, Blockchain Enterprise Applications, and Enabling Tech/Infrastructure. Fin VC principally focuses on the US and EU/UK. As former corporate and start-up operators, the Fin VC team takes an active value-added approach, leveraging its Operating Playbook to steward its portfolio companies with business development, capital formation, corporate development, board advisory and talent sourcing. For more information, please visit finvc.co.

ABOUT THE CAP TABLE COALITION

The Cap Table Coalition is a partnership between high-growth startups, emerging investors and fund managers who want to work to close the racial wealth gap. Its mission is to diversify the VC ecosystem by creating investment opportunities for Black, Latinx, LGBTQ+, women and other traditionally marginalized investors. A growing list of committed startups includes Finix, Synctera, Orum and more, with investment community members featuring Qiana Patterson (Tamaa Capital), Roman Leal (Lead Global Partners), Camden McRae (Matador Ventures), Marcos Gonzalez (Vamos Ventures) and Luis Robles (Viento Ventures). The Cap Table Coalition was inspired by the Act One Diversity Rider for VCs and Finix’s unique fundraising efforts to diversify startup cap tables via Special Purpose Vehicles (SPVs). For more information, please visit www.captablecoalition.com.

Drone flight infrastructure platform Airspace Link raises $10M to make drones safer for operators and communities

An intro to Airspace Link's drone flight infrastructure.

Original article on TechCrunch by Matt Burns@mjburnsy

Airspace Link is today announcing it raised a $10 million Series A from Altos Ventures, Thales and others. The Detroit, Michigan-based startup anticipates using the additional funds to expand its domestic offering and expand overseas.

CEO Michael Healander explains to TechCrunch that the company sees airspaces as digital infrastructure lacking critical regulations. “Today you have rules and regulations on the road,” he says, explaining that the company is building digital roads and management for drones. Airspace Link’s novel platform addresses drone operators’ and communities’ concerns, enabling pilots to safely fly while complying with local airspace restrictions.

Airspace Link’s AirHub™ is the first cloud-based drone platform focused exclusively on merging the needs of state & local government with the operational planning tools pilots already use. Image Credits: Airspace Link

Airspace Links offers drone operation planning tools, including API access that allows developers to incorporate Airspace Link’s data into third-party platforms. The company’s system complies with the FAA’s Low Altitude Authorization and Notification Capability (LAANC), enabling drone pilots to submit operations while flying in controlled airspace. The company is one of seven FAA-approved companies to provide this service.

With the Series A funding, Healander says the goal is to integrate with as many transportation groups as possible.

Founded in 2018 by Michael Healander, Daniel Bradshaw and Ana Healander, the Detroit-based startup employs 20 full-time staff. The company says in a press release that it has partnerships with more than 40 government agencies and municipalities in the United States. Going forward, the company is looking to expand to Australia and Canada.

According to Healander, what distinguishes Airspace Link from the other competitors in the market is its integration with mapping tools used by municipal governments to provide information on ground-based risk.

“Our core purpose is to safely integrate drones into the national airspace and our communities at scale,” said Healander. “We thank Altos Ventures and Thales for joining our vision of paving the way for the drone economy with shared, neutral, and affordable UAS infrastructure.”

For Healander, Airspace Link is only the latest entrepreneurial venture. He previously founded GeoMetri, an indoor GPS tracking company, which was acquired by Acuity Brands.

Altos Ventures led Airspace Link’s Series A round, with participation from Thales, a global leader of air traffic management systems, and previous investors Indicator Ventures,2048 Ventures, Ludlow Ventures, Matchstick Ventures, Techstars and Dan Gilbert’s Detroit Venture Partners (DVP).

“As Unmanned Aircraft Systems (UAS) usage continues to grow, for safe, low altitude operations around communities, airspace management must combine both air and ground insights,” said Todd Donovan, Thales vice president, Airspace Mobility Solutions Americas. “Our deep knowledge of airspace management and Airspace Link’s expertise in geospatial intelligence are the perfect combination to address this complex challenge.”

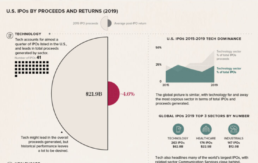

Tech IPOs by the numbers Hype vs Reality?

The Hype vs. Reality of Tech IPOs

Initial Public Offerings (IPOs) generate massive amounts of attention from investors and media alike, especially for new and fast-rising companies in the technology sector.

On the surface, the attention is warranted. Some of the most well-known tech companies have built their profile by going public, including Facebook by raising $16 billion in 2012.

But when you peel away the hype and examine investor returns from tech IPOs more closely, the reality can leave a lot to be desired.