Competitive intelligence platform Crayon raises $22 million Series B to empower companies

Crayon Raises $22 Million Series B to Empower Mid-market & Large Enterprises With Competitive Intelligence

AI-driven software helps increase sales with valuable data capture and analytics that inform business decisions and actions

READ MORE:

Crayon Draws Up $22M Series B To Help Companies Get That Competitive Edge - Crunchbase News

Celebrating Our 500th Customer & $22M Series B! - Crayon.Co

BOSTON--(BUSINESS WIRE)--Crayon, the leading competitive intelligence platform for the enterprise, today announced a $22 million Series B financing led by Baird Capital with participation from Baseline Ventures, Bedrock Capital, C&B Capital and Oyster Funds. Crayon also welcomed Gaingels as an investor in the Series B as part of our commitment to diversity, equity & inclusion. The company’s total capital raised to date is $38 million. Crayon will use the funding to accelerate product development and expand its team. The company also announced Baird Capital’s Benedict Rocchio joined its Board of Directors.

“Traditionally, gathering this data was a highly manual, time-intensive and expensive process. But today there’s a far better way to compete that’s software driven. Our platform captures competitive intelligence programmatically in real-time and empowers teams to take timely action towards increased sales and better differentiation in their market.”

Crayon helps mid-sized and large enterprises capture, analyze and act on competitive intelligence to drive better execution & decision-making in all areas of the business. More than 500 customers including Discover, Dropbox, Gong, Intuit, SurveyMonkey, Zendesk, and ZoomInfo, rely on Crayon to power competitive intelligence efforts across their sales, marketing, product, and executive teams. Crayon’s platform looks both within the organization and externally, generating insights from more than 300 million sources and enabling customers to publish, share and leverage intelligence in a variety of formats and frequencies to match stakeholder needs. From battle cards to newsletters, alerts and dashboards, Crayon integrates with CRM, chat, sales enablement and knowledge-sharing platforms to ensure teams never miss a competitive development or opportunity.

Competitive intelligence should be a strategic priority for every company with at least one competitor in their space. Standing out and differentiating through product design, packaging, and messaging is crucial, with 75% of technology buyers claiming they don’t understand how vendors are different[1]. And with nearly one-third of all sales pitches lost to competitors[2], discovering and sharing compelling insights can mean the difference between winning or losing a competitive deal for businesses. According to Crayon’s 2021 State of Competitive Intelligence Report, which surveyed more than 1,000 companies, over 60 percent of businesses report competitive intelligence has positively impacted revenue, a 17 percent increase from their 2019 report.

“It has always been critical that businesses respond with speed and urgency to competitive shifts because competitive intelligence informs everything from product launches to pricing strategies to marketing campaigns. But there’s traditionally never been a good way to pull that off,” said Jonah Lopin, co-founder and CEO of Crayon. “Traditionally, gathering this data was a highly manual, time-intensive, and expensive process. But today there’s a far better way to compete that’s software-driven. Our platform captures competitive intelligence programmatically in real-time and empowers teams to take timely action towards increased sales and better differentiation in their market.”

“Companies are drowning in data today and dedicating more resources -- both technology dollars and human capital -- to better understand and make use of it,” said Benedict Rocchio, Partner with Baird Capital and new board member of Crayon. “As a longtime active investor in the marketing technology space, Baird Capital saw the clear need for how Crayon's approach streamlines the vast amounts of data with a single source of truth for all competitive insights. Jonah and the Crayon leadership team have a proven track record of building marketing tools that simplify this level of complexity at scale. They are putting marketers in the enviable position of offense, pursuing ideas they know will work and mitigating the risk of being blindsided by a competitor.”

Crayon leads the competitive intelligence software category - recognized by Forrester Research in their New Wave as the Leader in Market and Competitive Intelligence Platforms, and consistently a leader among multiple categories in G2, based on thousands of reviews by real customers. Based in Boston, the company has nearly 100 employees and expects to double headcount over the next 12 months.

About Crayon

Crayon is the leading competitive intelligence platform that enables businesses to track, analyze, and act on everything happening outside their four walls. More than 33,000 Competitive Intelligence professionals rely on Crayon for a current, holistic view of their business to win sales, save time and costs, and develop long-term revenue and relationships. Based in Boston, Crayon is empowering mid-market and Fortune 500 companies every day with actionable insights to win. For more information go to https://www.crayon.co.

About Baird Capital

Baird Capital makes venture capital, growth equity and private equity investments in strategically targeted sectors around the world. Having invested in more than 320 companies over its history, Baird Capital partners with entrepreneurs and, leveraging its executive networks, strives to build exceptional companies. Baird Capital provides operational support to its portfolio companies through teams on the ground in the United States, Europe, and Asia, a proactive portfolio operations team, and a deep network of relationships, which together strive to deliver enhanced shareholder value. Baird Capital is the direct private investment arm of Robert W. Baird & Co. For more information, please visit BairdCapital.com.

[1] Gartner: “The Sad State of Differentiation for Technology Providers and What to Do About It”

[2] CSO Insights: “The 2018-2019 Sales Performance Report”

Contacts

Kerry Walker

kerry@walkercomms.com

WEBINAR Join us for SPAC Investing 101: A Guide to Wall Street's Hottest Asset Class

Panel at the Planet Microcap Showcase Conference features leading SPAC practitioners

Our expert panel of industry insiders has observed firsthand what makes for a successful SPAC deal, and I can’t wait to hear what they have to say.

Marcum Bernstein & Pinchuk LLP (MBP) invites you to attend a panel on "SPAC Investing 101: A Guide to Wall Street's Hottest Asset Class" at the Planet MicroCap Showcase conference.

The panel is scheduled for 9 a.m. Eastern time on April 20, 2021, and will also be available on replay after the event. Interested parties can register for the free event here.

Register for Free Today

“SPACs have taken the IPO investment world by storm during the pandemic as high profile, and celebrity sponsors, high-flying tech companies, and retail investor enthusiasm have sent many SPAC stocks soaring,” said MBP Co-Managing Partner Drew Bernstein. "After a record year of issuance in 2020, new SPACs have dominated the U.S. IPO market in Q1 2021, with 298 deals raising $87 billion. SPACs have gone from an arcane financing vehicle to a mainstream alternative for high-growth private companies seeking to raise capital and attain public status."

Panel Moderator:

Drew Bernstein, Co-Managing Partner, MBP

Panel Speakers:

Jay Heller, Head of Capital Markets, NASDAQ. Where he has been keeping very busy with this massive surge in SPAC IPOs.

Jay has worked on major Wall Street trading desks at Pershing, American Capital Markets, and other firms before heading Capital Markets for the NASDAQ.

Connect with Jay on LinkedIn

George Kaufman, Partner and Head of Investment Banking, Chardan Capital Markets. One of the early pioneers of the SPAC format and has continued to be highly active in underwriting new SPAC IPOs from the U.S. and other parts of the world, as well as managing the SPAC merger and PIPE process that it takes to get these deals to close.

Connect with George on LinkedIn

Mitch Nussbaum, Vice-Chair, Loeb & Loeb. Where he runs a very active team with SPACs, traditional IPOs, direct listings, and PIPEs and someone who has his finger on the pulse of the latest structures and deal terms.

Connect with Mitch on LinkedIn

Peter Bordes, Founder, Managing Partner, Trajectory Capital. A veteran venture investor, entrepreneur and CEO who led the IPO of Kubient last summer on the NASDAQ, and has now founded Trajectory Capital, which has recently filed their first SPAC with the SEC and has plans to take disruptive tech companies from seed funding to public listing on an accelerated basis.

Connect with Peter on Be/PeterBordes

Recent volatility in the sector serves as a reminder that SPACs are complex investment instruments, with varying risk levels at each phase of their lifecycle and multiple strategies that sophisticated investors employ to lock in gains. This panel will present industry insiders' perspectives who have observed firsthand what makes for a successful SPAC deal. If you want to make sense of and profit from the SPAC boom, this panel is a must-attend event.

The panel will explore topics including:

- What has led to the recent explosion in the number of SPAC IPOs and larger deal sizes?

- What are the various phases in the SPAC lifecycle, and what makes them attractive to different investors?

- How has the rise of celebrity SPAC sponsors and "SPAC factories" changed the game?

- Why are many venture-backed and growth companies now embracing SPACs as an attractive way to go public?

- "What issues determine if a SPAC will be successful as a public company once the merger closes, including financial reporting and investor relations?"

Marcum Bernstein & Pinchuk LLP (MBP) offers specialized audit and advisory services to support SPAC sponsors and SPAC targets in Asia. MBP and our parent company, Marcum LLP, have been involved in more SPAC transactions than any other audit firm, and we are the only audit firm to have a dedicated SPAC team. MBP performs all audits for Marcum in Greater China, and MBP is a top-five auditor for Chinese companies listed in the U.S.

Our SPAC team has worked with SPAC sponsors, underwriters, and targets. We draw on wide-ranging experience with both the initial public offerings and subsequent business transactions consummated by such companies. MBP has designed our audit platform to deliver technical expertise, efficiency, and urgency required by SPAC IPOs. And we can provide high-quality, PCAOB-compliant audits for private Asian companies that are contemplating entering a SPAC merger. Learn more at www.marcumbp.com

TripleLift acquired for $1.4 billion by Vista Equity Partners

We are thrilled to be a part of the journey of one of the largest transactions in the history of ad tech, and an awesome outcome for the founding leadership team Eric Berry, Ari Lewine, Shaun Zacharia, members of the team, shareholders, and digital advertising industry.

TripleLift announced today that a majority stake of the company will be acquired by Vista Equity Partners, a leading private equity firm focused on software, data, and technology-enabled businesses. Vista’s involvement will accelerate global growth and further drive product innovation for TripleLift.

A big shout out to Jeffrey Silverman and the Laconia Capital Group team for managing our co-investment in the mighty TripleLift!

- [Read the email] sent to all TripleLift employees immediately following an all-hands meeting where Co-Founder and CEO Eric Berry announced the acquisition of the company by Vista Equity Partners.

AdTech Leader TripleLift Announces Majority Investment from Vista Equity Partners

Partnership to Accelerate Global Product Expansion and Innovation in CTV

NEW YORK, March 29, 2021 /PRNewswire/ -- TripleLift, one of the largest advertising technology platforms in the world, announced today it has signed a definitive agreement to receive a majority investment from Vista Equity Partners. Vista, a leading global investment firm focused on enterprise software, data and technology-enabled businesses, will help drive further innovation across TripleLift and accelerate global growth.

"We have developed into a leader in the advertising technology space and are excited about our next chapter," said Eric Berry, Co-Founder and CEO of TripleLift. "When looking for an investment partner, we placed a premium on a deep understanding of ad tech and a willingness to lean into developing our portfolio of innovative, high-growth products. Vista is that partner."

Founded in 2012, TripleLift is driving the next generation of programmatic advertising by inventing new ad formats and building two-sided marketplaces that deliver monetization to publishers around the world. The company rose to prominence as the leader in Native programmatic advertising, expanded its offerings to display and video, and is now commercializing breakthrough products in Connected TV. TripleLift works with over 80% of the comScore 100 publishers, 100% of the Top 20 Demand Side Platforms (DSPs) and 100% of the AdAge Top 100 advertisers. Last year, TripleLift handled over 40 trillion ad transactions across desktop, mobile and connected television.

"TripleLift is a next generation ad tech company that has successfully identified and developed multiple new markets since its inception," said Michael Fosnaugh, Co-Head of the Vista Flagship Fund and Senior Managing Director. "In each case, they have created unique value to an entire ecosystem of companies, including brands, publishers, and partners, and we are thrilled to be working with Eric and the team to further scale their business."

"Vista is pleased to partner with TripleLift and we have a tremendous runway for growth," said Rod Aliabadi, Managing Director at Vista Equity Partners. "We look forward to continued market leadership in programmatic, further catalyzing our opportunity in CTV and building upon our expansion into priority international markets across Europe and Asia."

The transaction is expected to close in the second quarter of 2021. Eric Berry will remain as CEO and will continue serving on the Board of Directors. True Ventures and Edison Partners, two early investors in TripleLift, will remain invested in the company.

Centerview Partners LLC is serving as exclusive financial advisor to TripleLift, and Goodwin Procter LLP and Reitler Kailas and Rosenblatt LLC are serving as legal counsel. JP Morgan is serving as financial advisor to Vista, and Kirkland & Ellis LLP is serving as legal counsel.

About TripleLift

TripleLift, one of the fastest-growing ad tech companies in the world, is a technology company rooted at the intersection of creative and media. Its mission is to make advertising better for everyone— content owners, advertisers and consumers—by reinventing ad placement one medium at a time. With direct inventory sources, diverse product lines, and creative designed for scale using Computer Vision technology, TripleLift is driving the next generation of programmatic advertising from desktop to television. As of January 2021, TripleLift has recorded five years of consecutive growth of greater than 70 percent. TripleLift is a Business Insider Hottest AdTech Company, Inc. Magazine 5000, Crain's New York Fast 50, and Deloitte Technology Fast 500. Find more information about how TripleLift is shaping the future of advertising at triplelift.com.

About Vista Equity Partners

Vista is a leading global investment firm with more than $73 billion in assets under management as of September 30, 2020. The firm exclusively invests in enterprise software, data and technology-enabled organizations across private equity, credit, public equity and permanent capital strategies, bringing an approach that prioritizes creating enduring market value for the benefit of its global ecosystem of investors, companies, customers and employees. Vista's investments are anchored by a sizable long-term capital base, experience in structuring technology-oriented transactions and proven, flexible management techniques that drive sustainable growth. Vista believes the transformative power of technology is the key to an even better future – a healthier planet, a smarter economy, a diverse and inclusive community and a broader path to prosperity. Further information is available at vistaequitypartners.com. Follow Vista on LinkedIn @Vista Equity Partners, and on Twitter @Vista_Equity.

Y Combinator's $300B in startups success

Y Combinator recently published their latest Top Companies list online, listing the top 137 YC portfolio startups in descending order of valuation. The headline statistics are impressively shocking:

$300B+ combined valuation

125+ companies valued at $150 million+

60K+ jobs created

Since Rebel Fund’s job is to select and invest in the top 3–4% of YC startups in each new batch, we carefully study past YC startup successes to help us identify patterns that could be predictive of tomorrow’s unicorns. Many of these patterns are encoded in our proprietary Rebel Theorem machine learning algorithm, but we also like to understand them intuitively as we meet with future YC founders and decide which ones to support as a venture fund.

To that end, I’ll share some of the insights that we’ve gleamed by studying these 137 YC startup success stories creating $300B+ in total market value. While no retrospective data analysis can replace an expert assessment of an individual startup’s team, market, product and traction, there are some telling historical patterns that any smart early-stage investor should bear in mind.

Valuations

It’s best to start by highlighting how incredibly skewed value creation is in the world of tech startups. As explained in my previous post On the eery predictability of YC startup valuations, startup valuations tend to fall along a steep power-law curve and YC startups fall along one nearly perfectly.

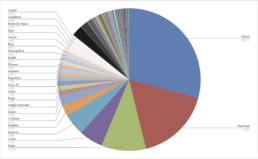

By our math, these 137 top companies represent the vast majority of the total value of YC’s 2500+ portfolio companies, even though they represent just ~5% of them by number. To help illustrate the power-law dynamic, here’s a pie chart showing the valuation breakdown of YC’s top companies according to our research:

Just 3 companies, Airbnb, DoorDash, & Stripe, represent more than half of YC’s top companies portfolio value, and the top 10 companies represent ~75% of it.

Every one of the labeled companies on this chart are ‘unicorns’ valued at $1B+ and even the smallest unlabeled slither is a company valued at over $100M. Despite that all of these top startups are incredible successes for their founders and investors, the ‘megacorns’ still dominate the chart.

Bear in mind that most of these companies raised seed rounds at $3M to $10M valuations, so a median top company with a ~$500M valuation is now valued at a whopping 50x to 150x its seed stage valuation. For Airbnb, you can multiply that by another 20x given its ~$100B valuation, for something closer to 3000x valuation growth.

The main implication for seed stage investors is to swing for the fences since a few mega successes drive the vast majority of YC’s portfolio value. Given the massive potential upside of even a middling top company, perhaps a secondary implication is “just swing!”

Location

So where are top YC companies located?

The short answer is “San Francisco” but it’s actually more nuanced. Here’s a pie chart showing where these top startups are headquartered:

Clearly my home city of San Francisco dominates, and even more so when you consider that several runners-up are also in the San Francisco Bay Area (San Mateo, Redwood City, Oakland and Mountain View). However, as Wayne Gretzky famously said, “Skate to where the puck is going, not where it has been.”

While the top startup puck has been in Silicon Valley for quite some time, it’s slowly sliding away as I discussed in On the slow erosion of Silicon Valley’s dominance. This phenomenon can also be seen when we chart top company location by age bracket:

San Francisco’s grip on startup success is loosening over time, with the single biggest beneficiary being Bangalore, India. This is partially due to YC’s efforts to recruit there, though the logic is a bit circular since they recruit there for a reason.

Note that “Remote” is only 4.4% of the total today, but all of the remote top startups are relatively young and I expect that percentage to grow dramatically in the coming years. Startups had already been trending towards remote for several years, and covid greatly accelerated the trend.

Also note the emergence of Mexico City in the graph. While there’s only 1 LATAM startup on YC’s Top Companies list today (Rappi), we’ve seen and invested in some strong startups from this region in recent batches, and I expect many more LATAM unicorns in the years ahead.

The main implication for early stage investors is to look beyond Silicon Valley. While the SF Bay is undoubtedly still the single best location for startups, one shouldn’t ignore how colorful the younger bars above are starting to look.

Age

Next let’s examine the age of YC’s top companies. This chart shows the age distribution of these 137 top YC companies:

Before concluding that YC reached its peak 5 years ago, bear in mind this chart is distorted in a couple of ways:

- Newer YC batches are much larger than older batches, so the fall off after year 5 largely reflects smaller YC batch sizes in the out years, though attrition is also a factor

- It typically takes several years for a startup to grow to a $150M+ valuation, so the 1 to 4 year old companies likely aren’t lower quality than the 5 year old companies, they’re just still climbing up the valuation ladder

Also bear in mind that while fewer in number, the older companies are much more valuable on average, as illustrated in the chart below:

The main implication for early-stage investors is to be patient since it often takes several years for companies to grow into a $150M+ valuation, and the best ones continue to grow rapidly in value for a decade or more. YC’s top companies currently have an average age of 6.6 years, which implies its portfolio is poised for ~3x more growth even if no new investments were made. I believe YC startups will almost certainly reach $1T in total value in the coming years >>> READ MORE

The key to long term SPAC success: Leaders with an operational edge

This is very relevant research in relation to our "operators for operators" model for SPACs acquiring highly disruptive innovators when they're coming out of their "S Curve" and entering rapid growth. Which can be hyper-accelerated leveraging SPACS, giving them the ability to dominate their industry segment, have the credibility of being public with public currency to accelerate organic growth with accretive acquisitions.

Earning the premium: A recipe for long-term SPAC success

Special-purpose acquisition companies are having a moment. But not all are thriving. One key to success: leaders with an operational edge.

As more SPACs raise funds and pursue deals, sponsors may find themselves under increasing pressure to differentiate their approaches and demonstrate returns. Having operators at the front, from the IPO to the combination and beyond, may offer SPACs a path toward better performance.

Special-purpose acquisition companies (SPACs) have raised funds at substantial rates, attracting more and more high-profile investors. We reviewed the performance of recent SPACs—a mixed track record—and found a strategy that has produced success: SPACs that are led or co-led by operators rather than solely by investors tend to outperform throughout the deal cycle. One year after taking a target public, operator-led SPACs traded about 10 percent higher than their sector index and much better than other SPACs (a premium of about 40 percent). In this article, we review the changes that have placed SPACs at center stage, and we offer practical suggestions for sponsors that seek to deploy the operator’s edge.

Same SPACs, new tricks

After some scandals in the 1990s and regulatory reforms in the 2000s, SPACs had a few moments of popularity. However, they generally remained small and developed a reputation as capital sources of last resort.

In the past five years, however, SPACs have reemerged. In 2020, they have attracted unprecedented, market-shifting sums of capital: as of August 2020, SPACs that were actively seeking business combinations held about $60 billion of capital (across more than 100 SPACs) and made up 81 out of 111 US IPOs.1 In one month in 2020, SPACs raised more than they had in all of 2019. While private equity (PE) firms still hold vastly more capital, with an estimated $1.4 trillion in dry powder, many PE firms (or their alums) have also decided to raise SPACs.

SPACs, at their core, have remained consistent throughout their history. They have a single objective: merge with a company and take it public (“de-SPAC”). SPAC sponsors file with the US Securities and Exchange Commission (SEC) just like any other IPO does, raise capital and place it in a trust, and publicly list their shares. The SPAC model affords sponsors great flexibility, with few constraints on the choice of target (thus SPACs are commonly called “blank check” companies). Sponsors also have relatively few responsibilities after the close: the SPAC sponsor typically takes a minority stake in the merged company (or a combination) and may also take a board seat.

So, what changed? Starting in 2015, SPACs appeared to become better-organized, more serious investment vehicles, with three notable differences from previous years:

- More closes, fewer liquidations. More than 90 percent of recent SPACs have successfully consummated mergers (Exhibit 1). Prior to 2015, at least 20 percent of SPACs had to liquidate and return capital to investors.

- More well-known participants. SPACs entered the mainstream by increasing their number of high-profile investors and recruiting executives from high-profile companies.

- Increased size. The average trust size of SPACs has increased more than fivefold in the past decade, as the average leapt to more than $200 million in 2016 and $400 million in 2020.

Sponsors and investors have also begun seeing SPACs as compelling and perhaps even better alternatives to traditional IPOs. From our discussions with SPAC leaders, bankers, and lawyers, we discovered three consistent themes. First, SPACs offer a simpler IPO process that saves time and energy for all parties and gives sponsors more flexibility to set their targets’ narratives. Second, SPACs offer protections, such as the right of an investor to withdraw capital with interest at the time of a proposed business combination, which essentially creates a riskless “free option.” Third, SPACs offer their targets’ shareholders greater certainty on valuation. Those shareholders may leave less money on the table than they would in a traditional IPO, when underwriters may set an initial price below the market’s actual valuation.2

Outperformance matters—especially for sponsors

SPACs keep sponsors motivated mostly with carrots, not sticks. While sponsors may profit from mediocre deals, they can earn more if the combination modestly increases in value. In a typical $300 million SPAC, a 20 percent increase in stock price in the first year after combination can yield a double-digit multiple of up-front capital. Consider the following:

- A promote grows larger with outperformance. Typically, the sponsor receives about 20 percent of the SPAC’s value (inclusive) in equity in the combined company. Those shares will benefit from a rising stock price.

- Reputation can lead to repeats. The sponsor may want to raise another SPAC and enjoy an additional promote. More generally, established investors will want to guard their records for whatever fundraising may follow. The sponsor will want to secure a good deal—one that outperforms—to build a record for future fundraising.

- Lockups create discipline. For most SPACs, the sponsor must hold the promote as equity in the combination for one year. Outperformance can end the lockup early, but in any case, the sponsor will need sustained outperformance for months after the combination.

- Warrants magnify returns. The sponsor usually receives special warrants that convert to equity if the combination’s stock price exceeds certain thresholds. This structure has a powerful magnifying effect, as it can, in some cases, significantly increase the sponsor’s stake.

- SPACs’ investors have a say. This term functions more like a stick: as with most merger transactions, SPACs’ investors must still vote to approve any deals. While rejections are rare, they can happen; sponsors are sensitive to the investors that choose to redeem their capital versus participate in mergers. Good deals secure sponsors’ promotes—and their reputations

Maximizing returns through the operator’s edge

Despite explosive growth, and the many incentives sponsors have to succeed, most SPACs have not outperformed. On average, SPACs since 2015 have substantially lagged behind their market indexes one year after the combination.3

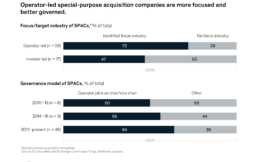

Some SPACs have bucked the trend. We have observed a potential recipe for SPAC success: add the operating edge. We analyzed the 36 SPACs from 2015 to 2019 of at least $200 million with at least 12 months of publicly available trading data. One year after merging, operator-led SPACs outperformed both other SPACs (by about 40 percent) and their sectors (by about 10 percent) (Exhibit 2).4 “Operator led” means a SPAC whose leadership (chair or CEO) has former C-suite operating experience (versus purely financial or investing experience). The findings, while not statistically significant, strongly suggest that operators make a meaningful difference.

Operator-led SPACs behave differently from other SPACs in two ways: they specialize more effectively, and they take greater responsibility for the combination’s success.

Operator-led SPACs have a higher tendency to identify an industry focus in their initial SEC filings (Exhibit 3). Unsurprisingly, the operators generally focus on their areas of expertise. Such initial filings typically do not unduly constrain the SPAC; instead, they signal to investors that the SPAC’s leaders will focus their resources on the areas they know best. Resources are scarce, so the focus matters; SPACs only have 18 to 24 months to find a deal, with minimal working capital. A narrower, more informed search may yield more effective sourcing, higher-quality diligence, better value-creation plans, and ultimately, better-performing assets.

Second, operators have increasingly taken leadership roles on combinations’ boards. In almost two-thirds of combinations, operators take chair or vice-chair roles. Those roles allow the operators to put their industry experience to work for the longer term. The operators can provide more influential governance and see plans through to execution. As in PE, operators may prove better collaborators for management—or know when to find new management teams.

In short, operators have helped drive outperformance starting from the SPAC’s IPO and continuing throughout the combination’s life cycle. An operator’s expertise may serve an important role in helping the SPAC narrow and vet its targets, then in exercising influence over the combination’s governance.

Sharpening the operating edge: Practical advice

McKinsey has long observed the advantages of the “operating edge” in PE transactions. We can apply similar lessons to SPACs in three phases of their life cycle:

- IPO and search for a target:

- First and foremost, hire the right operators. Find seasoned executives with clear, proven experience. They serve a dual purpose in providing expertise and in signaling the SPAC’s seriousness to investors.

- Focus the search. Narrow the SPAC’s primary search to the operator’s area of expertise. SPACs can declare this intention in their initial filing. Of course, the SPAC can remain opportunistic, but at least the initial intent will help marshal limited resources in the most efficient manner. Operators may also bring in differentiated deal flows through their networks.

- Due diligence:

- Leverage the experts. Bring the operators into the diligence process, from start to finish. Their experience will help quickly weed out bad deals and pressure-test targets’ fundamentals, strategic plans, and management teams.

- Establish a value-creation plan jointly with target management. C-suite executives have long spoken with investors about their industries. Build on their knowledge to create credible value-creation plans that will translate into sensible, exciting narratives for the combination. Operators can also help tell these stories in the road shows leading up to de-SPACs.

- Postclose:

- Lead. Join the board—preferably in a position of leadership, such as a chair or vice chair, to help guide the combination through its value-creation plan.

- Collaborate with (or replace) management. At the combination, SPACs dissolve into their individual shareholders. With a leadership role on the board, operators can represent sponsors’ interests with management, bolstered by their own credibility as seasoned C-suite leaders.

- Engage in active governance. In 2005—a lifetime ago in investing circles—and again in 2008, we showed the benefits of active ownership by operating partners in PE firms. Done well, SPACs combine the best of private and public ownership: the superior rigor of PE-style governance and the lower capital costs of public firms.

Chamath Palihapitiya Outlines His Vision for Social Capital

Chamath Palihapitiya, who started his career as a disruptive force in Silicon Valley with Facebook has big ambitions for Social Capital venture capital firm and its driving global digital transformation forward. As well as upending Wall Street as the king of SPACs.

What started as a venture-capital firm in 2011 could be a Berkshire Hathaway for the 21st century and social media generation.

In this Bloomberg Front Row interview, Wall Street’s king of special-purpose acquisitions companies, or SPACs, explains why he hopes to create as much wealth as Warren Buffett, why he’s betting on Bitcoin and Tesla, and how he’s trying to solve for inequality and climate change. Palihapitiya spoke exclusively with Erik Schatzker on Bloomberg’s “Front Row.”

Covering topics from:

- Day Traders, hedge funds, and the GameStop Reddit moment.

- How he made his first $10 Billion.

- The next frontiers for Social Capital.

- Chamath's political ambitions.

30 best insights and pieces of advice for entrepreneurs

With collective intelligence being a disruptive innovation theme we are investing in. We found these great collective insights from entrepreneurs and annual series from First Round ventures to be a great resources.

The 30 Best Pieces of Advice for Entrepreneurs in 2020

Here on the Review, we have an annual tradition that we look forward to each January. We press pause, pour ourselves a big cup of coffee, and pore over each article we published the previous year, with an eye for the very best pieces of advice that we’re still thinking about, one year on.

Since the Review’s genesis in 2013, we’ve interviewed hundreds of folks who are among the very best at what they do — and 2020 was no exception. We cherish the opportunity to carefully parse through the advice of the experts that were featured on the Review’s digital pages — from repeat successful founders, to events gurus, to top psychologists. (If you’re curious to see how this collection has evolved over time, check out previous editions from 2019, 2018, 2017, 2016, 2015, 2014 and 2013.)

As we leafed through what we published in 2020, a few themes stood out to us. No 2020 retrospective would be complete without a nod to “these unprecedented times” (and we’ve given up combing the thesaurus for any language to replace this rote phrasing). Despite the whirlwind of changes and explosion in content since 2013 — from the rise of Substack newsletters to the endless Twitter threads full of advice for entrepreneurs — our aim has remained consistent over the years. We seek not to chase trends or tackle specific industry verticals, but rather to publish enduring, evergreen company-building advice that both stands out from the crowd and can be put to use right away.

But this past year there was a pressing need to cover unexpected, timely topics where folks were clamoring for guidance. With our editorial plans upended, we quickly shifted gears. More importantly, founders, leaders and experts stepped forward, generously opening up their playbooks to offer wisdom that met the moment, from navigating the lightning-quick shift to virtual work, managing through turmoil, and adjusting your leadership mindset when it feels like you’re running on empty. You may have seen a lot written on these particular subjects across the internet, but as is always our goal, we hope the Review’s takes offered something a bit different.

2020 also brought the strength of pooling wisdom and leaning on community into sharp focus. No one person has all of the answers, and there’s power in bringing together plenty of different perspectives — some that you may agree with, and others that may not quite ring true for you. We tapped into that impulse more than ever this year, whether it was calling on a slew of recession-era investors and CEOs for their hard-won wisdom in the earliest days of the crisis, drawing on the experiences of over a dozen design leaders, or crowdsourcing the best tips on managing up and must-ask interview questions for candidates.

We even pushed ourselves out of our comfort zone of the written word and launched a brand-new podcast, In Depth, where we deliver the same signature interview style we’ve cultivated on the Review directly to your headphones.

We may not know what 2021 has in store, but as we reflect on the year that’s passed and what’s still to come, our sincere hope is that you continue to find a dose of inspiration, an actionable new tactic to try, or a compelling story to sink into whenever you turn your attention to the Review. We know the time you spend diving into an article or popping in your headphones is more precious than ever, and we continue to be sincerely grateful to all of you for spending it with us. Here are the 30 best pieces of advice from our articles last year — take them with you as we look towards brighter days to come.

1. Bookmark these 40 questions to ask interviewers on your next job hunt.

When it comes to interview advice, there’s plenty to go around for hiring managers. But for candidates, when the tables inevitably turn and the interviewer asks, “Do you have any questions for me?” it’s critical to not only stand out from the crowd, but also unearth some valuable information about whether this prospective company’s a good fit.

That’s why we published a follow-up to one of our most popular Review articles, sourcing ideas for questions candidates should ask from some of the sharpest folks we could find. Our aim? A robust roster of questions that go much deeper than “What’s the culture like?”

We’ll highlight a handful of our favorites below. Our advice? Narrow down your list of must-ask questions to the hiring panel by focusing on your deal-breakers — what would make you walk away?

-

What are the top three customers that you’ve won, and the top three customers that you’ve lost? “You get a real sense of how the company is doing in the market, what's working well — and what's not,” says Max Branzburg, VP of Product at Coinbase.

-

What’s something that would only happen here but wouldn’t at other organizations? “The culture of a workplace — an organization’s values, norms and practices — has a huge impact on our happiness and success,” says Adam Grant.

-

What area of the business would you say this company is behind on, given its stage? “This question can often highlight functions that are not established and areas where you have to fill in cross-functionally that might surprise you,” says Cristina Cordova, Head of Platform and Partnerships at Notion.

-

Can you tell me about your founding team’s background and why you’re tackling this particular problem? “More job candidates should think like an investor. After all, joining a company is one of the biggest investments one can make,” says Ryan Hoover, Founder of Product Hunt.

-

How would your team describe you? “What’s your management style?” is an all-too-common question, more likely to elicit platitudes than nuggets of wisdom. “Framing it from the perspective of the reports prompts the manager to think beyond their intent and instead consider their actual working relationships with the team,” says Zainab Ghadiyali (alum of Airbnb and Facebook).

-

Can I see your calendar for the week? “I believe there’s truth in calendars. If someone tells you in an interview that they really care about the learning, development and mentorship of their employees, their calendar should reflect that,” says Anna Binder, Head of People Operations at Asana.

READ MORE >>>> HERE

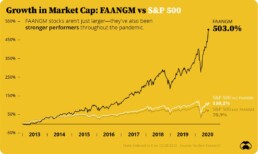

FAANGM market cap vs the S&P 500 performance

FAANGM vs S&P 500

Summary

- The tech-related FAANGM stocks have continued to outperform, and account for 20% US market cap, a doubling in only five years ago. This has been a critical market driver.

- They now trade at twice the market valuation, and the premium has never been bigger. We argue this is more than justified, and these stocks will only be stronger post-crisis.

- They have more than twice the margins, profitability, and growth of market. Are net cash, globally diversified, and the crisis accelerating tech adoption, reducing regulatory risk, and cutting competition.

FANG

An acronym that originally referred to Facebook, Apple, Netflix and Google and the leadership that these four stocks had provided to market indexes. At Commerce Trust, we expanded the group to six companies, adding Amazon and Microsoft for an even longer acronym, FAANGM

The S&P 500

A market capitalization-weighted index of the 500 largest publicly traded U.S. companies. A company’s market capitalization is calculated as its current stock price multiplied by its total number of outstanding shares. Market caps change over time, with movements determined by daily stock price fluctuations, the issuance of new stock, or the repurchase of existing shares (also known as share buybacks).

Celebrating visionary entrepreneur Tony Hsieh

Tony Hsieh

Former Zappos CEO & Visionary, 1973-2020

Tony Hsieh — Tony Hsieh (/ˈʃeɪ/ shay, Taiwanese; December 12, 1973 – November 27, 2020) was an American Internet entrepreneur and venture capitalist. He retired as the CEO of the online shoe and clothing company Zappos in August 2020 after 21 years. Prior to joining Zappos, Hsieh co-founded the Internet advertising network LinkExchange, which he sold to Microsoft in 1998 for $265 million

Let’s fall down the rabbit hole, together. Let’s choose our own adventure and follow our own bliss in this thing we call life. Let’s create a better world, together. Let’s imagine.

Our Goal = ICEE Inspire Connect. Educate. Entertain - Tony Hsieh

Sad times for the world and all fellow entrepreneurs. Tony Hsieh was one of the most remarkable, successful, and humble human beings I have ever meet. I am blessed to have been able to have him touch my life and have fun bending the conventional legacy business rules with him of what a CEO should do and be.

We were both early adopters of social media and Twitter as a way to be open, transparent, approachable, and connected to our industry, employees, and customers. We talked about and Tweeted back at Business Week and other publications that called us out. Saying CEOs should not be on social media. It was a waste of time, etc etc. We both ademantly believed and Tweeted back that those that were not would become irrelevant as leaders and out of touch with their customers, and that transparent openness equaled trust. "Trust" being the new currency along with culture and core values as the foundation of innovative companies. Years later those same publications were touting the power of the social enterprise and all execs need to embrace social. Funny to think about that now. Tony was always bending the rules.

One last thought on that front was when I emailed him about a joint marketing collaboration and I received a Jira ticket back with the Zappos marketing team. Jira ticketing at that time was an "engineering only ticketing system". We immediately adopted Jira across the entire company. Which made us significantly more efficient and accountable from a task management perspective that is now managed using tools like Asana.

The world seems a bit small as I magine all the amazing things he would have done to impact humanity. Which was his next mission and part of his entrepreneurial journey in his post Zaposs life. We will never know.

Today, we are saddened to share the news of Tony Hsieh’s passing. We can only imagine what he would say if he were here to announce this to you all, but we envision his message would resonate that:

Energy cannot be created or destroyed.

Energy is the ability to bring about change.

Tony has given energy to so many people. For those of you who knew him well, you knew of his childlike wonder; his love for experiences and relationships over material things. Let us all feel Tony’s energy and use it to deliver happiness.

It is with very heavy hearts that we are sharing some very sad news with all of you, as we have learned that Tony passed away earlier today (11-27-20). Though Tony retired this past summer, we know what a tremendous impact he has had on both Zappos and on Zapponians, as he has dedicated the past 20 years focusing on the success of both the company and our employees.

The world has lost a tremendous visionary and an incredible human being. We recognize that not only have we lost our inspiring former leader, but many of you have also lost a mentor and a friend. Tony played such an integral part in helping create the thriving Zappos business we have today, along with his passion for helping to support and drive our company culture.

Tony’s kindness and generosity touched the lives of everyone around him, as his mantra was of “Delivering Happiness” to others. His spirit will forever be a part of Zappos, and we will continue to honor his memory by dedicating ourselves to continuing the work he was so passionate about.

We will be working on ways to celebrate Tony’s extraordinary life in the coming days. In the meantime, we invite you to share your memories of the ways he brightened your life - you can send them to CelebratingTony@zappos.com and we will share them with his family.

Our thoughts remain with him and his loved ones. Zappos is a family, and we will continue to hold Tony close in our hearts. - Kedar Deshpande Zappos CEO

During his tenure at Zappos, Hsieh helped the company become one of the largest online shoe stores in the world. And in 2009, he helped ink Amazon's $1.2 billion purchase of the company. Prior to joining Zappos in 1999, when it was still called ShoeSite.com, Hsieh had founded an online ad company called LinkExchange, which he sold to Microsoft for $265 million in 1998.

Zappos's philosophy has long been "We don't sell shoes, we sell customer service," and its No. 1 core value is "Deliver WOW through service." For well over a decade, employees have authored Zappos's annual Culture Book, where Zapponians--as they're called internally--say in a few paragraphs what the company means to them. With about 1,500 employees, not everything makes it into the book, but it's brimming with photos of happy employee outings, aphorisms, and cheerful wishes.

Hsieh's tenure at Zappos was not without problems. Its experiment with holacracy--a decentralized system meant to distribute decision-making throughout the organization--is today largely seen as a bust. Around 18 percent of the staff left the company after Hsieh in 2014 first ordered that Zappos would no longer employ "people managers," and the company has been quietly backing away from the structure in recent years.

Separately, he has described losing $100 million over the course of Zappos's history, just from hiring mistakes. "Especially [true] amongst startups and entrepreneurs," he told Inc. in 2012. "There's a temptation to just get warm bodies in and hire as fast as possible. And then just by human nature when firing people, most people just drag their feet. What we learned is instead of trying hire quickly and fire slowly really it should be the reverse: we should hire slowly and fire quickly when it's not the right fit."

Despite that financial success, Hsieh's biggest impact on the world of business will likely revolve around his efforts to elevate customer service and company culture--to the point where his ideas are no longer novel but normal.

His corporate culture book/autobiography, Delivering Happiness, debuted at No. 1 on the New York Times bestseller list in 2010, and remains a foundational tome for entrepreneurs. In 2009, Zappos launched Zappos Insights, a consulting firm that helps other businesses fine-tune their own company cultures.

I was fortunate to have been able to meet Tony at the Inc 500 awards and see his "Delivering Happiness" keynote. Which is a timeless presentation based on principles that changed the way we approached our corporate culture as a marketing asset that dramatically impacted our growth and ability to build the MediaTrust brand into the 9th fastest growing company in the United States. Every company, startup, entrepreneur, and executive needs to understand and embrace these principles, and the power of culture as an important element in the stack of an organization.

The 4 core principles of delivering happiness are:

1. Find your one true passion and don't follow the money

2. Hire the right people, have the right company culture, and the rest will develop

3. Surprise your customers and show them how much you care

4. Make learning a priority for yourself and staff

His impact on e-commerce, the startup community, and entrepreneurship will remain indelible. Delivering happiness was always his mantra. So instead of mourning his transition, we should be celebrating his life.

I will leave you with this shared memory.

This ❤️. Thanks to @hitRECordJoe @hitrecord for sharing this special memory of Tony, and to everyone who has written in. If you have a memory of Tony Hsieh you'd like to share, please send it to: CelebratingTony@zappos.com https://t.co/EmM0DJ6Waw

— Zappos.com (@Zappos) December 1, 2020

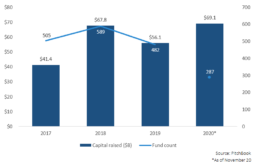

VC fundraising hits record $69B in 2020 with a16z closing 2 mega-funds

Andreessen Horowitz has helped the US VC industry set a new annual fundraising record—$69.1 billion year-to-date—after the firm closed two funds at a combined $4.5 billion.

a16z closes two mega-funds at the end of 2020

a16z Website | Portfolio | Twitter | Podcast

Mega-funds of $1 billion or more are making up a growing share of the VC landscape, highlighting a disparity between established investors and those raising capital for the first time.

US venture capital funds have raised a combined $69.1 billion in 2020, edging past a 2018 record and defying the odds amid a pandemic-rattled economy. The high-water mark was set after Andreessen Horowitz announced a pair of mega-funds with $4.5 billion in commitments Friday.

The news reinforces the dominant theme of fundraising in 2020: Big investors have gotten bigger while smaller firms have struggled. The 2020 year-to-date fundraising total was set by just 287 funds, compared with 589 funds in 2018 >>> READ MORE ON PITCHBOOK