Securitize acquires Onramp Invest to expanding alternative asset access for financial advisors

Acquisition Makes it Easier than Ever for Registered Investment Advisors to Access Top Performing Private Equity, Private Credit, and Secondaries Asset Classes

ALSO READ:

Securitize & Onramp Invest: Expanding Alternative Asset Access for RIAs - Securitize blog

Securitize acquires $40B crypto fund manager Onramp - CoinTelegraph

Securitize, the leader in expanding investor and business access to tokenized alternative assets, today announced its acquisition of digital asset wealth platform Onramp Invest.

As a result of this acquisition, and for the first time, RIAs will instantly be able to offer their clients investments in top performing alternative asset classes such as private equity, private credit, secondaries, real estate, and more, through the same Onramp Invest dashboard they are already familiar with, increasing and diversifying the investments they are able to manage with the ease of their existing reporting systems. By giving RIAs direct access to Securitize's alternative investment portfolio, they will be able to offer their clients institutional share classes from top alternative asset managers, lower minimum investments, lower fees, and access to liquidity.

Onramp Invest is the premier advanced digital asset wealth platform for forward-thinking financial professionals. Bringing together everything financial advisors need to safely and intelligently invest in digital assets for their clients, Onramp Invest integrates seamlessly into existing RIA tech stacks like Orion, Advyzon, Wealthbox, AssetBook, among others, and offers leading market research through their academy and various innovative partners in the space. Onramp's platform serves a community of RIAs across the U.S. representing over $40B in cumulative AUM, as well as recognized asset managers and index providers in the digital asset space like WisdomTree, CoinDesk, Global X, Valkyrie Invest, and more.

Most business value is created through private market alternative investments – that is, investments which are not traditional stocks and bonds listed on public exchanges. As a result of this acquisition, RIAs will now be able to offer their clients access to attractive, liquid alternative investment1 classes, including:

- Private Equity: One of the most exclusive asset classes historically, private equity provides exposure to funds composed of companies that are not publicly traded, and which investors expect to grow significantly over the next year.

- Private Credit: One of the most in-demand asset classes right now, private credit consists of loans or debt investments extended by non-bank lenders, which in the second quarter alone captured $71.2 billion in capital from investors.

- Secondaries: Buying and selling of existing, pre-established stakes in private companies or funds, which as a sector is showing signs of a closer agreement between buyers and sellers—with the median bid-ask spread on new indications of interest declining to the lowest percentage in a year.

"Our acquisition of Onramp is another big step forward in expanding investor access to top-performing alternative assets and in democratizing private capital markets. Onramp already offered RIAs easy access to digital assets, so it is a very natural extension to offer them tokenized alternative assets to complement their portfolios," said Securitize CEO Carlos Domingo. "Most wealth is generated in private market alternative assets and bringing Securitize and Onramp together enables registered investment advisors to give their clients access to that wealth generation."

"We started Onramp with the goal of breaking down barriers for advisors to access meaningful investment opportunities for their clients, and there's no better way to continue that mission than working with Securitize," said Eric Ervin, Founder and CEO of Onramp Invest. "More advisors would choose alternatives for their clients because the benefits are clear, but challenges like illiquidity and restricted access were previously significant problems to overcome. Securitize solves for this through offering lower minimums, lower fees, and potential for exit liquidity through secondary markets. Tokenization will be a major player in the investment space, and it's imperative that all financial professionals are able to embrace this change."

The acquisition follows a partnership Securitize and Onramp announced in March through which its RIA members could access private equity feeder funds Securitize offers with investment giants KKR and Hamilton Lane, and the news last month that Securitize had begun issuing tokenized securities in Europe.

Securitize connects investors seeking to access the wealth generated in the private markets with businesses seeking to raise capital, with shares securely recorded on leading blockchains such as Ethereum, Avalanche, Polygon, and Algorand.

Looking forward, Onramp is expected to continue operating as a subsidiary of Securitize and to integrate Securitize products into their existing offering over time. The transaction is anticipated to close in the next several days and the terms of the transaction were not disclosed.

Galaxy Digital Partners LLC is serving as the exclusive financial advisor to Securitize.

About Securitize

Securitize is making private equity, venture capital, and other exclusive, real-world, private market assets accessible to a broader range of investors. With 1.2 million investors and 3,000 businesses already connected, Securitize is modernizing the relationship between companies and their investors by digitizing capital raising, investor onboarding, identity verification, and the issuance and trading of securities. Securitize, LLC is an SEC-registered stock transfer agent. Securitize Capital, LLC is an exempt reporting investment advisor. Securitize Markets, LLC runs the alternative trading system and is SEC-registered and a member of FINRA and SIPC. Learn more at http://www.securitize.io.

About Onramp Invest

Onramp is a turn-key digital asset management platform that seamlessly connects traditional and digital asset financial infrastructures. Through Onramp, financial professionals can onboard clients to the digital asset investing ecosystem in minutes, both view held-away accounts and directly invest in digital assets, and access an expanding library of funds, models, indices, and portfolio management services.

Media Contacts

Securitize: Evan Keegan, evan.keegan@securitize.io

Onramp: Eddie Ranchigoda, press@onrampinvest.com

Disclosures

Private market investments are speculative and considered risky, including potential loss of your investment, and may not be appropriate for every shareholder. Private investments are generally an illiquid asset class; shareholders cannot sell their funds when they want to without potentially facing high losses. Any discussion of liquidity is purely speculative. Past performance is not indicative of future results.

Blockchain investing involves a degree of risk that can be different from traditional markets. These risks include, but are not limited to, risk of regulatory uncertainty, market adoption, market manipulation, market exiting, price volatility and security risk.

1 Liquidity is not guaranteed or on demand, but is possible through monthly redemptions or trading.

Capstack closes $6M Pre Seed to launch the first integrated operating system and marketplace for banks

The first integrated operating system for banks, Captack, announced it has emerged from stealth backed by $6 million in pre-seed funding. The round was oversubscribed and led by Fin Capital with participation from Alloy Labs, Rex Salisbury’s Cambrian Ventures, Cowboy Ventures, Future Perfect Ventures, Gaingels, Selah Ventures, Uncorrelated Ventures, and Valor Equity Partners.

ALSO READ:

Pipe co-founder raises $6M for CapStack, a bank-to-bank marketplace aimed at ‘de-riskifying portfolios’ - Techcrunch

CapStack, the first integrated operating system for banks, today announced it has emerged from stealth backed by $6 million in pre-seed funding. The round was oversubscribed and led by Fin Capital with participation from Alloy Labs, Rex Salisbury’s Cambrian Ventures, Cowboy Ventures, Future Perfect Ventures, Gaingels, Selah Ventures, Uncorrelated Ventures, and Valor Equity Partners.

Founded by Michal Cieplinski, CapStack is building the platform to address key gaps around loan and deposit exposure, portfolio diversity, and profitability for banks. The company’s pioneering approach to bank-to-bank connectivity will have far-reaching implications for risk management––especially during a critical time when stability and confidence in the banking sector are paramount.

"CapStack is the first integrated operating system for banks enabling cooperation across banks and other financial services institutions in order to drive profitability and asset diversification,” said Jillian Williams at Cowboy Ventures. “It's the solution banks have been waiting for and we are excited to be supporting Michal and his team in this endeavor."

"This is a significant milestone for CapStack and the banking industry as a whole," said Michal Cieplinski, Founder and CEO of CapStack. Cieplinski brings more than two decades of operating and legal experience in financial technology to CapStack. Prior to CapStack, he co-founded Pipe, a global trading platform for recurring revenue streams, was Senior Vice President at Lending Club, the largest publicly-traded fintech lender, and a co-founder of Fundbox, a B2B fintech lender.

With CapStack, Cieplinski brings together a premier team including Tzvika Perelmuter, CapStack’s Co-Founder, as Chief Technology Officer, and former R&D Team Leader at Fundbox. Cieplinski added, "our innovative platform will transform the way banks collaborate and manage risks, ultimately improving efficiency and instilling confidence in the banking infrastructure."

Rex Salisbury, Founder and General Partner at Cambrian Ventures added, "CapStack's platform is needed now more than ever as small and mid-sized banks can continue to own the relationships they've built over decades with their customers, while rebalancing exposure to specific asset classes and geographies on the backend to build more resilient balance sheets. Michal and his colleagues are a great team to tackle this problem having worked together for years at Fundbox. Michal’s experience building marketplaces with deep bank partnerships at both Lending Club and Pipe provides a strong foundation for CapStack.”

"CapStack has the opportunity to dramatically improve solutions for bank risk management at a critical time for the stability of our country's banking infrastructure,” said Logan Allin, Founder and Managing Partner at Fin Capital, who has joined CapStack’s board. “Banks still rely on legacy technology for managing risks around their balance sheets, and to restore confidence for consumers, commercial customers, regulators, and other stakeholders, they absolutely need an upgrade. We are thrilled to back Michal again as a repeat founder from within our portfolio and the talented team at CapStack."

For more information about CapStack, visit CapStack.com

About CapStack:

CapStack is building the first integrated operating system enabling cooperation across banks and financial services institutions in order to increase profitability and asset diversification. Founded by Michal Cieplinski, CapStack is dedicated to building a sophisticated infrastructure that will redefine banking operations, enhance risk management, and deliver cutting-edge solutions for SMBs.

Contact:

Name: Michal Cieplinski

Contact info: michal@capstack.com

AI powered data collaboration platform Narrative revolutionizes how companies get value from data

Data collaboration platform Narrative announced their newest innovation to revolutionize the data collaboration experience: Rosetta.

Rosetta is more than an AI assistant—it's a game-changer for distributed data access, query, and processing.

In the spirit of Rosetta Stone, their groundbreaking automated data standardization technology, Rosetta represents a fresh paradigm, an unprecedented leap forward in AI-enabled data collaboration.

Rosetta is publicly available on the Narrative Data Collaboration Platform and can be accessed at rosetta.st.

Narrative, the pioneer in data collaboration, is thrilled to unveil its groundbreaking AI-enabled product for its Data Collaboration Platform, enhancing how companies share, buy, and sell data.

Building on its proprietary Rosetta Stone technology, Narrative has transformed how companies share data and established itself as the world's premier data collaboration platform. Today, the company introduces Rosetta, the first AI Assistant dedicated to data collaboration, empowering users to search, discover, and access data in proprietary datasets without coding or data expertise. By harnessing advanced AI technology, Narrative streamlines the traditionally time-consuming and complicated process of data querying into a swift, secure, transparent, automated, and conversational experience.

"Rosetta capitalizes on the potential of our universal data catalog, which contains petabytes and trillions of rows of company-owned business data," stated Tim Mahlman, Narrative's CEO. "By allowing users to query the largest source of standardized, proprietary data using plain English, we're making data discovery and access available to individuals from all technical backgrounds."

Designed with a focus on privacy and security, Rosetta reinvents the data clean room concept by functioning as a secure user within protected environments. This method strengthens the data's privacy and security without sacrificing its usability.

"Data clean rooms effectively safeguard your data but often at the expense of usability," commented Nick Jordan, Narrative's Founder. "We believe that AI Assistants like Rosetta offer a powerful solution for users to gain insights and value from data without needing a human to view the underlying information."

Narrative is capitalizing on groundbreaking advancements in the field of large language models, adding a layer of value currently absent in the market.

"Rosetta is more than an AI assistant—it's a game-changer for distributed data processing, simplifying the process and reducing costs. It enables organizations to consolidate their data stack, eliminate unnecessary tools, and streamline data collaboration," explained Uri Bushey, Narrative's VP of Product Management. "While well-known large language models have effectively harnessed publicly available data, Rosetta accesses a much more extensive data ecosystem, unlocking value beyond the public data sphere."

Think of Rosetta as a translator for your data needs. People, teams, and organizations express their use cases differently, but with Rosetta, there is no need to learn a new "language." She’s here to understand you. Using plain English, translate your needs into a comprehensive query, and fetch results from our standardized data catalog. This means effortless data collaboration, no matter how unique your use case or technical background is.

What sets Rosetta apart?

- Scale: Rosetta can access the world's largest source of proprietary, standardized data, a catalog that even Google can't reach. Trillions of rows of business data, mapped, standardized, and ready to use, are just a query away.

- Simplicity: Create queries in plain English. You can discover data across all proprietary datasets using a simple chat interface. No coding or data expertise is required. Explain your use case in any terms you want, and Rosetta will gladly help!

- Speed: By transforming a traditionally complex & expensive process into a quick, secure, and automated conversation, Rosetta ensures anyone can find desired data in minutes - a process that traditionally takes days, weeks, or even months!

- Security: Rosetta offers an advanced solution to the data clean room concept. With unique user powers, Rosetta can ensure your data querying process is secure and private, matching data without making it viewable in the clean room scenario.

Rosetta is more than just an AI assistant. It's a game-changer destined to reshape the landscape of data collaboration. As we usher in this new era, we're eager to see how you will leverage Rosetta to drive your data-based initiatives.

Embrace the future of data collaboration with Rosetta.

The future of photonics infrastructure Lightmatter raises $154M to be the foundation for AI and high-performance computing

We couldn't be more excited to participate in this game-changing technology that is the future of all global technology infrastructure. Imagine if you could have invested in the internet's first infrastructure platform. We believe Lightmatter has the chance to be one of the most important disruptive innovations of this century.

ALSO READ:

Lightmatter triples valuation to solve generative AI's energy crunch - CrunchBase

Lightmatter’s photonic AI hardware is ready to shine with $154M in new funding - TechCrunch

Lightmatter Raised $154M to Deliver Photonic Products to Customers. Their photonic technologies will be the foundation for AI and high-performance computing

GV (Google Ventures), Fidelity Management & Research Company, SIP, Viking Global Investors, and others join Lightmatter Series C round—tripling the company’s valuation.

“We use light to link computer chips together and we also use light to do calculations for deep learning,” Lightmatter co-founder and CEO Nick Harris said. “The reason that we’re getting these customers and data center scale deployments with our interconnect is that the generative AI boom is driving high-end chips like crazy.”

Lightmatter, the leader in photonics, announced today that it raised a $154 million Series C investment round from SIP Global, Fidelity Management & Research Company, Viking Global Investors, GV (Google Ventures), HPE Pathfinder and existing investors. With this round, Lightmatter has raised a total of over $270 million to date. The company will leverage this new financing to arm some of the largest cloud providers, semiconductor companies, and enterprises with the power of photonic technology to bring a new level of performance and energy savings to the most advanced AI and HPC workloads.

“Rapid progress in artificial intelligence is forcing computing infrastructure to improve at an unprecedented rate. The energy costs of this growth are significant, even on a planetary scale,” said Lightmatter co-founder and CEO, Nick Harris. “Generative AI and supercomputing will be transformed by photonic technologies in the coming years, and our investors, partners, and customers are aligned with Lightmatter’s mission of enabling the future of computing infrastructure with photonics.”

The Generative AI Boom and Computational Impact

As generative AI systems proliferate across industries, the energy consumed and capital needed to run these algorithms is rising exponentially. The result is excessive heat loads, stagnant performance per watt, and increasing operating costs.

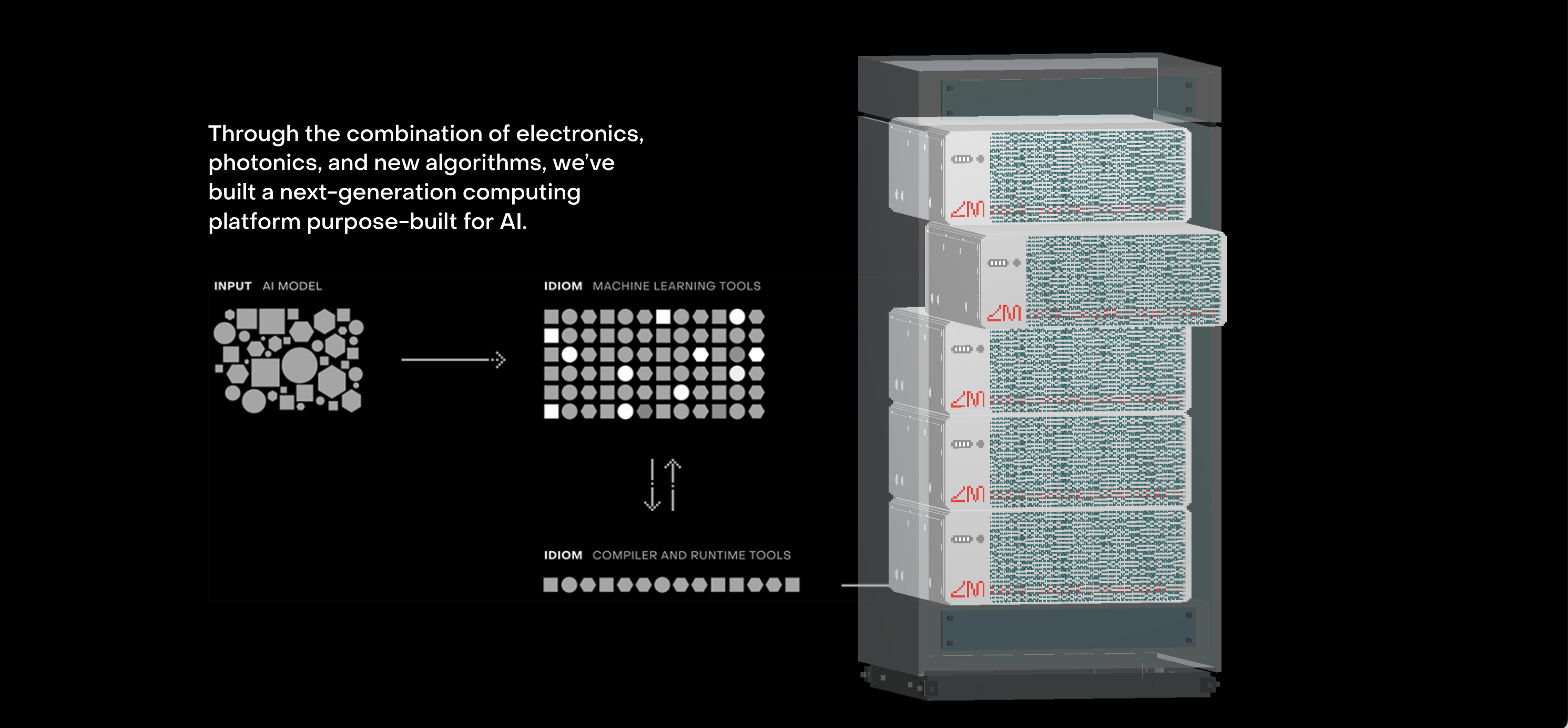

Large language models (LLMs) that power Generative AI are both more lucrative and resource intensive than their predecessors—leaders in the space are now claiming they see power and cost limits to the size of these models. Under this backdrop, Lightmatter is introducing its photonics-enabled products to the market: Envise, Passage, and Idiom, providing a full stack of hardware and software solutions to realize the benefits of photonic compute and interconnect technologies. The new capital will be used to fund the delivery of these products to customers.

“Lightmatter’s unique approach to harnessing the power of photonics in hardware trips will further the initial capabilities and use cases that we’re seeing from generative AI,” said Jeffrey Smith, General Partner at SIP Global Partners. “These technologies and its global customers will need the highest compute power to run these algorithms and apply them to new verticals, and we’re thrilled to invest in Lightmatter who can make that potential with computing that is faster and more sustainable.”

“Photonic technology has the potential to meet the demand of today’s artificial intelligence compute workloads. Lightmatter is taking a differentiated approach by using silicon photonics and bringing together a deeply technical team to further its mission,” said Erik Nordlander, General Partner at GV. “We’re thrilled to continue supporting Lightmatter’s next stage of growth as they build the leading silicon photonics company.”

In 2022, the company announced significant growth with the recruitment of top talent to its leadership team, including Richard Ho, who led Google’s Tensor Processing Unit program, and Ritesh Jain, who led datacenter chip packaging at Intel, as VPs of Hardware Engineering. Lightmatter also announced Jessie Zhang, who led corporate financial planning at Apple, as VP of Finance, and Steve Klinger, former VP at Innovium, as VP of Product. Lightmatter currently has over 20 active roles across product, R&D, and engineering, and holds over 150 patents worldwide.

About Lightmatter

Lightmatter is delivering a new paradigm in semiconductor chip architecture and the next transition for large-scale computing. The company has developed photonic processors that are faster, more efficient and cooler than any conventional processors in existence today and is answering the call for increased compute speed, low energy density, and reduced chip heating. Lightmatter is set to enable the continued rapid growth of artificial intelligence computing while minimizing its well-known and growing impact on the environment.

Contacts

Media Contact:

John O’Brien

lightmatter@sbscomms.com

Kubient and Adomni merge to create the next generation AI powered AdTech platform

Kubient, Inc. (NasdaqCM: KBNT, KBNTW) (“Kubient '' or the “Company”), a cloud-based software platform for digital advertising, and Adomni Inc. (“Adomni”) today announced they have entered into a definitive merger agreement, pursuant to which Adomni will merge with and into a wholly-owned subsidiary of Kubient (the “Merger”). The combined company will focus on growing and developing Adomni’s pre-existing programmatic advertising service and platform that delivers high-impact advertising campaigns via 725,000+ connected digital out of home screens across the world. Following the closing of the Merger, the combined company is expected to operate under the name “Adomni, Inc.”

The Merger is intended to allow Adomni to strengthen and diversify its advertising technology platform while also expanding its scope to address a much larger, growing digital ad market. Adomni is also poised to expand its product offering with enhanced features around artificial intelligence (“AI”) technology. Kubient’s AI product KAI will be harnessed to deliver better advertising campaigns via Adomni’s platforms. These include enhanced accuracy of fraud prevention via AI-powered algorithms, real-time data monitoring and analysis of incoming data, advanced pattern recognition within the data, brand protection from fraudulent media, and more.

About the Proposed Merger

Under the terms of the merger agreement, pending approval of the transaction by Kubient’s stockholders and Adomni’s stockholders and subject to customary closing conditions, Kubient will acquire 100% of the outstanding equity interests in Adomni, by means of a reverse triangular merger of a wholly-owned subsidiary of Kubient with and into Adomni, with Adomni surviving as a wholly-owned subsidiary of Kubient. In connection with the closing of the Merger, Kubient is expected to change its name to “Adomni, Inc.”

Immediately following the closing of the Merger, the equity holders of Adomni are expected to own approximately 74% of the outstanding common stock of the combined company, and the equity holders of Kubient are expected to own approximately 26% of the outstanding common stock of the combined company. The merger agreement also provides that the equity holders of Adomni may receive additional shares of Kubient equal to 1%, 2% or 5% of the outstanding shares of Kubient on a fully diluted basis following the filing of Kubient’s annual report on Form 10-K for the 2023 fiscal year upon the achievement certain audited net revenue thresholds of Kubient for the 2023 fiscal year.

The Merger has been unanimously approved by the board of directors of each company and is expected to close in the second half of 2023.

Lake Street Capital Markets LLC is acting as the exclusive financial advisor and Akerman LLP is serving as legal counsel to Kubient. Perkins Coie LLP is serving as legal counsel to Adomni.

Management Commentary

“We are proud to merge the Kubient and Adomni teams, and look forward to rolling out our growth strategy as a combined entity,” said Jonathan Gudai, Adomni’s Chief Executive Officer. “Kubient’s team and tech stack is an excellent fit with our business and we believe it will play an important role in our overall growth strategy to broaden market diversification and extend the development of our platforms. By combining our platform for Digital-Out-Of-Home with Kubient’s leadership team and knowledge in the realms of online digital advertising and connected television, we believe we can bring these elements together and deliver a truly omni-channel advertising and content experience. We believe the synergies between our companies will advance our strategic mission to deliver higher levels of ad-tech service globally.”

Paul Roberts, Kubient’s Founder and Chief Executive Officer, added: “We are very excited about what the combined strength of Kubient and Adomni will bring to the ad-tech industry, including both advertisers, and publishers. Following an extensive process of searching for the best possible partner, we are very encouraged to have arrived at this proposed merger with Adomni; we believe that Kubient has delivered its promise of providing stockholders with an initiative that brings our proprietary technology further to the forefront of the advertising market. We believe Kubient’s proprietary technology will provide Adomni’s customers with the benefit of enhanced product performance, and advanced solution capability as the company broadens its reach further into global markets. Together, we will build upon our core competencies and advance forward-thinking initiatives that play to our combined strengths. I’d like to take the chance to extend our gratitude and appreciation to our extraordinary employees, who’s hard work and commitment have brought Kubient to this point in our journey.”

Acquisition Conference Call Information

Kubient and Adomni will hold a conference call today at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss the details of the Definitive Agreement.

Date: Wednesday, May 24, 2023

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 1-888-506-0062

International dial-in: 1-973-528-0011

Participant Access Code: 210517

Please call the conference telephone number 10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the Investor Relations section of Kubient’s website.

A telephonic replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through June 7, 2023.

Toll-free replay number: 1-877-481-4010

International replay number: 1-919-882-2331

Replay ID: 48481

About Adomni

Adomni = advertise everywhere. The company was founded in 2015 with the vision to provide an online marketplace for brand marketers and ad agency media specialists to easily and quickly launch digital advertising campaigns in the real world. Today, Adomni’s connected screen inventory reaches a monthly audience of over one billion people across 37 digital screen types. Digital screen types range from outdoor placements such as digital billboards, urban panels and vehicle tops to indoor placements in high-traffic locations such as airports, bars and restaurants, gas stations, gyms and shopping malls.

Adomni’s ad planning and buying platform enables media planners and buyers to view inventory availability, transparently view pricing, target their ideal audience using its proprietary Audience IQ technology, and measure the performance impact of the ad campaign on the brand’s business goals via custom reports. The simplicity and ease of Adomni’s platform enables campaigns to be planned and launched in just minutes.

Adomni also owns and operates a consumer-facing platform called Shoutable. Shoutable specializes in putting user-generated-content (UGC) on digital billboards as the first direct-to-consumer marketplace that bridges social media with the physical world. In just minutes, anyone can choose a template, add their photo and text and make a credit card purchase for small amounts of space on digital billboards and other digital out of home screens. Brands are also able to sponsor Shoutable campaigns by providing custom templates for consumers to add their personal content and place a free order which is subsidized by the brand.

For additional information, please visit www.adomni.com or www.shoutable.me.

About Kubient

Kubient is a technology company with a mission to transform the digital advertising industry to audience-based marketing. Kubient’s next generation cloud-based infrastructure enables efficient marketplace liquidity for buyers and sellers of digital advertising. The Kubient Audience Marketplace is a flexible open marketplace for advertisers and publishers to reach, monetize and connect their audiences. The Company’s platform provides a transparent programmatic environment with proprietary artificial intelligence-powered pre-bid ad fraud prevention, and proprietary real-time bidding (RTB) marketplace automation for the digital out of home industry. The Audience Marketplace is the solution for brands and publishers that demand transparency and the ability to reach audiences across all channels and ad formats. For additional information, please visit https://kubient.com.

Additional Information about the Proposed Merger and Where to Find It

This communication relates to the proposed merger transaction involving Kubient and Adomni and may be deemed to be solicitation material in respect of the proposed merger transaction. In connection with the proposed merger transaction, Kubient will file relevant materials with the United States Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 that will contain a proxy statement (the “Proxy Statement”) and prospectus. This communication is not a substitute for the Form S-4, the Proxy Statement or for any other document that Kubient may file with the SEC and or send to Kubient’s stockholders in connection with the proposed merger transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF KUBIENT ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KUBIENT, THE PROPOSED MERGER TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4, the Proxy Statement and other documents filed by Kubient with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by Kubient with the SEC will also be available free of charge on Kubient’s website at www.kubient.com, or by contacting Kubient Investor Relations at kubient@gatewayir.com. Kubient, Adomni and their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from Kubient’s stockholders with respect to the proposed merger transaction under the rules of the SEC. Information about the directors and executive officers of Kubient is set forth in its proxy statement on Schedule 14A for its 2023 annual meeting of stockholders, filed with the SEC on April 26, 2023 and its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 30, 2023. Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, which may differ from the interests of Kubient’s stockholders generally, will also be included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding the structure, timing and completion of the proposed merger; the combined company’s listing on The Nasdaq Capital Market after closing of the proposed merger; expectations regarding the ownership structure of the combined company; the expected executive officers and directors of the combined company; each company’s and the combined company’s expected cash position at the closing of the proposed merger and cash runway of the combined company; the future operations of the combined company; the nature, strategy and focus of the combined company; the location of the combined company’s corporate headquarters; and other statements that are not historical fact. All statements other than statements of historical fact contained in this press release are forward-looking statements. These forward-looking statements are made as of the date they were first issued, and were based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Kubient’s control. Kubient’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to (i) the risk that the conditions to the closing of the proposed merger are not satisfied, including the failure to timely obtain shareholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed merger and the ability of each of Kubient and Adomni to consummate the proposed merger; (iii) risks related to Kubient’s ability to manage its operating expenses and its expenses associated with the proposed merger pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed merger; (v) the risk that as a result of adjustments to the exchange ratio, Kubient shareholders and Adomni stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Kubient’s stock relative to the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed merger; (ix) the uncertainties associated with Adomni’s platform and technologies; (x) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance Adomni’s platform and technologies; and (xi) risks associated with the possible failure to realize certain anticipated benefits of the proposed merger, including with respect to future financial and operating results, among others. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the SEC, including the factors described in the section titled “Risk Factors” in Kubient’s Registration Statement on Form S-1 filed with the SEC on December 21, 2020, and in other filings that Kubient makes and will make with the SEC in connection with the proposed merger, including the Proxy Statement described above under “Additional Information about the Proposed Merger and Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. Kubient expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

Kubient Investor Relations

Gateway Investor Relations

Matt Glover and John Yi

T: 1-949-574-3860

Kubient@gatewayir.com

The critical state of todays global CO2 emissions and the need for carbon capture innovation

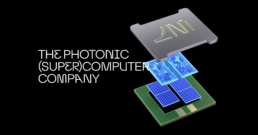

This interactive chart shows the breakdown of global CO2 emissions by region.

We see that until well into the 20th century, global emissions were dominated by Europe and the United States. In 1900, more than 90% of emissions were produced in Europe or the US; even by 1950, they accounted for more than 85% of emissions each year.

But in recent decades this has changed significantly.

In the second half of the 20th century, we see a significant rise in emissions in the rest of the world, particularly across Asia, and most notably, China.

The US and Europe now account for just under one-third of emissions.

In 2010-2019 average annual global greenhouse gas emissions were at their highest levels in human history, but the rate of growth has slowed. Without immediate and deep emissions reductions across all sectors, limiting global warming to 1.5°C is beyond reach. However, there is increasing evidence of climate action, said scientists in the latest Intergovernmental Panel on Climate Change (IPCC) report released today.

Since 2010, there have been sustained decreases of up to 85% in the costs of solar and wind energy, and batteries. An increasing range of policies and laws have enhanced energy efficiency, reduced rates of deforestation and accelerated the deployment of renewable energy.

“We are at a crossroads. The decisions we make now can secure a liveable future. We have the tools and know-how required to limit warming,” said IPCC Chair Hoesung Lee. “I am encouraged by climate action being taken in many countries. There are policies, regulations and market instruments that are proving effective. If these are scaled up and applied more widely and equitably, they can support deep emissions reductions and stimulate innovation.”

We have options in all sectors to at least halve emissions by 2030

Limiting global warming will require major transitions in the energy sector. This will involve a substantial reduction in fossil fuel use, widespread electrification, improved energy efficiency, and use of alternative fuels (such as hydrogen).

While reducing CO₂ production through renewable energy and sustainable practices is essential, it alone cannot tackle the current CO₂ levels.

This is where carbon capture steps in. By taking CO₂ from the atmosphere and safely storing it, we actively reverse the process contributing to climate change. According to the Intergovernmental Panel on Climate Change, carbon capture strategies are indispensable for achieving our climate targets.

There are various approaches to carbon capture, ranging from tech-oriented solutions to nature-based methods.

Nature-based solutions tap into the power of photosynthesis, where plants absorb CO₂ and release oxygen. However, deforestation limits this natural process, necessitating human intervention.

Tech-oriented solutions involve capturing CO₂ directly from sources or from the atmosphere, offering business opportunities and the potential for innovative materials.

Tesla veteran Leopold Visser joined Autonomy, the nation's largest electric vehicle subscription company

Autonomy™, the nation’s largest electric vehicle subscription company, announced that auto finance industry veteran, Leopold Visser, has joined the company as Senior Vice President of Strategy and Operations. With over two decades of experience in the auto finance and insurance industry across Europe, Asia, and North America, Leopold’s appointment signals a commitment by Autonomy to transform the way we protect EVs and their drivers as well as how we access them. Leopold brings valuable expertise and knowledge to Autonomy’s mission to make carbon-neutral mobility accessible and affordable.

Autonomy™, the nation’s largest electric vehicle subscription company, announced that auto finance industry veteran, Leopold Visser, has joined the company as Senior Vice President of Strategy and Operations. With over two decades of experience in the auto finance and insurance industry across Europe, Asia, and North America, Leopold’s appointment signals a commitment by Autonomy to transform the way we protect EVs and their drivers as well as how we access them. Leopold brings valuable expertise and knowledge to Autonomy’s mission to make carbon-neutral mobility accessible and affordable.

“I am excited to be once again working with Leopold”

Leopold has held numerous leadership roles including Chief Financial Officer, Chief Risk Officer, and Managing Director for the BMW Group Financial Services. During his tenure, he was instrumental in expanding the company’s presence in China and the Asia Pacific. Taking China’s operation from about 150 people to over 750 associates and opening up a new dealership every week. Later, as Senior Director of Finance at Tesla, Leopold founded and implemented Tesla Insurance globally, which revolutionized the auto insurance industry and, according to Elon Musk, is on track to represent as much as 30-40% of the Tesla car business’ future value.

Leopold has held numerous leadership roles including Chief Financial Officer, Chief Risk Officer, and Managing Director for the BMW Group Financial Services. During his tenure, he was instrumental in expanding the company’s presence in China and the Asia Pacific. Taking China’s operation from about 150 people to over 750 associates and opening up a new dealership every week. Later, as Senior Director of Finance at Tesla, Leopold founded and implemented Tesla Insurance globally, which revolutionized the auto insurance industry and, according to Elon Musk, is on track to represent as much as 30-40% of the Tesla car business’ future value.

As an avowed crusader for creating a better consumer experience for automotive shoppers, Leopold joined Carvana in April 2020 as part of the management team that helped the company grow exponentially as the fastest-growing used automotive retailer in US history. “I believe in the agency of the consumer and their right to a hassle-free, flexible, and fair way to access mobility. Now is the time for a massive change in how we improve our understanding of mobility. The industry is ready, and the movement has started. I am genuinely passionate about being part of a team who are looking to improve the experience of carbon neutral mobility,” said Leopold Visser, Senior Vice President at Autonomy.

“We are thrilled to have Leopold join our team as he shares our fearless attitude towards this innovative startup that is revolutionizing the automotive industry,” said Scott Painter, CEO and Founder of Autonomy. “He embodies the energy that we need to propel us forward, and he is aligned with our mission."

Leopold’s arrival comes at a pivotal moment for the industry. As car ownership shifts towards more flexible models, Autonomy is uniquely positioned to lead this shift. Vehicle subscriptions are increasingly being seen as the future. With subscription-based models, consumers have access to Autonomy’s fleet of electric vehicles without the commitment of purchasing or leasing a specific vehicle.

“I am excited to be once again working with Leopold,” said George Bauer, President and Chairman of Autonomy. “His passion for changing the auto industry and his ability to anticipate future trends as well as his commitment to transparency, fairness, and flexibility, aligns perfectly with our mission at Autonomy to provide easy and flexible mobility options to our customers. Leopold’s leadership is going to be critical for our growth.”

About Autonomy

Autonomy is a mission-driven company that uses technology to accelerate the adoption of electric vehicles by making them more accessible and affordable. The company was founded by Scott Painter and Georg Bauer, disruptors in the auto retail, finance, and insurance industries who pioneered the Car-as-a-Service (CaaS) category with the first-ever used-vehicle subscription offering, Fair. Building upon that experience, Autonomy is up-leveling its commitment to carbon neutrality and financial inclusion. Its customers have driven over 11 million miles to date, saving more than 9.7 million pounds of CO2 from being emitted into the earth’s atmosphere. Easier to qualify for than a lease, its low commitment, 100% digital solution allows people to pay monthly on their credit card and aims to get more people driving EVs who otherwise might not be eligible or interested in traditional lease or loan products. And unlike leases of loans, everyone who qualifies is charged the same rate regardless of FICO score. Autonomy believes that the future of mobility is electric. It exists to enable that transition more rapidly through innovations in technology, finance, and insurance. Autonomy relies on partnerships with AutoNation and Tesla to bring easier and more affordable ways for people to access electric vehicles. Autonomy is based in Santa Monica, California.

Follow Autonomy on LinkedIn, Twitter, Instagram, Facebook, YouTube, and TikTok.

Neon and Vercel partner to unlock the first serverless Postgres database for the frontend cloud

Neon, a leading provider of Serverless Postgres in the Cloud, partners with Vercel, the frontend cloud provider, to introduce Vercel Postgres, the first serverless SQL database built for the front end. This strategic partnership will provide businesses with the ability to deploy high-performing, low-latency web applications with serverless Postgres capabilities.

"Our partnership with Vercel is the perfect next step in this mission, allowing us to provide developers with Postgres databases that are powerful and affordable."

With the Vercel-Neon integration, developers can now seamlessly integrate Neon's Serverless Postgres into their Vercel Applications. The world's best Open Source database combined with the world's best application development platform. With Neon's scale to zero pricing, developers can build applications without worrying about upfront costs, allowing them to focus on innovation and speed.

“Our goal is to bring databases to the edge, and empower developers to make the Web faster and more personalized for every visitor across the globe,” said Guillermo Rauch, CEO of Vercel. “By partnering with Neon, Vercel’s frontend platform is now the end-to-end serverless solution for building on the Web, from Next.js all the way to SQL.”

Neon Postgres will also be able to integrate with Next.js App Router and Server Components. This will allow developers to easily fetch data from the database to render dynamic content on the server.

"Neon's Serverless Postgres is designed to give developers the flexibility and scalability they need to build great, cost effective applications," said Nikita Shamgunov, CEO of Neon. "Our partnership with Vercel is the perfect next step in this mission, allowing us to provide developers with Postgres databases that are powerful and affordable."

- The integration between Vercel and Neon Serverless Postgres is now available for developers looking to build modern web applications. For more information on this integration, visit https://vercel.com/templates/next.js/postgres-starter.

About Vercel

Vercel is the platform for frontend developers, providing the speed and reliability innovators need to create at the moment of inspiration. By providing the toolkit frontend teams love, Vercel unlocks developer potential and enables you to go from idea to global application in seconds. Vercel enables customers like Under Armour, Nintendo, The Washington Post, and Zapier to build delightful user experiences on the Web. To learn more about Vercel, visit https://vercel.com.

About Neon

Neon is a leading provider of Fully Open Serverless Postgres in the Cloud, designed to meet the high demands of businesses of all sizes. With unparalleled scalability and affordability, Neon's solutions enable developers to unlock the full potential of their web applications. Neon's unique database branching feature allows developers to branch their database as easily as they branch their source code on GitHub. To learn more about Neon, visit https://neon.tech.

For more information or media inquiries, please contact katieh@bulleitgroup.com.

Logiq appoints technology visionary and investor Peter Bordes to Board of Directors

Logiq, Inc. (OTCQX:LGIQ), a leading provider of digital consumer acquisition solutions, has appointed tech industry visionary and venture investor, Peter Bordes, to its board of directors. Following his appointment, the board consists of four directors, with two serving independently.

Bordes has been a lifelong entrepreneur with more than 30 years of executive and board experience, leading private and public companies across AdTech, media, AI, fintech and technology sectors. He also brings to Logiq years of accomplishment in venture investing focused on disruptive technology innovation driving digital transformation.

“We anticipate Peter's extensive experience as a venture investor, senior executive and board member contributing significantly to our growth strategy and M&A initiatives,” stated Logiq CEO, Brent Suen. “His focus on advancing disruptive technologies aligns with our mission and vision for Logiq.”

As an active angel investor and entrepreneur mentor, Bordes has been ranked among the nation’s Top 100 Most Influential Angel Investors. He has scaled companies from startup to fully operationalized organizations. Bordes has also been a noted thought leader across multiple industry sectors, including the performance marketing industry as a founding member and former chairman of the Performance Marketing Association.

Commented Bordes: “I’m excited to join the board of Logiq at this pivotal stage in its development, particularly as it continues to close in on a number of strategic M&A targets that have unique capabilities and IP in Adtech, direct-to-consumer and B2B sales, digital advertising, and performance marketing. Most recently this has included Park Place, a tremendously synergistic acquisition to the platform. I look forward to helping Logiq continuing to succeed in its M&A endeavors and support the significant organic growth expected in 2023.”

Peter Bordes Bio

For more than 30 years, Bordes has been an entrepreneur, CEO, board member, and venture investor focused on disruptive innovation in artificial intelligence, big data, fintech, cybersecurity, digital media and advertising, and blockchain technology.

He is the founder and managing partner of Trajectory Ventures, a venture capital platform with investments in over 100 tech innovators, and collective of operators, founders, and entrepreneurs focused on advancing technology and industry innovation, as well as Trajectory Capital, a later-stage investing platform and private equity fund.

Through Trajectory Ventures, he has led investments in multiple disruptive companies, including TripleLift, a global Adtech platform; Think-Realtime (acquired by Dealer.com), the first machine learning RTB platform for performance advertising; and, LocalMind (acquired by AirBNB), a location-based information platform providing real-time answers for destination-related queries.

He is co-founder and managing partner of TruVest, a next generation impact real estate investment, development, and technology company.

He also serves as CEO and a board member of Trajectory Alpha Acquisition (NYSE: TCOA), a special purpose acquisition corporation focused on high growth innovative technology.

As an active angel investor and entrepreneur mentor, Bordes has been ranked among the Top 100 Most Influential Angel Investors in the U.S. and social media.

He currently serves as vice chairman of Ocearch.org, a non-profit world leader in scientific data related to tracking and biological studies of keystone marine species such as great white sharks. He is also chairman of Hoo.be, a leading platform for the creator economy.

His other board directorships include:

- GoLogiq, Inc. (OTC: GOLQ), a U.S.-based global provider of fintech and consumer data analytics.

- Beasley Broadcast Group (Nasdaq: BBGI), a public media and digital broadcast company providing music, news, sports information and entertainment to over 19 million listeners from 63 stations across the U.S.

- Kubient (Nasdaq: KBNT), a cloud advertising platform, where he previously served as its CEO and led the company’s IPO and listing on NASDAQ.

- Fraud.net, a leading AI powered collective intelligence fraud prevention, risk mitigation cloud infrastructure platform for the real-time economy.

- BeeLine, a fintech infrastructure platform transforming the mortgage and real estate finance industry with their embedded finance tools for real-time transactions.

- Fernhill MainBloq (OTC: FERN), a modular cloud-based infrastructure platform for trading digital assets.

- MediaJel, a transformative software platform with proprietary data tools and compliant MarTech solutions, purpose-built to serve cannabis, CBD, and regulated brands worldwide.

- Board of Trustees for New England College.

Bordes previously founded and served as CEO and chairman of MediaTrust, the leading real-time performance marketing exchange. The company was recognized as the 9th fastest growing company in the U.S. in 2009. He also founded and served as member and chairman of the Performance Marketing Association, a non-profit trade association.

He has contributed his technology insights to a number of articles, including a CNBC article, “A.I. can ‘Augment Humanity in a Very Positive Way,’ says Family Office Investor Peter Bordes,” published on May 8.

Bordes holds a Bachelor’s degree in communication, business and media studies from New England College.

About Logiq

Logiq Inc. is a U.S.-based provider of e-commerce and digital customer acquisition solutions. It simplifies digital advertising for agencies, SMBs and enterprises by providing a data-driven, end-to-end marketing solution. The company’s digital marketing offerings include a holistic, self-serve ad tech platform. Its proprietary AI-powered solutions enable brands and agencies to advertise across thousands of the world’s leading digital and connected TV publishers. For more information, visit www.logiq.com.

Important Cautions Reading Forward-Looking Statements

This press release contains certain forward-looking statements and information, as defined within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the Safe Harbor created by those sections. This press release also contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation that relate to Logiq’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon.

These statements speak only as of the date of this press release. Forward‐looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond Logiq’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. In particular and without limitation, this press release contains forward‐looking statements regarding the consummation of our DataLogiq segment’s proposed SPAC merger, our products and services, the use and/or ongoing demand for our products and services, expectations regarding our revenue and the revenue generation potential of our products and services, our partnerships and strategic alliances, potential strategic transactions, the impact of global pandemics (including COVID-19) on the demand for our products and services, industry trends, overall market growth rates, our growth strategies, the continued growth of the addressable markets for our products and solutions, our business plans and strategies, and other risks described in the Company’s prior press releases and in its filings with the SEC including its Annual Report on Form 10-K and any subsequent public filings, and filings made pursuant to Canadian securities legislation that are available on www.sedar.com, including under the heading “Risk Factors” in the Company’s Canadian Prospectus.

Logiq undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Logiq to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

Company Contact

Brent Suen, CEO

Logiq, Inc.

Email contact

Logiq Investor Relations:

Ron Both

CMA Investor Relations

Tel (949) 432-7566

Email contact

Logiq Media & ESG Contact:

Tim Randall

CMA Media Relations

Tel (949) 432-7572

Email contact

AI innovation can ‘augment humanity in a very positive way,’ says Peter Bordes on CNBC family office investor

Excited to have had the opportunity to speak with Robert Frank on CNBC about how AI impacts global digital transformation and investing in the next generation of technology infrastructure.

Artificial intelligence can either “augment humanity” or become a job-killing digital predator, depending on how companies and regulators manage its growth in the coming years, said tech investor Peter Bordes.

“While everyone is looking at ChatGPT, there are deeper conversations within the industry right now about ethics and integrity,” said Bordes, founder and managing partner of Trajectory Ventures and Trajectory Capital, the venture-capital and family office platform. “We need to start addressing this proactively versus just setting it free in the wild. Do we find a balance? They can take jobs away, but they can also augment humanity in a very positive way. It’s up to us as humans and entrepreneurs to dictate where it goes, especially within the next five to 10 year period.”

Despite the focus on tech giants like Microsoft, Google and Meta when it comes to A.I., Bordes said family offices are uniquely positioned to invest in emerging A.I. technology. He said family offices’ long time horizon, entrepreneurial experience make them ideal investors in A.I. start-up focusing on specific uses like finance, energy, and even farming.

“There is a lot of money out there from investors,” Bordes said. “Operators and entrepreneurs are looking not just for money, but for collaborative partnerships. And that’s one of the things that family offices don’t really think leverage up as much as they should. It’s an amazing opportunity in today’s economy right now. Not only an A.I. but all the disruptive global innovation that’s happening because all family offices, family businesses, those businesses have far reach into industries where they can have influence and helping these companies really accelerate.”

When it comes to broader markets and the investment landscape, Bordes said he sees many similarities to today’s market and the dot-com bubble, which he also lived through as an investor.

“Here we go again,” he said. “The perceived values got so out of whack with tangible values. It’s going to compress more.”

To avoid tech blow-ups, Bordes said he tries to invest with “second-time” founders who have already started another company. He said family offices that do invest with first-time founders should provide their experience and expertise along with their capital.

If this is their “first rodeo,” give them guidance, he said. “Don’t just give them money.”

We are thrilled to announce the merger of Kubient (KBNT: NASDAQ) and Adomni to create the next-generation leading AI AdTech platform, fueling:

? Smarter ad campaigns with new AI features

? Diversification into omnichannel ad products such as CTV and mobile

? Talent expansion across public markets M&A and data science