Y Combinator recently published their latest Top Companies list online, listing the top 137 YC portfolio startups in descending order of valuation. The headline statistics are impressively shocking:

$300B+ combined valuation

125+ companies valued at $150 million+

60K+ jobs created

Since Rebel Fund’s job is to select and invest in the top 3–4% of YC startups in each new batch, we carefully study past YC startup successes to help us identify patterns that could be predictive of tomorrow’s unicorns. Many of these patterns are encoded in our proprietary Rebel Theorem machine learning algorithm, but we also like to understand them intuitively as we meet with future YC founders and decide which ones to support as a venture fund.

To that end, I’ll share some of the insights that we’ve gleamed by studying these 137 YC startup success stories creating $300B+ in total market value. While no retrospective data analysis can replace an expert assessment of an individual startup’s team, market, product and traction, there are some telling historical patterns that any smart early-stage investor should bear in mind.

Valuations

It’s best to start by highlighting how incredibly skewed value creation is in the world of tech startups. As explained in my previous post On the eery predictability of YC startup valuations, startup valuations tend to fall along a steep power-law curve and YC startups fall along one nearly perfectly.

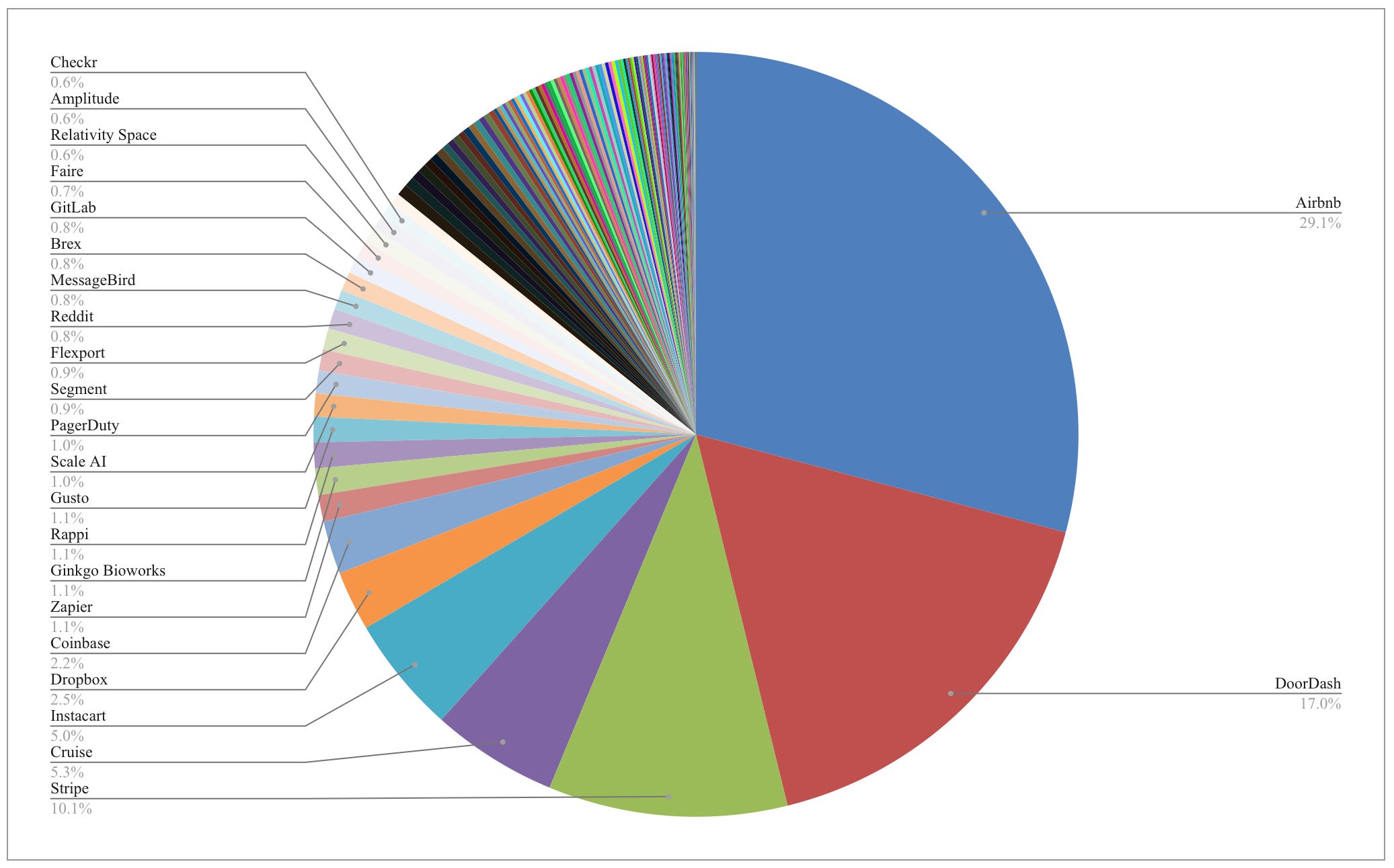

By our math, these 137 top companies represent the vast majority of the total value of YC’s 2500+ portfolio companies, even though they represent just ~5% of them by number. To help illustrate the power-law dynamic, here’s a pie chart showing the valuation breakdown of YC’s top companies according to our research:

Just 3 companies, Airbnb, DoorDash, & Stripe, represent more than half of YC’s top companies portfolio value, and the top 10 companies represent ~75% of it.

Every one of the labeled companies on this chart are ‘unicorns’ valued at $1B+ and even the smallest unlabeled slither is a company valued at over $100M. Despite that all of these top startups are incredible successes for their founders and investors, the ‘megacorns’ still dominate the chart.

Bear in mind that most of these companies raised seed rounds at $3M to $10M valuations, so a median top company with a ~$500M valuation is now valued at a whopping 50x to 150x its seed stage valuation. For Airbnb, you can multiply that by another 20x given its ~$100B valuation, for something closer to 3000x valuation growth.

The main implication for seed stage investors is to swing for the fences since a few mega successes drive the vast majority of YC’s portfolio value. Given the massive potential upside of even a middling top company, perhaps a secondary implication is “just swing!”

Location

So where are top YC companies located?

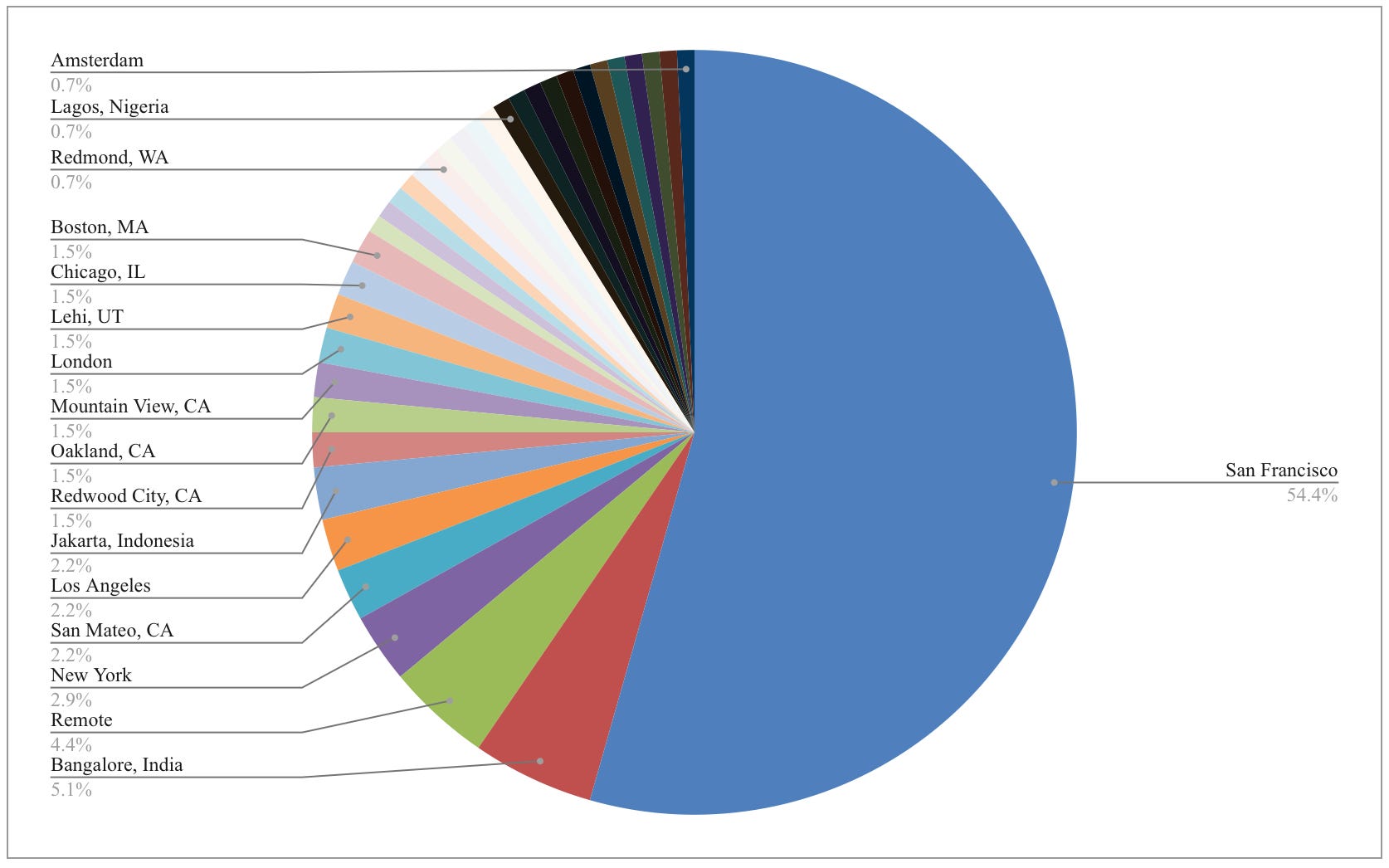

The short answer is “San Francisco” but it’s actually more nuanced. Here’s a pie chart showing where these top startups are headquartered:

Clearly my home city of San Francisco dominates, and even more so when you consider that several runners-up are also in the San Francisco Bay Area (San Mateo, Redwood City, Oakland and Mountain View). However, as Wayne Gretzky famously said, “Skate to where the puck is going, not where it has been.”

While the top startup puck has been in Silicon Valley for quite some time, it’s slowly sliding away as I discussed in On the slow erosion of Silicon Valley’s dominance. This phenomenon can also be seen when we chart top company location by age bracket:

San Francisco’s grip on startup success is loosening over time, with the single biggest beneficiary being Bangalore, India. This is partially due to YC’s efforts to recruit there, though the logic is a bit circular since they recruit there for a reason.

Note that “Remote” is only 4.4% of the total today, but all of the remote top startups are relatively young and I expect that percentage to grow dramatically in the coming years. Startups had already been trending towards remote for several years, and covid greatly accelerated the trend.

Also note the emergence of Mexico City in the graph. While there’s only 1 LATAM startup on YC’s Top Companies list today (Rappi), we’ve seen and invested in some strong startups from this region in recent batches, and I expect many more LATAM unicorns in the years ahead.

The main implication for early stage investors is to look beyond Silicon Valley. While the SF Bay is undoubtedly still the single best location for startups, one shouldn’t ignore how colorful the younger bars above are starting to look.

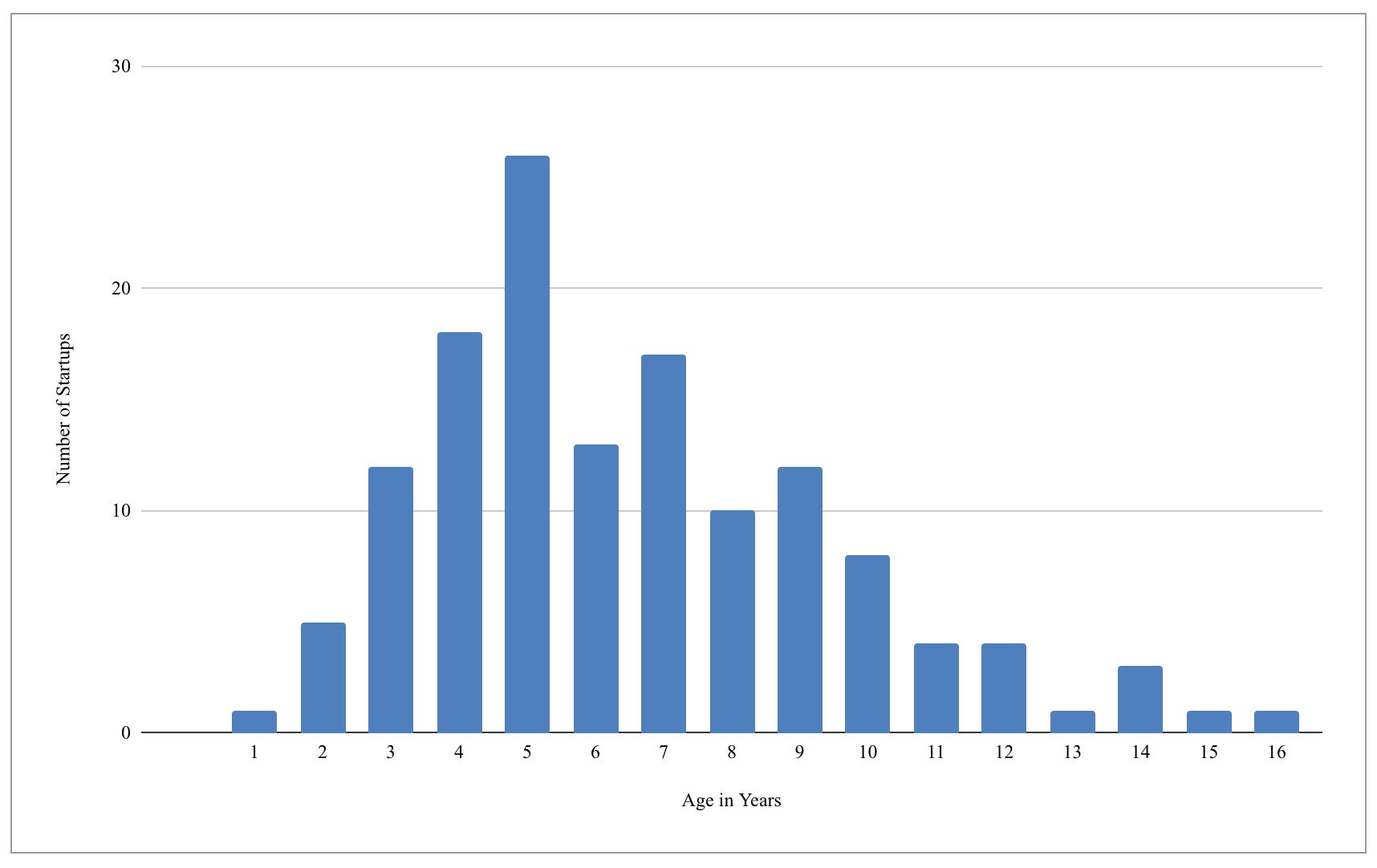

Age

Next let’s examine the age of YC’s top companies. This chart shows the age distribution of these 137 top YC companies:

Before concluding that YC reached its peak 5 years ago, bear in mind this chart is distorted in a couple of ways:

- Newer YC batches are much larger than older batches, so the fall off after year 5 largely reflects smaller YC batch sizes in the out years, though attrition is also a factor

- It typically takes several years for a startup to grow to a $150M+ valuation, so the 1 to 4 year old companies likely aren’t lower quality than the 5 year old companies, they’re just still climbing up the valuation ladder

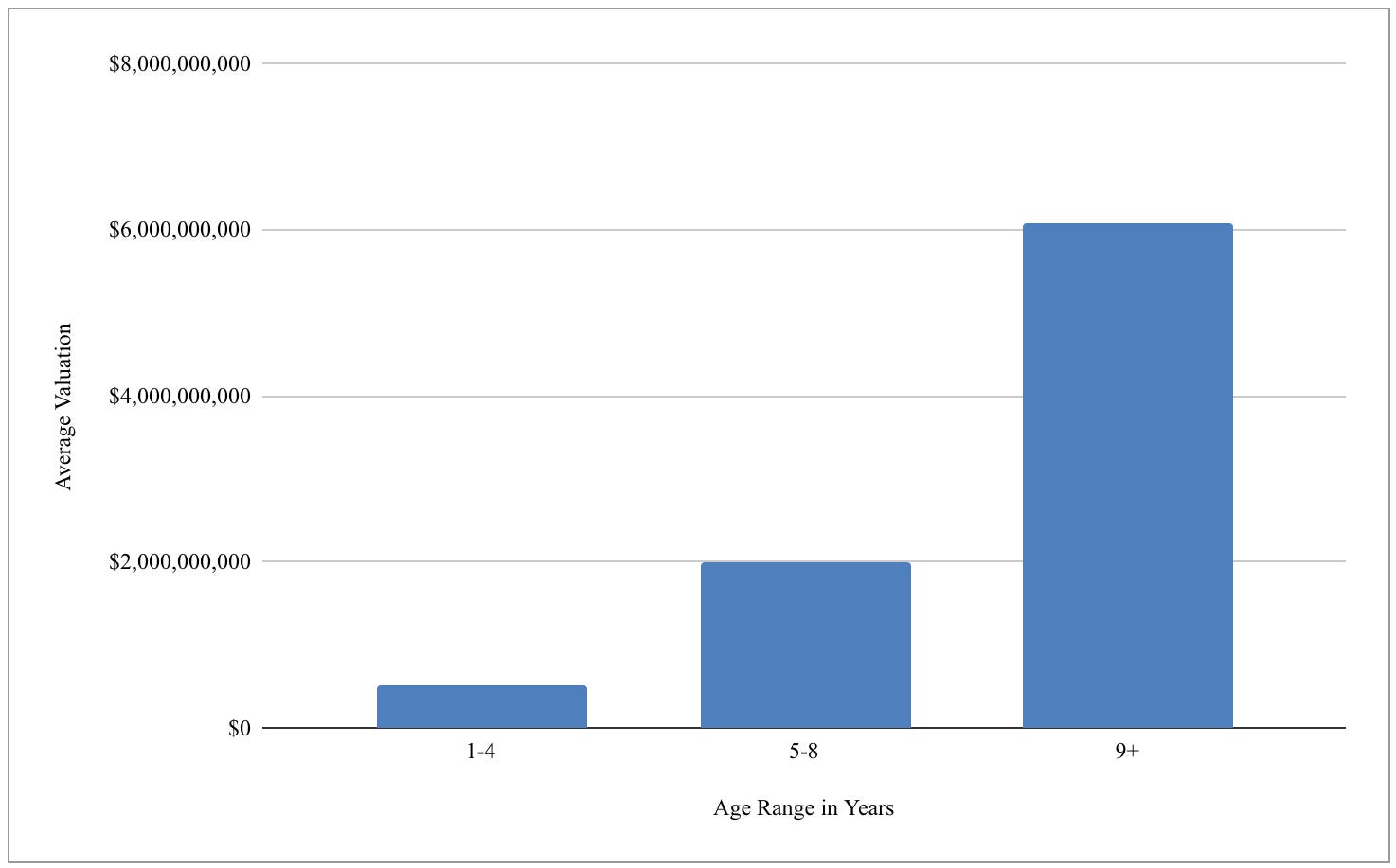

Also bear in mind that while fewer in number, the older companies are much more valuable on average, as illustrated in the chart below:

The main implication for early-stage investors is to be patient since it often takes several years for companies to grow into a $150M+ valuation, and the best ones continue to grow rapidly in value for a decade or more. YC’s top companies currently have an average age of 6.6 years, which implies its portfolio is poised for ~3x more growth even if no new investments were made. I believe YC startups will almost certainly reach $1T in total value in the coming years >>> READ MORE