When To SPAC with Michael Frankel on The Deal Scout podcast

Had a great time dissecting the complex topic of when a SPAC is the right vehicle for a company with Joshua Wilson on The Deal Scout podcast. As with any capital tool, understanding how it works and where it's best used is the difference between using a hammer on a nail and using a hammer to crack an egg!

The SPAC market has exploded in the last couple of years. Many growth company CEOs are being contacted by a number of SPACs. These CEOs need to consider whether the SPAC is the right vehicle for the next phase of growth and just as importantly how to choose the right SPAC to partner with.

Michael is a seasoned executive with a track record of driving growth and strategic change through organic and inorganic investment/expansion. He is a Founder/Managing Partner of Trajectory Capital, an investment firm focused on disruptive technologies in large addressable markets. He is also President and CFO of Trajectory Alpha, a NYSE-listed (ticker: TCOA) special purpose acquisition company (SPAC).

Michael has held corporate development, strategy, and general management leadership roles in global technology, information services, and professional services companies including VeriSign, LexisNexis Group, IRI, GE Capital, and Deloitte.

Michael holds a BA, MA, JD, and MBA from the University of Chicago. Michael is a frequent speaker on corporate growth and innovation. He is the author of three books and numerous articles on innovation, M&A, and strategic transactions. Michael has served on public and private corporate boards as well as the Alumni Board of Governors at the University of Chicago. Michael lives in the New York area with his wife and daughter.

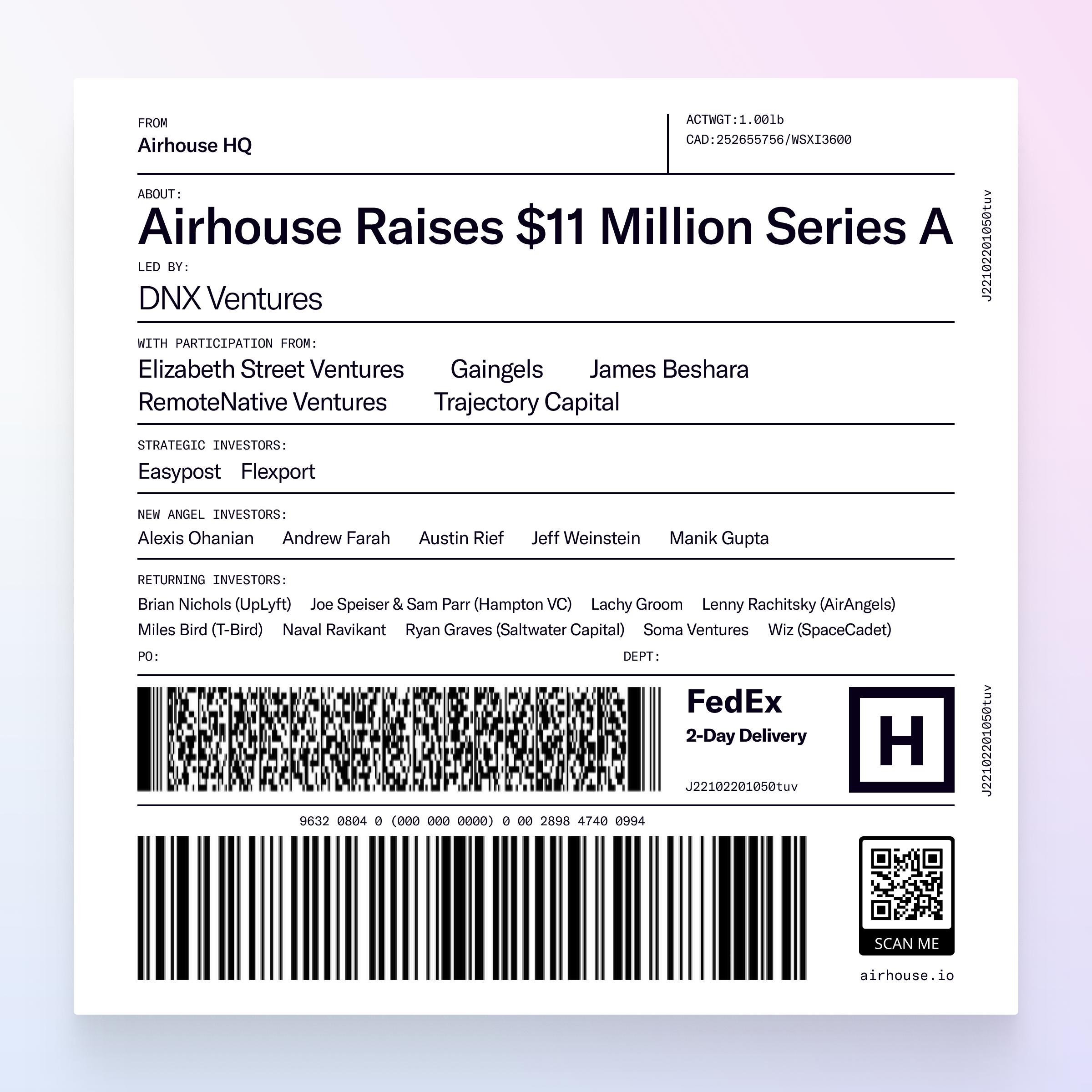

Airhouse announces $11 Million Series A to Power Modern Ecommerce Operations

Follow Airhouse on TWITTER | LINKEDIN

Please help spread the word and share the news from the Airhouse blog

Also Read

Airhouse closes $11M Series A to help DTC brands manage logistics - Techcrunch

FROM Founders Kevin & Sarah >>>

Today, I’m excited and proud to share that Airhouse closed an $11 million Series A financing round led by DNX Ventures with participation from Elizabeth Street Ventures, Gaingels, James Beshara, RemoteNative Ventures, and Trajectory Capital. The round also includes participation from some notable strategic investors—Flexport and Easypost—as well as a host of new angel investors I’m honored to welcome to the team: Alexis Ohanian, Andrew Farah, Austin Rief, Jeff Weinstein, and Manik Gupta. My co-founder and Chief Revenue Officer, Sarah Siwak, and I are proud to welcome DNX Managing Partner, Q Motiwala, to Airhouse’s board of directors and we’re beyond grateful for the continued support of our returning investors.

We launched Airhouse in June of 2020 as a next-generation fulfillment platform to simplify ecommerce operations and logistics for modern brands. Why? Because the existing logistics and operations solutions fail to meet their needs. Airhouse solves for the host of inefficiencies brands face when working with legacy providers to get their products in the hands of customers: outdated and inefficient software, inconsistent and non-transparent pricing, poor and mismanaged quality control, and a fractured and unscalable fulfillment process.

Airhouse offers brands an intuitive software platform that powers fulfillment from factory to front door. We’ve spent the last 20+ months fine-tuning the technical infrastructure of the product, acquiring even more partnerships with 3PL facilities across the country, and merging the two to scale our automated partner network. As a result, our customers benefit from access to best-in-class, modern warehouses and 3PL partners that historically have been out of reach due to high order minimums. We’re leveling the playing field for these emerging brands to access these high-quality partners.

What’s more, Airhouse operates from a sales channel-agnostic point of view—Airhouse integrates with whichever sales channel is best for a given customer (spoiler alert: it’s usually more than one). Regardless of where our customers want to sell—from Shopify and Squarespace to Walmart and Target—fulfillment technology is no longer what holds them back. Fulfillment and operations are the largest non-core element of a brand’s business that they historically would have to learn about and hire a vast team for. With Airhouse’s easy-to-use technology, simple onboarding, and account management systems, it’s all outsourced with what feels like a flip of a switch.

We are proud and humbled by the level at which our platform is now resonating with thousands of the next generation of beloved brands. Since launching publicly, we’ve seen customer growth increase by 600 percent and our partner network footprint grow by 500 percent. This growth in our partner network allows our customers to split their inventory across locations more strategically, which translates to getting products in the hands of customers very quickly, even in one day.

In the last 12 months, we’ve quintupled revenue and doubled the headcount of our team. This additional capital will allow us to expand our team so we can continue scaling alongside our existing and new customers by continuing to build features and functionality that meet their ever-changing needs. We will also continue scaling our partner network with plans to expand Airhouse globally.

We chose to partner with DNX for a variety of reasons, but the effort Q and the team have already put toward truly understanding our business is at the top of the list. Through a discovery process whereby they connected directly with potential and existing customers in addition to our partners, we were impressed with the opportunities they brought to the table that we hadn’t considered ourselves. Here’s what Q had to say about investing in Airhouse:

“The co-founding team of Kevin and Sarah possesses a unique perspective on ecommerce logistics. As repeat entrepreneurs in this sector, they bring deep domain knowledge, have a deep appreciation of GTM challenges, and have a great team. They also display unmatched tenacity and grit. DNX is humbled by the opportunity to partner with them and the Airhouse team.”

We are looking forward to the next 12+ months of their trajectory!

Thank you for being a member of the Trajectory community,

Paul, Mike & Peter

Trajectory Alpha Acquisition Corp. TCOA: NYSE Announces the Separate Trading of Class A Common Stock & Warrants

Trajectory Alpha Acquisition Corp. (the “Company”) announced that, commencing on January 31, 2022, holders of the units sold in the Company’s initial public offering of 17,250,000 units may elect to separately trade the shares of Class A common stock and public warrants included in the units. Shares of Class A common stock and public warrants that are separated will trade on the New York Stock Exchange under the symbols “TCOA” and “TCOA WS,” respectively. Those units not separated will continue to trade on the New York Stock Exchange under the symbol “TCOA.U.” No fractional public warrants will be issued upon separation of the units and only whole public warrants will trade. Holders of the units will need to have their brokers contact Continental Stock Transfer & Trust Company, the Company’s transfer agent, in order to separate the units into the shares of Class A common stock and public warrants.

A registration statement relating to these securities was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on December 9, 2021. Guggenheim Securities, LLC served as sole book-running manager for the offering. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of the Company, nor shall there be any offer, solicitation or sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Trajectory Alpha Acquisition Corp.

The Company is sponsored by Trajectory Alpha Sponsor LLC, and the Company’s leadership team is led by Trajectory Capital partners Peter Bordes, Michael E.S. Frankel and Paul Sethi, who together bring more than 80 years of experience investing in and operating technology-enabled companies. The Company is a blank check company incorporated as a Delaware corporation for the purpose of effecting a merger, consolidation, capital stock exchange, asset acquisition, share purchase, reorganization or business combination with one or more businesses. While the Company may pursue an initial business combination with any company in any industry, the Company’s objective is to identify and work with a disruptive, technology-driven business that leverages its unique intellectual property and proprietary data to develop a sustainable competitive advantage and, in turn, dislodge slower-moving incumbents in the target’s selected end markets.

Cautionary Note Concerning Forward-Looking Statements

This press release includes, and oral statements made from time to time by representatives of the Company may include, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements regarding possible business combinations and the financing thereof, and related matters, as well as all other statements other than statements of historical fact included in this press release, are forward-looking statements. When used in this press release, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions, as they relate to the Company or the Company’s management team, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors detailed in the Company’s filings with the SEC. All subsequent written or oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by this paragraph. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the “Risk Factors” section of the Company’s registration statement and final prospectus relating to the Company’s initial public offering filed with the SEC. Copies are available on the SEC’s website at www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by applicable law.

Contact:

Trajectory Alpha Acquisition Corp.

Peter Bordes

info@trajectorycapital.com