Trajectory Alpha Acquisition Corp. TCOA: NYSE Prices $150 Million SPAC IPO

Trajectory ALPHA Acquisition Corp. (NYSE: TCOA) is a special purpose acquisition company (SPAC), formed to enable an IPO-ready disruptive technology innovation-driven company to list publicly.

NEW YORK, Dec. 9, 2021 /BUSINESS WIRE/ — Trajectory Alpha Acquisition Corp. (the “Company”), a special purpose acquisition company, announced the pricing of its initial public offering of 15,000,000 units at a price of $10.00 per unit. The units will be listed on the New York Stock Exchange and trade under the ticker symbol “TCOA.U” beginning December 10, 2021. Each unit consists of one share of Class A common stock of the Company and one-half of one redeemable public warrant. Each whole public warrant entitles the holder thereof to purchase one share of Class A common stock of the Company at a price of $11.50 per share. Once the securities comprising the units begin separate trading, the shares of Class A common stock and public warrants are expected to be listed on the New York Stock Exchange under the symbols “TCOA” and “TCOA WS,” respectively.

The Company is sponsored by Trajectory Alpha Sponsor LLC, and the Company’s management team is led by Peter Bordes, Michael E.S. Frankel and Paul Sethi, who together bring more than 80 years of experience investing in and operating technology-enabled companies. The Company is a blank check company incorporated as a Delaware corporation for the purpose of effecting a merger, consolidation, capital stock exchange, asset acquisition, share purchase, reorganization or business combination with one or more businesses. While the Company may pursue an initial business combination with any company in any industry, Trajectory Alpha Acquisition Corp.’s objective is to identify and work with a disruptive, technology-driven business that leverages its unique intellectual property and proprietary data to develop a sustainable competitive advantage and, in turn, dislodge slower-moving incumbents in the target’s selected end markets.

Guggenheim Securities, LLC is serving as sole book-running manager for this offering. The Company has granted the underwriters a 45-day option to purchase up to 2,250,000 additional units at the initial public offering price to cover over-allotments if any. The offering is expected to close on December 14, 2021, subject to customary closing conditions.

The offering is being made only by means of a prospectus. When available, copies of the prospectus may be obtained from:

- Guggenheim Securities, LLC, Attn: Syndicate Prospectus Department, 330 Madison Avenue, New York, NY 10017; Telephone: (212) 518-9658; E-mail: GSEquityProspectusDelivery@guggenheimpartners.com.

The registration statement relating to the securities became effective on December 9, 2021. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Cautionary Note Concerning Forward-Looking Statements

This press release contains statements that constitute “forward-looking statements,” including with respect to the proposed initial public offering and the anticipated use of the net proceeds. No assurance can be given that the proposed initial public offering will be completed on the terms described, or at all, or that the net proceeds of the initial public offering will be used as indicated. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the “Risk Factors” section of the Company’s registration statement and preliminary prospectus relating to the Company’s initial public offering filed with the Securities and Exchange Commission (the “SEC”). Copies are available on the SEC’s website at www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by applicable law.

About Trajectory ALPHA Acquisition Corp.

Trajectory ALPHA Acquisition Corp. is a newly organized blank check company formed by Trajectory Capital. TCOA: NYSE is a special purpose acquisition company (SPAC), formed to enable an IPO-ready disruptive technology innovation-driven company to list publicly.

Contact: Peter Bordes

Trajectory Alpha Acquisition Corp.

info@trajectorycapital.com

Neptune Retail Solutions acquires RevTrax and doubles down on in-store innovation, AI and first party data

We are thrilled for the team at Revtrax who have worked incredibly hard disrupting the CPG industry with a game-changing platform. They have been acquired by a great company that understands the value of what they developed, and how the online and digital CPG marketing world works to create an integrated ecosystem vs being fragmented and siloed.

It has been a great journey to be a part of and help contribute to getting them to this pivotal point in their trajectory.

Neptune Retail Solutions (NRS), a leading omnichannel retail marketing company, announced today that it has acquired RevTrax®, the leading promotions marketing platform. The RevTrax founding leadership team will join the NRS executive team long-term to help accelerate the integration of its Offer Management Platform (OMP), Universal Mobile OfferTM (UMO) solution, and its AI-driven dynamic pricing and promotions engine into Neptune's robust network of omnichannel activation solutions.

"We recently partnered with RevTrax to become the exclusive in-store seller of its UMO solution and are excited to take this partnership to the next level. We will accelerate the integration of our collective data sets across the NRS network – providing our brand and retail partners with unique digital offer and personalization capabilities at a massive scale," said Bill Redmond, CEO, Neptune Retail Solutions. "Our company focus has been to create transformative innovation within the industry and this acquisition puts us in a position to execute against client strategies with tangible results, in a way no other organization can."

RevTrax's industry-leading Offer Management Platform delivers innovation to brands at the intersection of digital marketing, offers and artificial intelligence. RevTrax solutions empower brands to modernize promotional marketing campaigns through one-to-one offer personalization, advanced performance measurement, best-in-class security and anti-fraud features. Their turnkey integrations with both cloud-based digital messaging platforms (web, display, email, mobile, etc.) and backend providers (payments, point-of-sale, etc.), deliver increased value to consumers while driving optimal ROI for brands and retailers.

Leveraging more than 11 years of powerful and unique first-party data, combined with state-of-the-art artificial intelligence for offer management, brands use RevTrax to automatically deliver each individual consumer the precise offer value needed to drive increased response, revenue, and profitability.

Increased shopper adoption of UMO reflects consumers' increased preference for digital coupons (vs printed coupons), in turn allowing for increased levels of data-driven personalization, actionable insights/analytics and fraud prevention for brands and retailers – both online and at the shelf. Owning this capability allows NRS to offer retail & CPG partners unique flexibility of offer delivery, along with enhanced benefits from a deeper understanding of shoppers and performance metrics at scale.

"We are thrilled to be accelerating our growth together with the Neptune team. It was clear from the beginning that their incredible in-store network of over 47,000 North American grocery and drug stores would quickly expand the potential and reach of game changing products like UMO and future RevTrax solutions," said Jonathan Treiber, CEO, RevTrax. "As part of the Neptune family, we are now squarely positioned to bring the much-needed digital innovation and transformation to brands and retailers at a scale that we simply couldn't accomplish as a standalone company."

ABOUT Neptune Retail Solutions:

NRS is a leading omnichannel retail marketing company in the US & Canada that delivers profitable growth for retailers and brands. The NRS platform is powered by both exclusive in-store marketing rights in North America's largest grocery and drugstores, including Kroger, Ahold, Loblaws, Walgreens and CVS, in addition to exclusive deterministic first-party shopper data, generated from the company's owned and operated cashback app, Checkout 51, capturing deterministic first-party shopping data via receipt scans from key retail locations across the US and Canada including Walmart, Target, Costco, Sam's Club and the retailers noted above.

About RevTrax:

RevTrax empowers brands to deploy intelligent promotions and offers across channels, track performance, and increase profit and marketing ROI. With a robust portfolio of patents relating to offer security, RevTrax brings control back into the hands of the brand. For more information, visit revtrax.com.

MainBloq digital asset trading platform acquired by Fernhill, a blockchain infrastructure platform optimizing & automating the digital asset ecosystem

We are excited to announce Trajectory Capital Co MainBloq is being acquired by FernHill to build the modern infrastructure to power the digital assets and cryptocurrency finance industry.

LAS VEGAS, NV / ACCESSWIRE / November 15, 2021 / Fernhill Corp (OTC PINK:FERN) is pleased to announce that it has completed its acquisition of MainBloq, a groundbreaking digital asset trading platform serving both banks and hedge funds. MainBloq's software platform, API and services deliver automated algorithmic trading, smart order routing, and customized trading solutions that optimize digital asset trading operations with connectivity to over 30 of the top crypto exchanges globally. MainBloq's platform bridges the gap for digital asset trading and provides institutional capabilities similar to more traditional fx, derivative, and equities trading platforms.

"We could not be more excited about this acquisition," said Marc Lasky CEO of Fernhill. "As we searched for an acquisition target, MainBloq met and exceeded all of the criteria we had put in place. Not only is MainBloq an exceptional product, with a world class management team, but their state-of-the-art proprietary technology fits perfectly with our short term and long-term goals of becoming a leader in the blockchain and digital asset industry. In addition, the synergies are very compelling when combining MainBloq with our Crypto Mining OS, PerfectMine. This truly enables Fernhill to become a one stop shop for all things crypto, from mining to trading and beyond."

With the MainBloq acquisition in place, Fernhill plans on developing a larger digital asset mining and trading ecosystem that combines the capabilities and resources to simplify, optimize and automate the ability for people and businesses globally to participate in the crypto industry.

Fernhill is proud to announce that the acquisition of MainBloq also comes with the addition of three new members to the Company's Board of Directors, Chris Kern, Peter Bordes, and Ryan Kuiken.

Chris Kern, Fernhill's strategic advisor and investor, is a 25+ year technology finance and M&A specialist that has been involved in several high-tech companies as an investment banker, senior executive, board member, investor and advisor where he completed over $650 million in transactions. Over the past 20 years, Chris has worked with a wide variety of financial service firms and investment banks such as Fisher Francis Trees and Watts, Lehman Brothers, Maximum Venture, Gunn Allen and New Century Capital Partners. Chris also has been an investor, advisor and director of strategy for FinTech and blockchain companies such as Latium, RadJav, FogChain, and ClickIPO. Chris will be joining Fernhill as its Chairman of the Board of Directors.

"Today is a very exciting day for Fernhill as we carve our path in the digital asset economy and complete the incredible acquisition of MainBloq, said Fernhill's newly appointed Chairman of the Board Chris Kern. "I'm also very thankful for having leaders and forward thinkers like Ryan and Peter join Fernhill's Board of Directors, both of whom have had great success with building companies, leading teams and driving a long-term strategic vision. As a combined force, I'm extremely confident in our abilities to become one of the leading ecosystems for digital asset mining and trading, and achieving many great things together, including uplisting to Nasdaq."

Ryan Kuiken, MainBloq's founder and CEO, has over 10 years of high-level sales and business development experience with companies such as T-Mobile and PayChex where he was awarded the #1 national sales rank for both firms. Ryan is also a partner in Bull Run Capital, a private digital asset trading fund focused on DeFi trading. Ryan will oversee and manage the overall execution of the growth plan and vision for MainBloq in coordination with Fernhill, and will be an observer of the Company's Board of Directors.

"To be honest, we were not even looking to be acquired, as we have been diligently working towards perfecting our technology," said MainBloq CEO/Founder Ryan Kuiken, "however, once Fernhill approached us, we immediately saw the synergies and long-term benefits to a partnership. They have a great team and we love their vision, so it's really the perfect opportunity to accomplish our goals in digital asset trading and DeFi."

Peter Bordes, MainBloq's Chairman and Founder, is a 30+ year technology entrepreneur, investor, advisor, board member and trusted growth hacker for a wide range of public and private companies which include being the CEO of Kubient (Nasdaq: KBNT) and member of the Board of Directors, Managing Partner of Trajectory Capital, a venture banking and venture investing platform, Board member and interim CEO for Alfi Technologies (Nasdaq: ALFI), as well as serving on the board of directors of Beasley Broadcast Group (Nasdaq: BBGI) and Chairs the digital transformation committee. Peter will be joining Fernhill as a member of the Board of Directors.

"I couldn't be more excited to join forces with Fernhill to accelerate our shared vision and journey, building the modern cloud infrastructure for the global cryptocurrency economy," said newly appointed Board member Peter Bordes. "Our combined teams' experience, resources and technology give us the core foundational building blocks to build our end-to-end ecosystem of crypto and blockchain applications, and infrastructure to power traditional and digital asset finance."

About Fernhill:

Fernhill Corp is a diversified technology holding company that has interests in and seeks to acquire, build and develop businesses in mobile applications, digital assets, SaaS, and FinTech space with a principal focus in the cryptocurrency and blockchain industries, as well as other technologies that address the world's leading environmental and social concerns. Fernhill supports and pursues ESG initiatives and is a Signatory Member of the Crypto Climate Accord (CCA).

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Fernhill Website:FernhillCorp.com

Company Contact Information: info@fernhillcorp.com

MainBloq Website: mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or it's subsidiaries.

#$FERN #FernhillCorp #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading

Forward-Looking Statements: This release includes 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute 'forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words 'estimate', 'project', 'intend', 'forecast', 'anticipate', 'plan', 'planning', 'expect', 'believe', 'will likely', 'should', 'could', 'would', 'may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

Argentine fintech Ualá acquires Mexican bank ABC Capital

Argentine financial services firm Ualá said on Wednesday that it had reached an agreement to purchase Mexican bank ABC Capital, which will allow it to accelerate its expansion and growth plans in the North American country.

The closing of the deal is subject to obtaining the required government authorizations, the company said in a statement.

The Argentine unicorn, which estimates investments of some $150 million in Mexico in the next 18 months, says it plans to accelerate the launch of new business verticals to strengthen its financial ecosystem.

“Our commitment to financial inclusion in Mexico is absolute. We come to revolutionize the market with more technology, access and transparency,” Pierpaolo Barbieri, founder and CEO of Ualá, said in the statement.

“Once we obtain the corresponding authorizations, the incorporation of ABC Capital to our group will allow us to offer better financial services to all Mexicans. This great step will accelerate our investment and growth in this beautiful country,” he added.

Ualá in August closed an investment round for $350 million led by China’s Tencent Holdings Ltd, and SoftBank Group Corp’s Latin America-focused fund, reaching a valuation of around $2.45 billion.

Launched in October 2017, Uala offers a Mastercard branded prepaid card and an app that allows users access to a number of financial services including sending and receiving money, online shopping, withdrawing cash at ATMs, and requesting loans.

The round came at a time when investors were putting a lot of money into Latin America, with the economy shifting to digital payments.

Ualá debuted operations in Mexico in September 2020. It has issued around 1,000 cards per day and has issued over 2.5 million cards in Argentina since 2017 when it launched.

The company also announced plans to buy Wilobank, Argentina’s first digital bank, a move that would help the company reach more unbanked customers in a region where nearly half the population has no access to financial services.

Lendflow Closes $10.8 Million Series A round to enable any company to be a Fintech

We are thrilled to be a part of LendFlow's Series A round with our partner 2048 Ventures and join Jon and the team's disruptive embedded financed innovation journey. They are growing rapidly into the infrastructure that democratizes fintech finance and enabling any company to offer capital, lend, and much more to come in 2022.

ALSO READ:

Why We Invested in Lendflow: The Future of Embedded Finance - Underscore VC

Lendflow, the market leader in embedded small and medium business lending, today announced it has raised a $10.8 million Series A funding round. Underscore VC led the financing, which brings its total funding raised since its 2019 inception to over $13 million. Uncorrelated Ventures, Y Combinator, 2048 Ventures, Knoll Ventures, I2BF, Hack VC and Navitas Capital also participated in the latest round.

Lendflow enables every SaaS company to become a fintech. Lendflow's white label solution allows vertical SaaS technology companies servicing small and medium businesses (B2SMB) to easily build, enhance or embed financial products within their ecosystem and offer hyper-contextual financing solutions.

The way in which small businesses access credit has shifted away from being a standalone activity handled by a financial institution, to a more contextual, in-workflow manner, offered and managed by companies that intimately understand their SMB customers. These companies are in a better position to use the data, knowledge, and relationships with their existing customers to deliver a superior financial product experience at a lower cost.

"The idea of contextual lending isn't new; in-market lending services have existed for some time, but historically, it took a tremendous amount of effort and time for a product or service provider to become a lender," said Jon Fry, CEO, Lendflow. "We've built a platform on which software companies can quickly launch financial products tailored to their audience. This promotes higher user engagement, increases revenue per user, and decreases churn. We're excited to execute alongside new partners, including Underscore VC, as they're deeply committed to the vertical SaaS space, and that added expertise will be crucial as we enter this next phase of growth."

Lendflow works with top vertical SaaS companies in construction, transportation, e-commerce and home services industries to help them launch lending services quickly and effectively. The platform includes:

- Robust API and data services offerings that include KYB and credit verification, which allows customers to build elegant and seamless credit programs directly within their existing lending platforms

- User-friendly code to minimize operational complexity, development resources, and time to market

- A white label solution that provides a native experience and allows vertical SaaS platforms to maintain brand control.

"High performing teams that narrow focus on their specified areas of expertise are interesting to us as they get traction quickly and grow in a sustainable, managed way. That's why we're excited to back the team at Lendflow," said Chris Gardner, Partner at Underscore VC. "They understand their customers deeply, and have the insight and know-how to deliver an integrated platform on which these companies can build to deepen relationships with their customers, and offer customized services that would otherwise have to be outsourced to banks that don't have the intimate, industry knowledge to make these relationships consistently successful."

Customers have embraced Lendflow's user-friendly, industry-specific approach to lending vs. going through traditional banks. "Lendflow has helped us expand our reach into new markets by enabling us to quickly launch a robust capital program. Their full-service capabilities allow us to meet our customers' needs for fast, transparent access to capital in an efficient, scalable way." says Andrew Dunn, VP of Financial Products at Levelset.

The new funding will enable the company to expand its product suite with an improved customer experience and enhanced data services offerings to serve a broader group of customers in the U.S. and abroad.

About Lendflow

Lendflow is a technology leader that provides embedded finance infrastructure for vertical SaaS platforms. Combining a vast marketplace, contextual product placements and powerful data services that include data aggregation, orchestration, decisioning, monitoring and standardization, Lendflow enables every tech platform to build, enhance or embed financial products within their ecosystems. With Lendflow, SaaS platforms increase customer engagement and retention, lenders can expand their reach and increase operational efficiencies and SMBs can quickly access capital to power their growth.

About Underscore VC

Underscore VC is a Boston venture capital firm that backs bold entrepreneurs from seed to series A with dynamic capital and an aligned community designed to fit each startup's unique needs. To learn more about Underscore VC and the Underscore Core community, visit www.underscore.vc.

FraudNet cloud wins Juniper Research fintech innovation award for AI platform of the year

ALSO READ:

Fraud.net Recognized in 2021 Gartner Market Guide for Online Fraud Detection - Fraud.Net

Fraud.net, a leading fraud prevention and risk management platform, is proud to announce that it has won the 2021 Platinum Juniper Research Future Digital Award for "AI Platform of the Year" in Fintech Innovation.

Juniper Research recognizes and awards the "most impactful financial products and services operating across: Banking, Fraud and Security, and Retail and Payments."

"We are honored to be the Platinum Award winner in this category, the highest accolade awarded by Juniper Research, and are tirelessly working on further improving our AI solutions to isolate fraud and digital risk so our clients can grow faster," says Cathy Ross, President and co-founder of Fraud.net.

About Fraud.net:

Fraud.net operates the first end-to-end fraud management and revenue enhancement ecosystem specifically built for digital enterprises and fintechs globally. The award-winning, cloud-born platform helps organizations of all sizes harness AI-driven risk intelligence to detect fraud, streamline their customer onboarding and transaction monitoring workflows, and leverage real-time, actionable insights to make safer, smarter, and more profitable decisions.

To learn more about their award-winning fraud detection solution, visit Fraud.net today.

About Juniper Research:

Juniper Research specializes in 'identifying and appraising high growth market sectors within the digital ecosystem.' It is one of the leading analyst firms in digital tech, using market forecasting, competitive analysis, and strategic assessment in its research to provide impartial, independent commentary on opportunities that businesses are considering taking in the digital industry.

Disruptive innovation and the power “Market Networks”

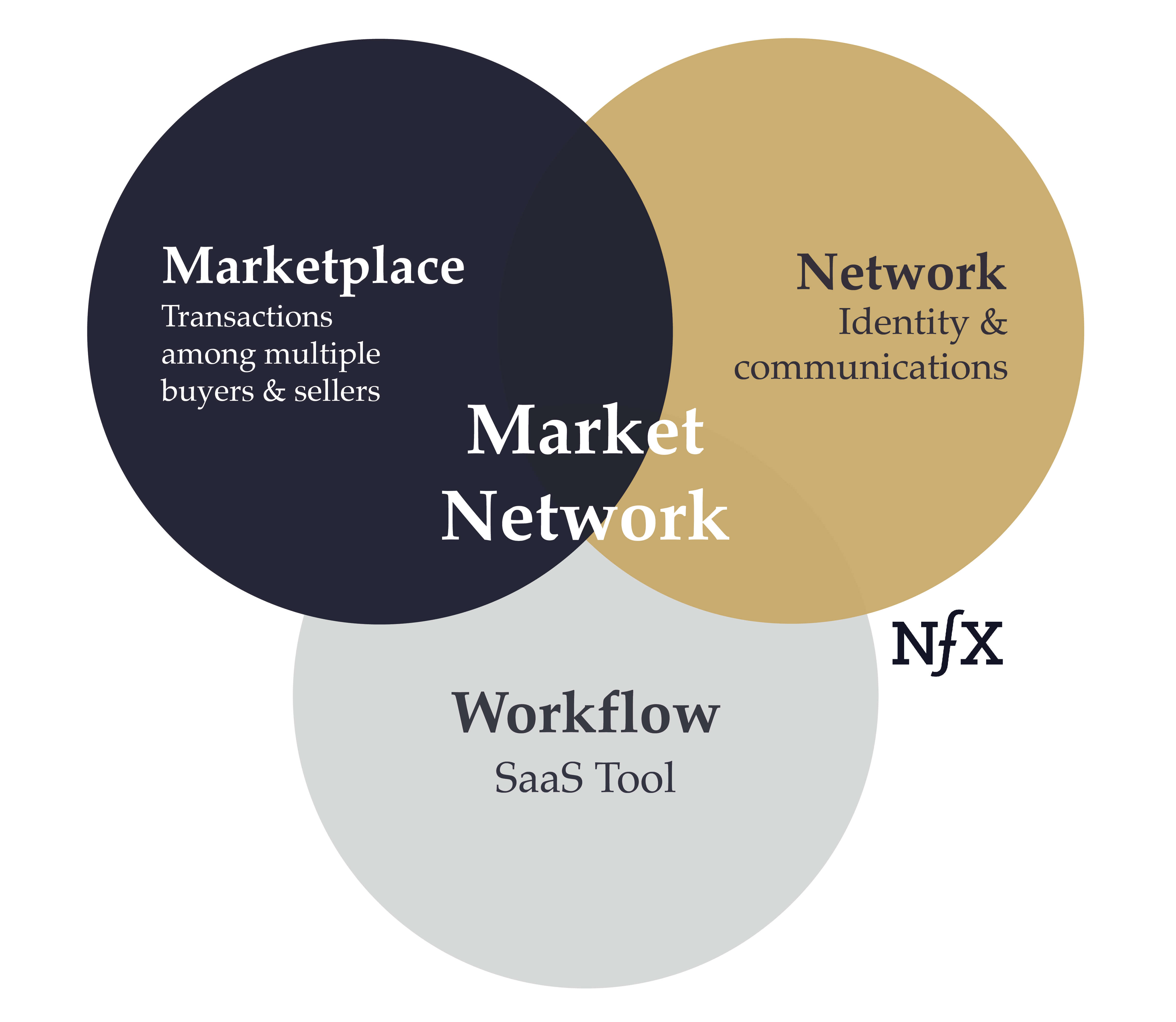

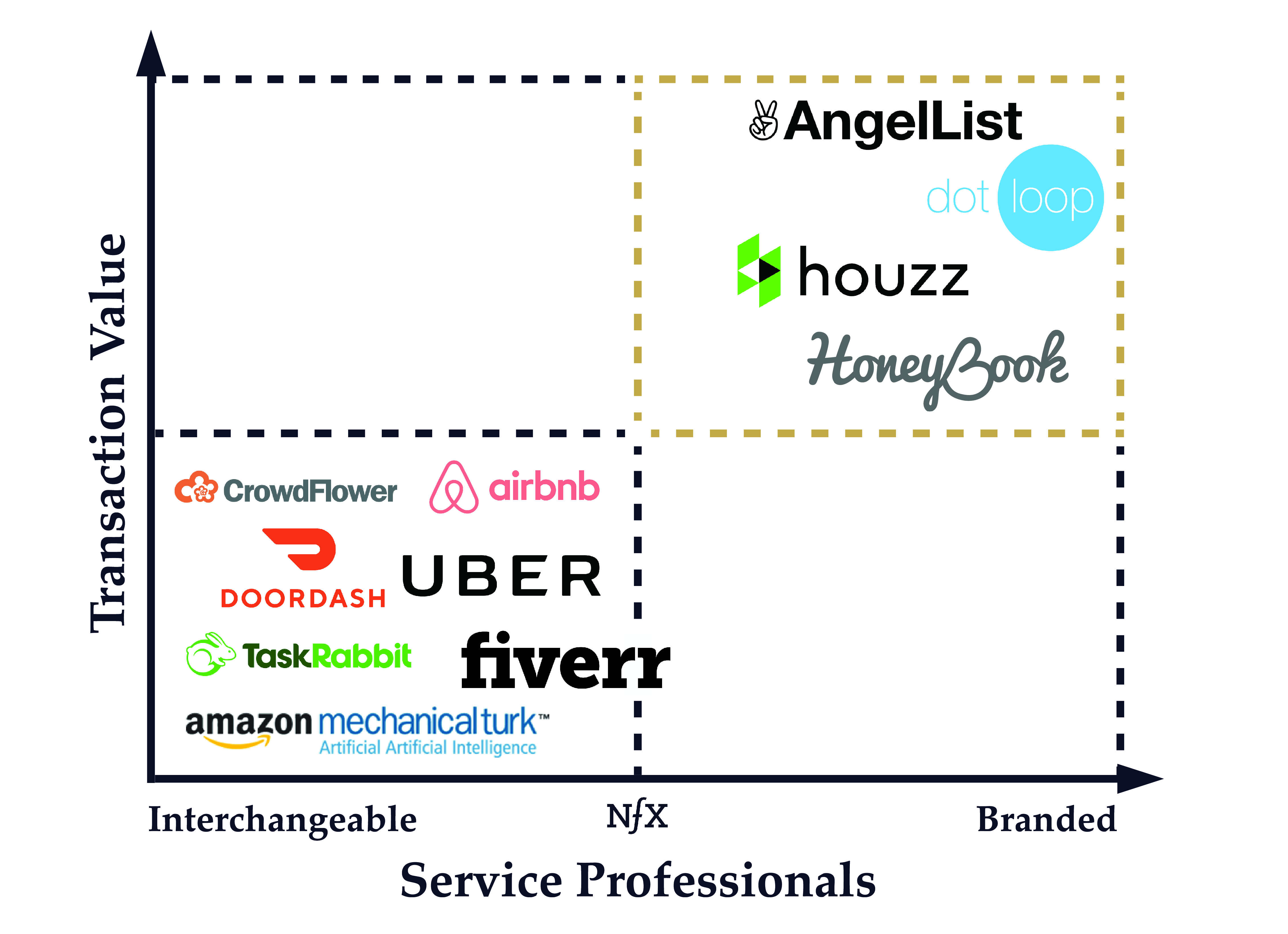

A market network is what you get when you combine a social network, a marketplace, and a SaaS company.

They demonstrate the power of an investment theme we focus on regarding post-digital transformation fragmentation within industry segments. A pattern that can be found repeating itself when disruptive innovation transforms industries, causing hyper fragmentation and silos in the first wave of digital transformation.

The 2nd wave of companies are those that build the infrastructure efficiency by defragmenting and bringing the best aspects together that enable the next wave of scalability. The emergence of the market network is a perfect example that every entrepreneur, start-up, and company looking to disrupt should study and apply to their critical thinking, approach, and strategy to evolving platforms.

Market Networks: Dissecting ‘The Business Model Of The Decade’ - Forbes

Watch "Market Networks the Hidden Advantage" with James Currier,

General Partner at NFX, a seed-stage venture firm headquartered in San Francisco.

Most people didn’t notice when a 35-person company in San Francisco called HoneyBook announced a $22 million Series B in March 2015.

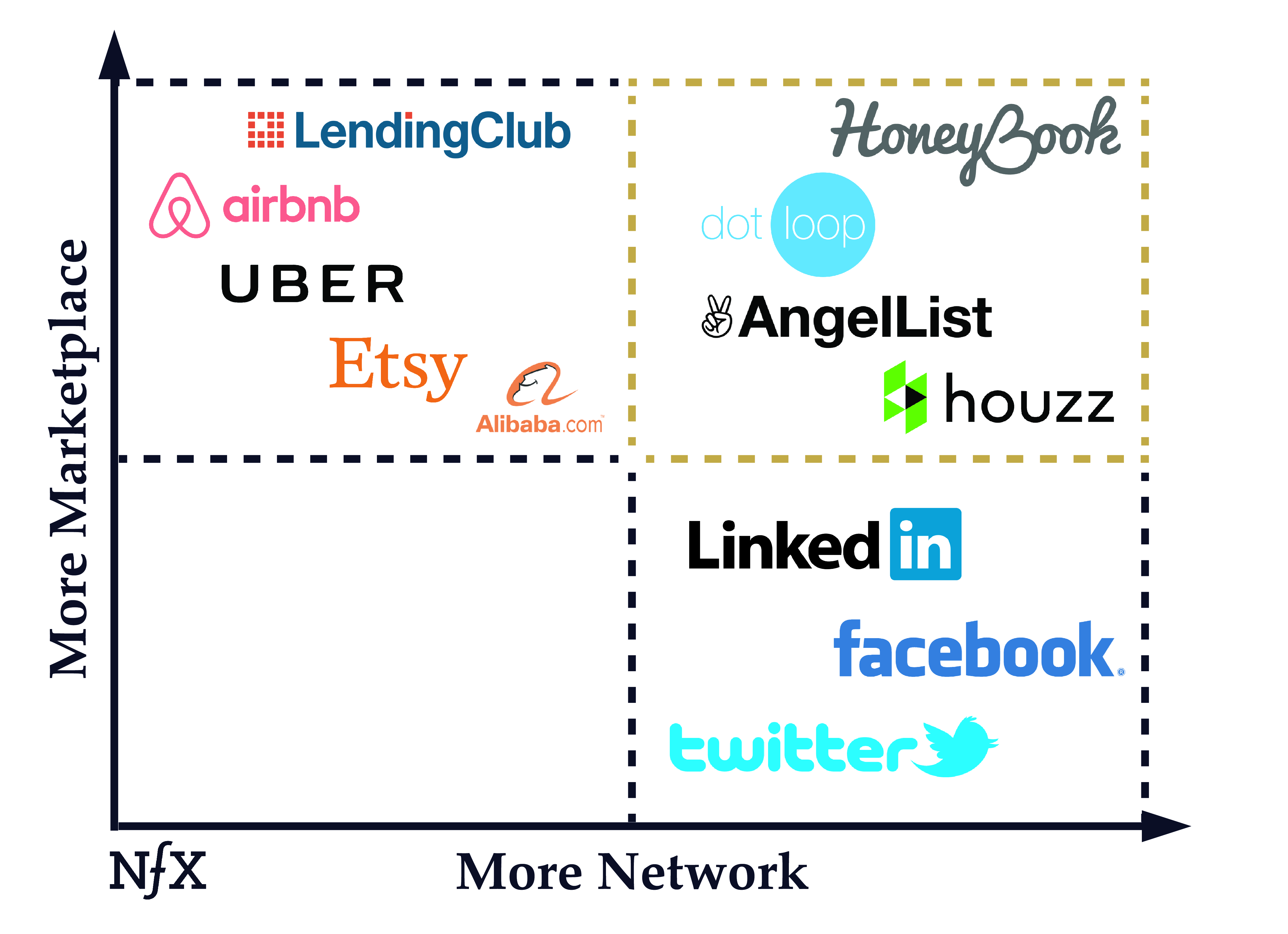

What was unusual about the deal is that nearly all the best-known Silicon Valley VCs competed for it. That’s because HoneyBook is a prime example of an important new category of digital company that combines the best elements of networks like Facebook with marketplaces like Airbnb — what we call a market network.

Market networks will produce a new class of unicorn companies and impact how millions of service professionals will work and earn their living.

What Is A Market Network?

Marketplaces provide transactions among multiple buyers and multiple sellers — like Poshmark, eBay, Uber, Patreon, and LendingClub.

Networks provide profiles that project a person’s identity and then lets them communicate in a 360-degree pattern with other people in the network. Think Facebook, Twitter, Goodreads, and LinkedIn.

What’s unique about market networks is that they:

- Combine the main elements of both networks and marketplaces

- Use SaaS workflow software to focus action around longer-term projects, not just a quick transaction

- Promote the service provider as a differentiated individual, helping build long-term relationships

Market networks are also unique from a monetization standpoint. They combine the strong network effects defensibility and scalability of direct networks like LinkedIn or Facebook together with the lucrative revenue models of SaaS or marketplace businesses.

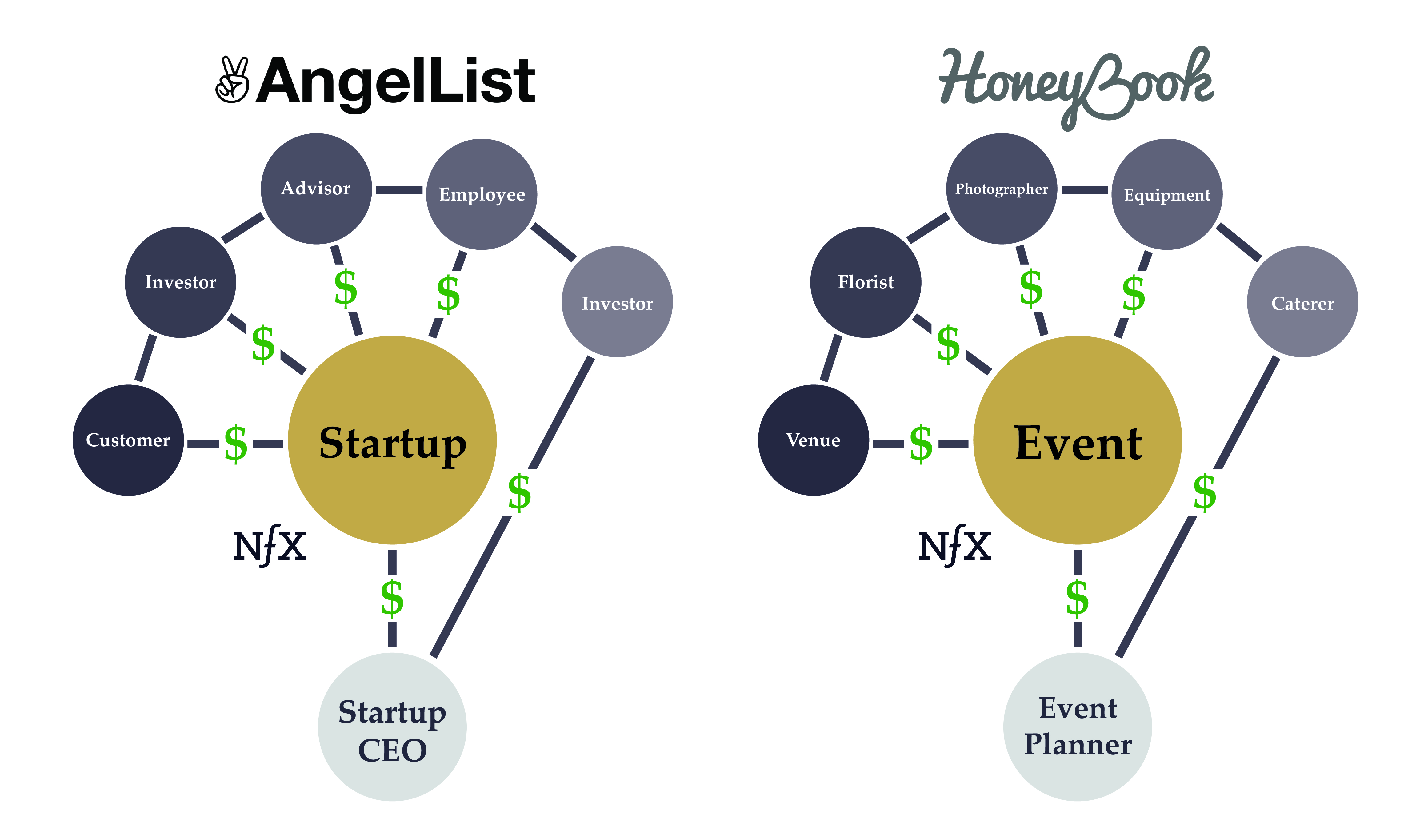

An example will help: let’s go back to HoneyBook, a market network for the events industry.

An event planner builds a profile on HoneyBook.com. That profile serves as his professional home on the Web. He uses the HoneyBook SaaS workflow to send self-branded proposals to clients and sign contracts digitally.

He then connects the other professionals he works with like florists and photographers to that project. They also get profiles on HoneyBook and everyone can team up to service a client, send each other proposals, sign contracts and get paid by everyone else.

This many-to-many transaction pattern is key. HoneyBook is an N-sided marketplace — transactions happen in a 360-degree pattern like a network, but they come here with transacting in mind. That makes HoneyBook both a marketplace and network.

A market network often starts by providing a SaaS tool to a professional that lets them perform a critical task. That same SaaS tool then also lets the professional connect better with their network as it already exists offline today, whether they be clients or other professionals or both. Many of the people in these professional networks have been transacting with each other for years using fax, checks, overnight packages, and phone calls.

By moving these connections and transactions into software, a market network makes it significantly easier for professionals to operate their businesses and clients to get better service.

We’ve Seen This Before

AngelList is also a market network. I don’t know if it was the first, but Naval Ravikant and Babak Nivi deserve a lot of credit for pioneering the model in 2010.

On AngelList, the pattern is similar. The CEO of the startup creates her own profile, then prompts her personal network of investors, employees, advisors, and customers to build their own profiles. The CEO can then complete some or all of her fundraising paperwork through the AngelList SaaS workflow, and everyone can share deals with everyone else in the network, hire employees, and find customers in a 360-degree pattern.

In 2013, when I met Oz and Naama Alon, two of the founders of HoneyBook, they were building a beautiful network product — a photo-sharing app for weddings. We sat down and I walked them through the new idea of a market network. They embraced it immediately, and have taken it to a whole new level – from the design and workflow to the profile customization and business model. They are now able to become a horizontal platform for transactions and workflows, working across many professional sectors.

Similar Essay

Growth Frameworks For Your Marketplace

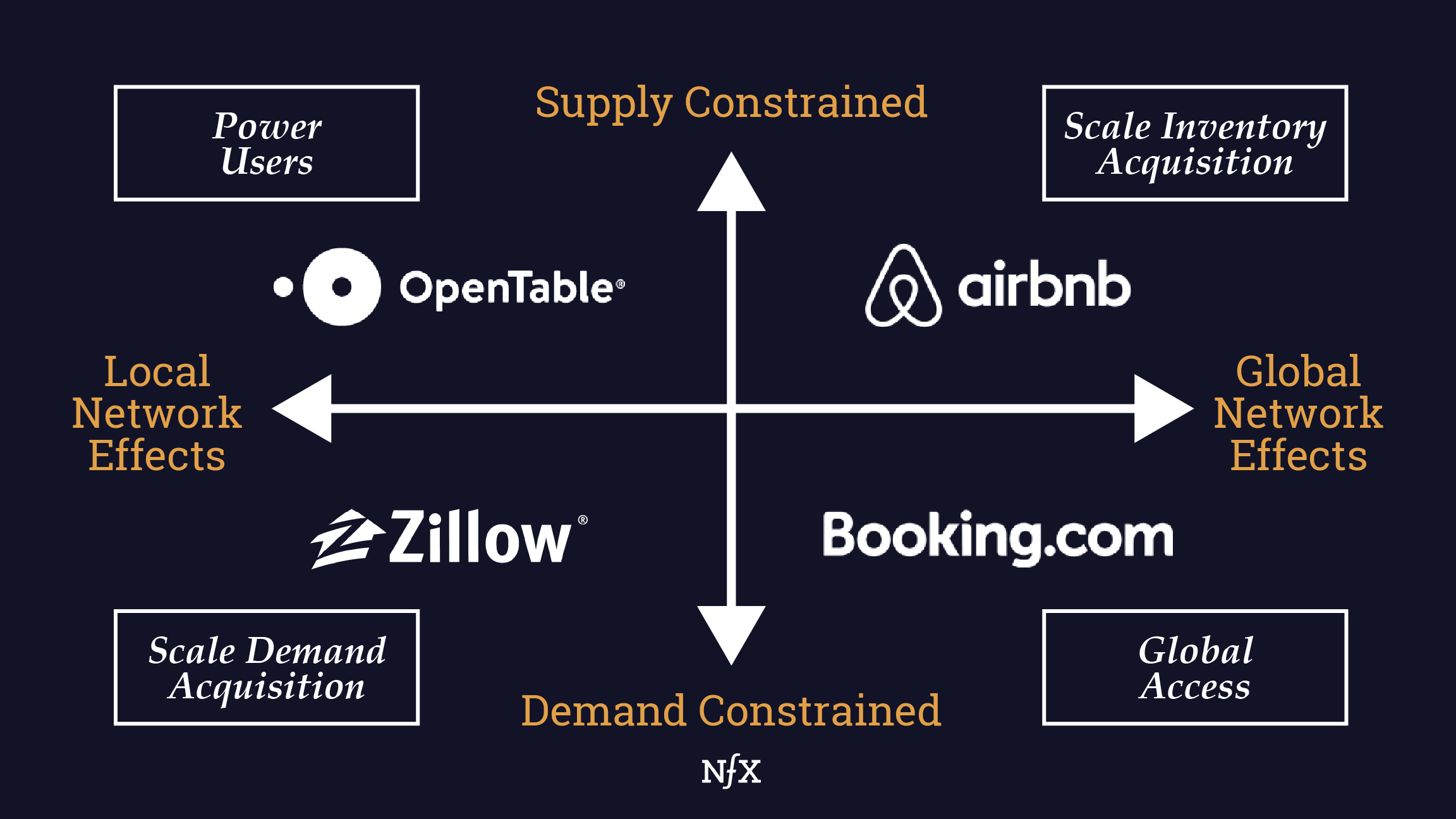

Houzz is a third good example. Houzz connects homeowners with home improvement professionals and with products they can buy for their homes. They have a product that is very nearly a market network. The company raised $165M in its last round (update: since the time of this article’s initial publication, Houzz went on to raise a $400M round valuing the company at a reported $4 billion. Further, they acquired Ivy, an NFX-backed company, which gives them the full market network capabilities with interior designers).

DotLoop in Cincinnati shows the same pattern for the residential real estate brokerage industry. DotLoop was acquired by Zillow Group for $108M in August 2015 as part of the Zillow Group’s evolution into a market network.

Looking at AngelList, DotLoop, Houzz, and HoneyBook, the market network pattern is visible.

Seven Attributes Of A Successful Market Network

1. Market networks target more complex services

In the last decade, the tech industry has obsessed over on-demand labor marketplaces for quick transactions of simple services. Companies like Uber, Lyft, Mechanical Turk, Thumbtack, DoorDash, and many others made it efficient to buy simple services whose quality is judged objectively. Their success was based on commodifying the people on both sides of the marketplace.

However, the highest value services – like event planning and home remodels — are neither simple nor objectively judged. They are more involved and longer-term. Market networks are designed for these.

2. People matter

With complex services, each client is unique and the professional they get matters. Would you hand over your wedding to just anyone? Does your home remodel? The people on both sides of those equations are not interchangeable like they are with Lyft or Uber. Each person brings unique opinions, expertise, and relationships to the transaction. A market network is designed to acknowledge that as a core tenet and provide a solution.

3. Collaboration happens around a project

For most complex services, multiple professionals collaborate among themselves—and with a client—over a period of time. The SaaS at the center of market networks focuses the action on a project that can take days or years to complete.

4. They have unique profiles of the people involved

Pleasing profiles with information unique to their context give the people involved a reason to come back and interact here. It captures part of their identity better than elsewhere on the internet.

5. They help build long-term relationships

Market networks bring a career’s worth of professional connections online and make them more useful. For years, social networks like LinkedIn and Facebook have helped build long-term relationships. However, until market networks, they hadn’t been used for commerce and transactions.

6. Referrals flow freely

In these industries, referrals are gold, for both client and service professionals. The market network software is designed to make referrals simple and more frequent.

7. They increase transaction velocity and satisfaction

By putting the network of professionals and clients into software, the market network increases transaction velocity for everyone. It increases the close rate on proposals and speeds up payment. The software also increases customer satisfaction scores, reduces miscommunication, and makes the work pleasing and beautiful. Never underestimate pleasing and beautiful.

Social Networks Were The Last 10 Years.

Market Networks Will Be The Next 10.

First we had communication networks like telephones and email. Then we had social networks like Facebook and LinkedIn. Now we have market networks like HoneyBook, AngelList, DotLoop, and Houzz.

You can imagine a market network for every industry where professionals are not interchangeable: law, travel, residential real estate, commercial real estate, media production, architecture, investment banking, interior design, personal finance, commercial construction, residential construction, consulting, and more. Each market network will have different attributes that make it work in each vertical, but the principles will remain the same.

Over time, nearly all independent professionals and their clients will conduct business through the market network of their industry. We’re just seeing the beginning of it now.

Market networks will have a massive positive impact on how millions of people work and live, and how hundreds of millions of people buy better services.

I hope more entrepreneurs will set their sights on building these businesses. It’s time. They are hard products to get right, but the payoff is potentially massive.

Jetty raises $23m and launches new flexible rent payment product

Rental-based financial services company Jetty has launched a new program, Jetty Rent, which will give more flexibility with late fees, according to a press release.

The service will take away the cost burden and give renters flexibility on when they pay rent.

Now, Jetty will set about paying rent for renters on the first of the month. Then, the renters will have until the 24th to pay rent to Jetty.

Jetty raises $23M to help give renters more payment flexibility

Fintech Platform Adds Latest Offering for Renters

Jetty, the financial services company on a mission to make renting a home more affordable and flexible, today announced the launch of Jetty Rent, a new product that removes the cost burden of expensive late fees by giving renters the flexibility to choose when they pay their rent. This latest offering on the Jetty platform was developed and brought to market with the backing of a new, $23M equity financing round from investors that include Citi and Flourish Ventures.

According to data from the National Multifamily Housing Council (NMHC), in the first six months of 2021 an average of 21% of renters failed to pay their rent by the 6th of the month*, a cutoff date that would typically trigger late fees from property owners. The federal eviction moratorium restricted the charging of late fees, but with the moratorium now partially lifted, many renters will once again be facing this financial challenge.

"It's a tricky situation—property managers need predictable cash flow to meet their financial obligations, yet forcing renters to meet rigid, first-of- the-month payment dates doesn't reflect the financial realities of today's renter population," said Mike Rudoy, Co-Founder and CEO of Jetty. "We solved this monthly headache with Jetty Rent, which gives renters more flexibility with payment while at the same time offering property managers the reliable cash flow they need."

With Jetty Rent, Jetty will pay rent on behalf of renters on the first of the month and renters will then have until the 24th of each month to repay Jetty, which they can do in one lump sum or through installments..

To launch Jetty Rent, the company partnered with Cortland, a top 20** real estate investment, development and management company, who rolled out the offering to residents across a portfolio of properties.

"At Cortland, we're focused on improving the resident experience, and the process of paying rent is a massive part of that," said Jonathan Kirn, Director of Ancillary Services at Cortland. "Jetty Rent makes life easier on our residents and takes the burden of rent collection off our shoulders—it's a true win-win."

Jetty Rent is the latest product to be offered by Jetty. The company also offers low-cost renters insurance as well as its industry-leading security deposit replacement, Jetty Deposit.

"We're seeing overwhelming demand from renters and property managers alike for new financial services across the entire renter lifecycle," said Rudoy. "Our team is working toward building the most all-encompassing financial services platforms for the rental market. From Jetty Deposit to Jetty Protect to now Jetty Rent, our platform is unrivaled in the industry."

Emmalyn Shaw, Managing Partner at Flourish Ventures, added:

"Embedded finance platforms like Jetty are quickly becoming one of the most influential technology trends taking place around the world—one where the customer's experience with such things as online payments and loans comes first. We're thrilled to back the Jetty team as they continue to develop their fintech platform and product offerings to help reach those who need relief and flexibility with meeting housing costs."

Jetty Rent loans are made by Cross River Bank, an Equal Housing Lender, Member FDIC. All new Jetty Deposit bonds are backed by Farmers Insurance®.

* Source: NMHC Rent Payment Tracker

** Source: NMHC Top 50 Apartment Managers

About Jetty

Jetty is the financial services platform on a mission to make renting a home more affordable and flexible. Jetty's integrated suite of products helps property managers increase lease conversions, improve resident retention, reduce bad debt, and boost NOI. For renters, Jetty decreases the financial burden of moving into a new home and offers greater flexibility with how and when to pay rent. To learn more about Jetty, visit jetty.com.

Contact

Jetty

Alex Vlasto

alex.vlasto@jetty.com

2021 Finovate award winner for top emerging tech Company goes to Synctera

We're excited to announce our disruptive fintech innovation portfolio company Synctera has been awarded the Finovate 2021 Top Emerging Tech Company Award. Which is given to a fintech startup two years old or younger that is the most likely to become the next fintech unicorn.

Synctera is just getting started with its rapid trajectory as the leading marketplace for banks and fintech platforms to partner, and we can't wait to share all the exciting things ahead. Make sure to reach out to our team if you have any questions or would like to connect to build a collaborative partnership as a bank or fintech CONNECT HERE with an expert

Synctera makes it easy for community banks and FinTechs to find their perfect match and work together.

2021 Finovate Award Winners Unveiled

Today we’re busting out the virtual confetti to announce the winners of the 2021 Finovate Awards, recognizing excellence in fintech across 25 different categories. This is the third annual Finovate Awards competition, which aims to highlight strong work done by the companies who are driving fintech innovation forward and the individuals who are bringing new ideas to life.

We may not get to congratulate the award winners with handshakes this year, but that doesn’t make the accomplishments any less compelling. These companies and individuals have proven that they have what it takes to capture the attention of the fintech world through standout products, services, and overall excellence.

Judges for the awards include media analysts, board members, bankers, fintech founders, and more. Each were given the difficult task of taking a record number of nominations and distilling them down to just a single winner in each category.

- Top Emerging Tech Company: Synctera

- Best Alternative Investments Platform: Pipe

- Best Back-Office / Core Service Provider: MANTL

- Best Consumer Lending Platform: Salary Finance

- Best Customer Experience Solution: TMRW by UOB

- Best Digital Bank: Oxygen

- Best Digital Mortgage Platform: LendingHome

- Best Embedded Finance Solution: ApexEdge

- Best Enterprise Payments Solution: GoCardless

- Best Financial Mobile App: Simplifi by Quicken

- Best Fintech Accelerator/Incubator: Financial Solutions Lab

- Best Fintech Partnership: T-Mobile and BM Technologies

- Best ID Management Solution: IDology

- Best Insurtech Solution: FloodFlash

- Best Mobile Payments Solution: Simpl

- Best RegTech Solution: Featurespace

- Best SMB/SME Banking Solution: Ramp

- Best Use of AI/ML: Zest AI

- Best Wealth Management Solution: Charles Schwab

- Excellence in Financial Inclusion: Airtel Money

- Excellence in Pandemic Response: Biz2Credit

- Excellence in Sustainability: BlocPower

- Executive of the Year: Barbara Morgan, FIS

- Fintech Woman of the Year: Jo Ann Barefoot

- Innovator of the Year: Jon Schlossberg

While only one company can win each category, it’s also worth recognizing the quality of all of the finalists who made it to the last stage in the process.

We owe a huge thank you to the panel of judges, followers, and everyone who took the time to submit a nomination. Congratulations to the winners!

Ecommerce fulfillment tech and services provider MasonHub opens East coast fulfillment center

The new 200,000 square-foot facility in Wilkes-Barre, Pennsilvania complements MasonHub's West Coast fulfillment operations. Tripling their capacity and enabling two day shipping in the United States.

MasonHub, a game-changing provider of fulfillment technology and services founded by retail operations veteran Donny Salazar, has opened a 200,000-square-foot East Coast fulfillment center in Wilkes-Barre, PA, enabling two-day ground shipping to 90 percent of U.S. customers. The custom-built facility is close to New York City and within the densely populated Northeast corridor, making it the optimal bicoastal complement to MasonHub's Los Angeles headquarters.

With this new facility, MasonHub gives its clients advanced order-routing capabilities based on the location of available inventory and transit time to the customer. In the future, this technology will allow MasonHub to automatically recommend the best inventory distribution throughout its network and recommend the fastest and most cost-effective way to route returns. Both facilities are fully owned and operated by MasonHub, and offer ambient temperature-controlled storage.

"In this day and age, fast shipping and low-cost delivery are table stakes. An East Coast facility is critical to meeting customers' needs as we continue to build our network of fulfillment centers," said MasonHub CEO Salazar.

In 2018, MasonHub raised $6.5M in seed funding led by Canvas Ventures, enabling the opening of a 100,000 sqf fulfillment center in Los Angeles' Inland Empire. Along with its cutting-edge technology and hands-on fulfillment services focused on the specific needs of fast-growing omnichannel retailers, MasonHub is modernizing the multi-billion U.S. third-party logistics industry.

As retailers search for a more cohesive way to connect and manage the disparate systems required for omnichannel distribution, MasonHub delivers with an easy-to-use, powerful order management system and an integration platform focused on fulfillment, paired with highly personalized customer service boasting an industry-leading NPS score of 78. Built by retailers for retailers, MasonHub is engineered to scale with fast-growing companies and take the guesswork out of connecting multiple sales channels.

About MasonHub, Inc.:

Founded in Los Angeles in 2018 by Stanford Graduate School of Business alumnus and retail operations veteran Donny Salazar, MasonHub, Inc. (www.masonhub.co), is an omnichannel fulfillment technology and services company revolutionizing the third-party logistics industry. Built from the ground up by retail veterans and innovators, MasonHub employs cutting-edge technology to meet the specific needs of fast-growing omnichannel retailers. Its high-touch, personalized service includes a user-friendly interface that provides clients with complete and real-time data visibility. MasonHub is supported by a seed round of $6.5M led by Canvas Ventures.