Airspace Link and Volatus Aerospace form global autonomous aircraft partnership

Airspace Link Inc., a leading provider of scalable drone software and solutions, and Volatus Aerospace, a leader in uncrewed aircraft operations, are announcing a newly formed global partnership.

In this partnership, the two companies will collaborate on advanced uncrewed operations, bringing together Airspace Link's advanced planning, integration, and data capabilities with Volatus technological and operational excellence. This partnership will enable the two companies to collaborate on advanced operations that propel the industry forward, while ensuring and showcasing the safe integration of remotely piloted aircraft systems.

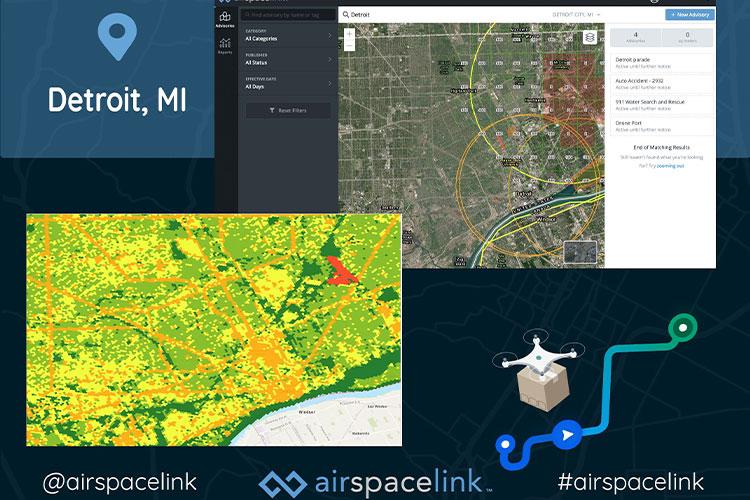

The group will be teaming on a multitude of projects which will include continued work on cross-border operations between Ontario, Canada and Detroit, Michigan. The United States and Canada enjoy the world's most lucrative and enduring trade relationship. Over the past few years, supply chain systems have experienced a growing hardship with the transportation of goods through air, ground, and maritime transport. The partnership between Airspace Link and Volatus will explore remotely piloted aircraft systems (RPAS) and applications for secured cargo package delivery between Windsor, Canada and Detroit, Michigan. The pair feels that RPAS will propose new mobility solutions to help solve some of the supply chain challenges as well as provide new solutions in times of need and Volatus, as a bonded carrier, can advance those operations even further.

Extending west, the team will explore development of oil and gas operations, as well as utility and rail inspections in North Dakota using the Vantis Network. Additional public safety and cargo operations are also underway to support local community development in Texas and other states.

On a global scale, the partnership will spread operational investments into Europe and the Middle East with their first project focused on airspace modernization for Dubai. Other target areas for advancement will include intra-island operations for cargo delivery around the Caribbean Islands along with opportunities in South America.

Volatus' team of experts have paved the way for advancing the use of uncrewed aircraft for BVLOS operations in Canada. Already conducting high volumes of oil and gas pipeline and utility inspections globally and leveraging opportunities in new applications such as methane detection and middle mile cargo operations, Volatus offers a variety of different aircraft platforms and capabilities, each one outfitted for the specific mission at hand.

"Airspace Link's AirHub™ platform connects with key stakeholders that need to participate in the implementation of these valuable services so that there is safe integration and community acceptance from local authorities. We work to manage, inform, and obtain authorizations, if required, from the regulatory agencies as well as communicate with drone operators and the community through digital data transfer, all in one shared platform. We are excited about partnering with Volatus to integrate our application services and data to inform the safe planning and execution of these challenging missions" said Michael Healander, Co-Founder & CEO of Airspace Link.

"Partnering with Airspace Link is a critical component in supporting our strategic global business efforts," says Michael Hill, Regional Director at Volatus Aerospace. "We look forward to advancing drone operations through these focused efforts with Airspace Link."

Airspace Link's AirHub™ solution assists with controlled airspace operations requiring Low Altitude Authorization and Notification Capability (LAANC) approval from the FAA in the United States. The AirHub™ solution offers approval for further justification digitally with the FAA.

About Airspace Link, Inc:

Airspace Link's vision is to create a world where the safe integration of drone's fuels human progress, advancing social equity, the environment, and the economy. Founded in Detroit in 2018 by CEO Michael Healander, Airspace Link is one of the few FAA Approved UAS Service Suppliers of the Low Altitude Authorization & Notification Capability (LAANC). Airspace Link's cloud-based platform, AirHub™, provides the digital infrastructure required to support the safe use of recreational and commercial drone use in communities at scale, supporting the growth of drone operations, drone service providers, drone manufacturers, package delivery and air taxi deployment in the future.

Visit https://airspacelink.com/ to learn more and stay up to date on the latest innovations in this space.

About Volatus Aerospace:

Volatus Aerospace Corp. is a leading provider of integrated drone solutions throughout North America and growing into Latin America and globally. Volatus serves civil, public safety, and defense markets with imaging and inspection, security and surveillance, equipment sales and support, training, as well as R&D, design, and manufacturing. Through our subsidiary, Volatus Aviation, we are introducing green and innovative drone solutions to supplement and replace traditional aircraft and helicopters for long-linear inspections such as pipeline, energy, rail, and cargo services. Volatus is committed to carbon neutrality; the fostering of a safe, equitable and inclusive workplace; and responsible governance.

Learn more today at https://volatusaerospace.com/

For partnership inquiries, please reach out to Alice Griffith alicegriffith@airspacelink.com

Media Contacts:

Airspace Link, Inc.:

Casie Ocana / casie.ocana@airspacelink.com

Volatus Aerospace:

Danielle Gagne / +1-579-977-5066; ext. 92006

Terraform Industries Whitepaper 2.0: Producing clean fuel from the sky

Imagine being able to produce fuel from the sky. Cheap hydrocarbons from CO2 direct air capture and sunlight. While enabling a giant #carbonneutral atmosphere step forward, reversing the leading cause of the climate crisis facing our planet and humanity.

ALSO READ:

How to Produce Green Hydrogen for $1/kg - Terraform Blog

Introducing the Terraformer Mark One - Terraform Blog

Terraform Industries is proud to publicly announce the Terraformer, our product designed to produce cheap natural gas from sunlight and air. The Terraformer is a carbon-neutral drop-in successor to drilling for fossil fuels.

This is becoming a reality from Terraform Industries, founder CEO Casey Handmer and the team's incredible carbon energy innovation. An elegant solution that most importantly enables decarbonization at scale in a short time period by integrating into existing infrastructure vs replacing it.

Terraform White Paper 2.0 is written in a format so that everyone can understand the climate change problem, and a solution that has the ability to make a global impact in the shortest time. Which is not humanity's friend.

Join the Terraform Journey

Follow them on Twitter @TerraformIndies and CEO/Founder @CJHandmer

LinkedIn Terraform Industries and Casey Handmer

Join their mailing list for updates mailinglist@terraformindustries.com

Read their Blog

White Paper 2.0 Terraformindustries.com Fuel from the sky: Cheap hydrocarbons from CO2 direct air capture and sunlight.

At Terraform Industries, we believe our species and civilization should survive climate change. We believe in a future of universal wealth and abundance for all of humanity.

The last seven decades have seen great strides in the human condition but at the cost of rising CO2 levels and changing climate. Oil is finite and ice caps are melting. It is time to wean our civilization from its dependence on fossil carbon by unlocking gigascale atmospheric hydrocarbon synthesis.

Terraform Industries is building the machines to mine the sky, to quench the flow of carbon from the crust into the atmosphere. Instead of extracting carbon from deep underground, Terraform’s technology enables humans anywhere to create cost effective industrial-scale quantities of hydrocarbons directly from solar energy and air.

Putting 50 GT of CO2 into the atmosphere every year isn’t easy or cheap. Coal, oil, and gas are buried deep underground in ever-diminishing pockets of ever-diminishing quality. By contrast, CO2 is present in air everywhere, and too much of it.

We intend to maximize our rate of construction so as to minimize the area under the curve of fossil carbon emission into the atmosphere. The success condition is reached when net fossil carbon flows drop below the level that biological processes can capture, which is ~10x below current levels.

Trends in solar energy cost and tech development make this vision inevitable by 2050, but 2050 isn’t soon enough. With concerted effort in the right directions, we should be able to bring the success condition back, into the early 2030s. A decade or so of frantic work at massive scale to displace fossil carbon production, forever.

We incorporated in December 2021 and published our first whitepaper. This is an update. Over the last eleven months, Terraform Industries has built out its first facility and early team, begun construction of its development prototype, and negotiated sales agreements with key customers.

What does Terraform’s vision of the future look like?

If we want to pave the world with DAC synthetic fuel plants, we’re going to have to engineer them to deliver ludicrous profits. Our business is oriented around finding the most value in exploiting ever-cheapening solar power.

At the fundamental level, Terraform’s machines capture carbon dioxide (CO2), generate hydrogen (H2), and react them to form carbon-neutral natural gas (CH4). Our CO2 concentrators can also capture enough water from the air to supply our process with plenty left over.

This is conceptually similar to the Haber Bosch process which combines atmospheric nitrogen (N2) with hydrogen (H2) to generate ammonia (NH3), an essential precursor for fertilizers that feed more than half the world’s population. 50% of the nitrogen atoms in your body were fixed using Haber Bosch, and soon >50% of the carbon atoms in your fuel will be fixed using the Terraform process.

Big picture, our machines can be thought of as blackboxes that consume capex and opex and produce a stream of natural gas, on terms that are favorable compared to traditional oil and gas wells. Because the product, natural gas, is backwards compatible with existing infrastructure, no large scale rebuilding of our energy systems is needed. Only a gradual displacement of exhausted wells by solar powered machinery that closes the carbon cycle in the atmosphere, with no new fossil carbon added to the mix.

We expect that economically motivated electrification of heating, cooking, and transportation will continue over time. There will remain, however, a substantial tail of durable natural gas and other hydrocarbon demand that we intend to service indefinitely.

Some counterintuitive insights that will make more sense by the end of this paper

In our work on the future of industrial hydrocarbon production, we’ve discovered a range of insights that initially appear quite counterintuitive and may inform the question of why no-one has done exactly this before.

- Low electrical efficiency is good.

- Many technical problems are soluble in copious cheap electricity.

- Use of local solar is good, even in relatively cloudy places like Germany or Vermont, because solar decosting is moving very quickly.

- We need a lot of solar panels. Something like 1000x current annual production. This will take 20-30 years, not 1000 years, because production is doubling every 33 months or so, and speeding up.

- CO2 production strongly correlates with economic growth and reduction of poverty so is not a moral failing, per se. Extraction of fossil hydrocarbons to fuel CO2 production is subideal, however.

- While our overall process is chemically similar to photosynthesis->biomass, the per area productivity is 1000x higher.

- Our competition is fracking and other conventional fossil oil and gas extraction.

- A 5 year equipment lifetime is plenty, as a short ROI is good for scale.

- We can make any desired commodity hydrocarbon long term.

- Synthetic fuel will use 80+% of all solar generation long term.

How does Terraform Industries’ business model work?

Sizing the Total Addressable Market

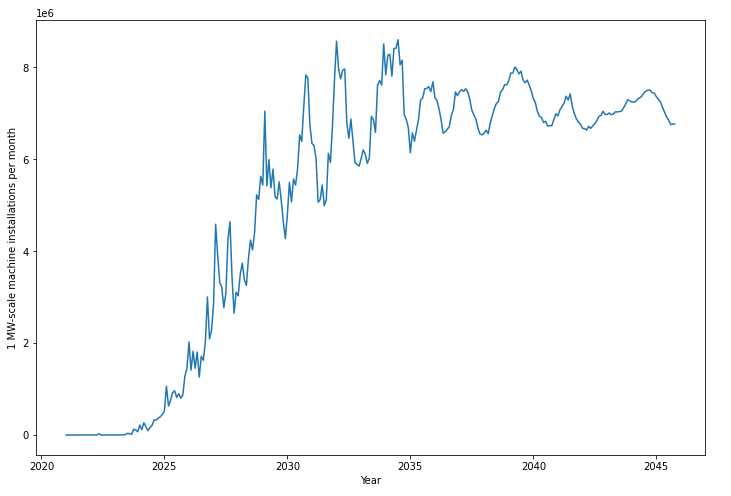

Using publicly available data on global solar power potential and human population density, it’s possible to predict what fraction of the Earth’s population will enter our addressable market as a function of gradual reductions in the cost of solar electricity relative to other sources. While cost improvements tend to come in bursts, the long term historical trend is that solar LCOE gets ~1% cheaper per month. Without loss of generality we can project this trend forward to find that early markets break even around 2024, median markets by 2032, and miserably gloomy places by the late 2030s. Note that variations of this cost trend do not affect the outcome – they may simply shift or stretch the time axis by a few years. Subsidies for CO2 capture, hydrogen production, and green energy production within the IRA significantly hasten market-entry dates in the US, by as much as a decade.

The graph below shows how many new installations are required per month as a function of time over the next few decades. At steady state, a five year replacement cycle would see monthly production of around 7 million MW, as shown in the graph.

This graph shows that with just 1% solar cost improvements per month (historically conservative), the entire world’s hydrocarbon supply chain will be within the TAM by 2036.

At a long term module cost of $30,000/MW, we’re looking at monthly global turnover of $180b, or $2.16t/year, just for manufacturing of fuel modules. This is comparable to the global automobile industry’s revenue, which also has similar volumes and prices though, we expect, tighter margins and more complex supply chains. We make this comparison to show that no miracles are required to achieve these production volumes, in terms of supply chain or integration. By comparison, some other business model that required 80 million units of modular nuclear reactors to be manufactured per year may evince more skepticism.

Depending on the relative value of servicing vs replacing installations at end of life, we expect to see substantial additional revenue for servicing of existing installations.

The solar part of this build out will trend long term to around $100k/MW, but since we expect panels to last for 30 years or longer, the per-year deployment will be 6x lower. Still, that’s a monthly turnover of $100b as soon as 2032, or $1.2t/year.

Unit Economics

Each 1 MW module produces around 6.5 kcf (thousand cubic feet) of natural gas per day (assuming 25% utilization or 6 hours of sun per day), so at a gas price of $10/kcf, each module produces $65/day of revenue, or $24,500/year. Including the IRA 45V green hydrogen production tax credit, each module earns an additional $31.80/kcf, or $75,400/year. The 45E green electricity production tax credit adds an additional $13.50/kcf, or $32,000/year, which more than offsets projected solar capex costs. Indeed, IRA provisions indicate that expanding into the solar plant development vertical would be nearly as lucrative for us as applications of green hydrogen production. In addition, conversion of solar power to hydrocarbons at the solar farm enables exploitation of existing gas pipeline networks to transport that energy to an eager market, bypassing the decade-long electricity transmission interconnection queue.

Our process can also form the basis of a liquid hydrocarbon supply chain, either through direct Fischer-Tropsch upgrading of methane, or via the direct synthesis of ethylene. As a result, DAC CO2 and solar hydrogen will displace all fossil hydrocarbons as soon as solar panel production ramps up to meet demand.

About 200 TW of solar power is adequate to service current hydrocarbon consumption, but we see two substantial opportunities for increased demand. First, solar powered synthetic gas will be cheaper than imported fossil gas for >99% of customers, inducing additional demand. Second, billions of people today do not enjoy reliable access to hydrocarbons and lack infrastructure to access them. Practically all of them do enjoy access to sunlight and air, and thus we expect Terraform Industries to catalyze industrial development and diminish poverty throughout the world.

These two factors combined are adequate to double the size of the global economy, increasing hydrocarbon sales revenue from $6.8t/year to ~$13t/year, and requiring 400 TW of solar power, covering 14% of the world’s deserts. This estimate includes declining hydrocarbon demand due to electrification of ground transport, heating, cooling, and cooking.

With 5 year module lifetimes, each module will generate $119,000 in revenue ($656,000 including IRA incentives) against capex of $30,000 for the module and $16,000 for 1/6 of the 1 MW solar farm. Even including interest and maintenance costs, this margin is significantly healthier than existing fossil fuel production, and Terraform is well positioned to capture value from the raw commodity stream as well as module manufacturing.

Global hydrocarbon price elasticity is around 7.5%, which means that a 7.5% increase in price results in a 1% reduction in consumption. In other words, it’s very inelastic. This reflects the fundamental desperation our economy has for hydrocarbons. We think that expanding access to hydrocarbons worldwide and incrementally decreasing the price will ultimately double the size of the global economy, from $104t/year in 2022 to >$500t/year by 2040 at an average of 10% annual GWP growth, compared to baseline $250t/year expected with historically supported 5% annual growth. While this will be a gratifying continuation of the last century’s trend against poverty, it also represents substantial value generation in the world of atoms.

We do not anticipate that Terraform Industries will have zero competitors on this journey. Competition is a corollary of a successful business, and we’re here to be exceptionally successful. Competition is the lifeblood of innovation and faster value creation. We fully expect this industry to generate thousands of different companies all specializing in different markets and technology, just as the current oil and gas industry supports a bewildering array of companies of every size. Terraform’s long term goal is to maximize our growth, revenue, and market share. The largest existing company in hydrocarbons (and the world) is Saudi Aramco, with just 5% market share and a mere $393b in annual revenue. In contrast, Tesla has led electrification of cars and retains >70% market share in that sector, among a field of securely established incumbents, more than 20 years after starting.

One year ago, we saw cost parity in limited markets by 2026. Since then, the timeline to healthy gross margins at scale has been pulled forward, first by Russia’s invasion of Ukraine, and second by the IRA and its lucrative production tax credits (PTCs). Synthetic fuel, if solar power were available at the necessary scale, would be cheaper in Europe today! Solar might get cheaper slower or faster than historical trends, and there are good reasons to suspect it could go slightly either way. No matter what happens, it is highly likely that the industry as a whole will be supply constrained as significant production increases for solar panels are required. Even under these relaxed assumptions, in large swaths of the world today solar powered synthetic fuel is cheaper to produce than petroleum, and the relative trend is clear. In other words, this adoption curve could shift or skew a bit but the underlying principle is inevitable.

The date at which we achieve the success condition is determined by how quickly we can translate market demand for machines into physical installations all over the world. Each year we shave off the schedule saves 50 GT of CO2, 0.09°C, and likely millions of lives.

Within the USA, the passage of the Inflation Reduction Act brings significant incentives for the production of green energy. The Section 45V subsidy for green hydrogen, at $3/kg or $31.80/kcf, quintuples our projected revenue. Our business model ultimately does not depend on subsidies, but the IRA will hasten our growth by as much as a decade. It’s time to build!

Let’s get specific. We know that there’s incredible unmet demand for cheaper, cleaner hydrocarbons, but how does Terraform’s business actually work?

Key products

Terraform Industries’ key products, in order of deployment, are natural gas, gas synthesis machines, machine operations, machine factories, factory construction and operation, project consultation, and project finance.

Gas

Terraform Industries’ fundamental product is natural gas, also known as methane or CH4. A widely used hydrocarbon, with steady and relatively inelastic demand. Europe imports 16.5 billion cubic feet per day! Vitally important to a range of industries including electricity, heating, cement, steel, chemicals, fertilizers, paints, and plastics. Significantly cleaner burning than coal or kerosene. Terraform Industries’ gas uses carbon captured from the atmosphere so it is, at worst, carbon neutral. In reality, a significant fraction of natural gas is converted to durable forms such as plastic so even without deliberate sequestration of some portion of the product, operation of our machines is net negative.

With minor tweaks our machines can produce other hydrocarbon fractions, such as ethene (ethylene) or methanol, and the Fischer-Tropsch process can convert natural gas to gasoline or kerosene. Depending on local market conditions, we may produce different mixes of hydrocarbons, but the principle is the same. Cheaper production of synthetic fuel durably displaces fossil hydrocarbon production, reducing net transport of carbon into the atmosphere.

Machines and support operations

It’s not enough to only produce gas, however. Our machines produce the gas, and so our product is also gas synthesis machines. Each machine produces around 6500 cubic feet per day (6.5 kcf/day) depending on capacity factor, enough for ~20 people at US levels of consumption. With some front loaded capex and predictable revenue, the machines are natural targets for securitization as low risk bond-like products. We will produce machines, operate them ourselves, lease them, and sell them to other operators.

Factories development, construction, operation

The factory is the machine that builds the machine that makes gas. Our current facility in Burbank will become our first two factory lines in the coming year, where we refine our manufacturing methods to ensure high reliability and the best possible value for our customers and partners. Going forward, one factory’s production will be able to service and replace enough machines for a million people, so we’re going to need to support standing up around 8000 factories in 20 years, which is about one per day. To keep costs down and EROI short, each factory is intended to be set up in 6-8 weeks using generic locally available construction hardware on a footprint of ~10,000 square feet. In other words, our factories are not billion dollar investments built once per decade on each continent, but rather local facilities that tap local supply chains. Each factory has predictable start-up costs and production, so long term it may make sense to franchise their ownership with an appropriate capital structure, particularly in markets where centralized supervision of, eg, foreign regulatory compliance would add unacceptably high levels of overhead. Where Terraform is not owning factories, we will offer high value-add services of construction, operation, and consulting.

Project development and finance

Finally, when Terraform’s global roll out reaches terascale, our capacity to self finance and define major projects lends itself to organizational expertise and revenue streams from lending project development capital. We anticipate that later developments will have higher margins, faster EROI, but operate at a scale that potentially overwhelms more traditional forms of capital supply. At this scale, we will use the strength of our global operation and revenue to self finance continued expansion.

Go to market strategy

While we are confident that producing carbon neutral natural gas at competitive prices will not suffer a demand problem, we think it’s vitally important to test our assumptions early. This is why we’ve commenced negotiations with California’s two largest utilities who will be our first partners during the prototyping and early manufacturing phase.

SoCalGas is a gas-only utility based in Southern California, serving 21.6 million residential customers and nearly $4b/year in revenue. It is a subsidiary of Sempra Energy. SoCalGas has been on the vanguard of climate conscious business innovation, leading the hydrogen-focused Angeles Link project. SoCalGas has expressed a high level of interest in our technology’s ability to save them and their customers from fossil CO2 emissions, create more robust local supply, and monetize high levels of solar electricity curtailment that occurs routinely in the area. In mid-September we signed our first natural gas offtake agreement contract with SoCalGas.

We’ve also been in talks with Pacific Gas and Electric (PG&E), another major California-based utility, with whom we plan to be both a customer for large quantities of cheap electricity from renewable sources, and a supplier of natural gas. Like SoCalGas, they are keenly aware of the fundamental contradiction inherent in hydrocarbon energy sources; too little kills us quickly, and too much kills us slowly.

We’ve been approached by numerous other utilities as well as various companies in the oil and gas industry regarding potential pilot programs, throughout the US and Europe. Our current focus is on serving local demand where, happily, solar power is some of the cheapest in the world, but we remain on excellent terms with interested parties no matter where they are.

Regulatory

On August 16, 2022, President Biden signed the Inflation Reduction Act of 2022 into law. Among many other provisions, the IRA significantly expands the Section 45Q tax credits for Direct Air Capture of CO2 to $130/T for utilization and $180/T for durable sequestration, which translates to a $6/kcf credit for natural gas production. A non-stackable alternative to 45Q is 45V, providing $3/kg for sufficiently green hydrogen, which translates to $32/kcf. There is also a PTC for green electricity (45E) that works out to $13.50/kcf. These credits, among other similar provisions, enable TI to reach cost parity with Henry Hub natural gas prices (~$8.80/kcf) as soon as we hit production and substantially increase the urgency of transition to manufacturing.

We welcome further developments in this space, as well crafted legislation could make it much easier for climate focused companies to reach a significant market in time to make a difference. In July 2022, Terraform Industries joined 40+ other companies as founding members of the Carbon Business Council, a trade association for the carbon capture industry focused on lobbying for responsible policy and legislation to enable the growing market and industry.

On the other hand, there is a fundamental limitation to well-intentioned attempts to internalize the externalized costs of carbon emissions, which is that affordable fuel is a public good, a powerful weapon against poverty, and politically non-negotiable. It is simply not possible to change fuel prices enough to reduce usage enough to make a difference on climate, without also immiserating billions of people into pre-industrial poverty. Similarly, we believe that artificial stimulus for otherwise economically unproductive carbon capture and sequestration (CCS) would require unsustainably high levels of expenditure indefinitely.

In short, yanking enough CO2 to make a difference out of the air and burying it underground will make fuel impossibly expensive or lead to hyperinflation. Taxing fuel enough to reduce usage to sustainable levels will make North Korea’s economic problems look rosy by comparison. And producing enough synthetic fuel to make a difference while using the California LCFS carbon market would quickly (within weeks) saturate demand.

Therefore while various incentives don’t hurt we cannot build our business model around an assumption that they will be durable and universal. Our machines are designed from day one to compete with oil and gas wells on price without any subsidies. Our defensible assumptions around falling solar costs mean that any attempted regulatory tilt towards or away from traditional fossil production won’t make much difference in the final analysis, although the IRA will certainly help us get started.

We have met with fed/state/local officials including Alexa Bishopric who serves on the House Science, Space and Technology Committee Energy Subcommittee, Fatima Maria Ahmad on the Select Committee on the Climate Crisis and staffers working with the Natural Resources Committee Energy Subcommittee. We are building relationships with both ARPA-E and the DOE office of Fossil Energy and Carbon Management and are pursuing a partnership with the National Energy Technology Laboratory.

Industry

Terraform’s technology sits at the intersection of the existing natural gas and renewable energy industries, and the emerging Carbon Capture economy. It is therefore critical for Terraform to build relationships with several industries at once. As part of our commitment to gas industry adoption and widespread deployment, the Terraform team has attended annual meetings for the American Public Gas Association and the Independent Petroleum Association of America to gain insight into these crucial industry communities, build trust, and to evangelize the synthetic fuel business model. These groups are both under pressure from government and customers and desperate for carbon-friendly solutions to their supply and industry sustainability problems. We believe Terraform’s synthetic gas is a natural fit solution for these industry-wide concerns. We have joined industry associations including the Carbon Business Council and have friendly relationships with fellow carbon management startups such as Prometheus Fuels, CarbonCapture, RenewCO2, Arbor, Heirloom, and Silicate.

What characteristics do Terraform’s machines need to enable this vision?

Summary

Our completed system includes:

- An industrial-scale 1 MW (5 acre) solar array to concentrate solar energy into usable electricity.

- An electrolyzer to convert solar electricity directly into hydrogen without inverters or transmission.

- A CO2 absorption bed to process large volumes of air and filter out the CO2, which can also produce water as a byproduct.

- A Sabatier reactor to convert locally produced CO2 and hydrogen into pipeline-ready natural gas without intermediate compression or transport.

The system embodies the essence of cheap solar electrons, consumed at the source. Capital efficiency is favored over electrical efficiency, in service of a cheap and scalable product.

Our waste products are oxygen and water.

This rendering shows a 1 MW solar array (blue), 1 MW electrolyzer (orange), Sabatier reactor (green), and CO2 capture device (brown, with white sorbent regenerators).

Performance

The Terraform Industries natural gas production machine is built on the 1 MW scale, to match the typical 5 acre solar array and bypass the cost of inverters and power transmission in getting energy to market. It is composed of three parts: carbon capture, hydrogen electrolysis, and methanation Sabatier reactor. In order of magnitude terms, the machine consumes 6 MWh/day at $10/MWh to filter CO2 from 7 m^3/s of air and produce 6.4 kcf/day of natural gas. This corresponds to 331 kg of CO2 recycled per day, and is enough to supply the per capita hydrocarbon needs of about 20 people at Western standards of living.

Scalability

The success condition requires that we displace >~90% of fossil production with DAC fuel synthesis, as soon as possible. Doing so will minimize the area under the curve of net transport of carbon from the crust into the atmosphere, reducing avoidable impacts of climate change. Quickly achieving the necessary scale also implies a strong economic forcing function, which means that achieving displacement will unlock enormous new sources of wealth for humanity.

What will it take to achieve this? What characteristics must the machinery embody?

We want to scale production to more than one million units per month by the early 2030s. Therefore the machines need to be, above all, inexpensive and capital efficient. We intend to measure the capital investment payback period in months, not decades. The machines must have a capital structure that is preferable to its competition; a fracking well.

How do we do this?

The machines are simple. They use standard commodity materials and parts available almost anywhere on Earth. Their manufacture is simple and requires no precision tooling, exquisite training, or particularly hazardous materials.

We will need to stand up a few thousand factories over two decades, or roughly one for every million people. These factories can be sited in generic industrial buildings and completed in weeks. Our design deliberately avoids a need for billion dollar gigafactories. Some products cannot be built without them but ours can, and given the choice, we would rather avoid it.

Our interfaces are simple. We can independently iterate and customize subcomponents of our machines with confidence in smooth integration at any gas production site, which will usually be powered by solar photovoltaic panels.

There is a tradeoff between efficiency and complexity/cost. But electrical efficiency matters less than capital efficiency when it comes to rapid scaling. Why is that? The Terraform Industries natural gas production system has many factors of production: labor, materials, electricity. Only one of these is getting cheaper. Cheaper, lower electrical efficiency machines capture the upside of cheaper electricity.

Let’s focus on some specific design choices intended to maximize scaling potential and reveal our progress towards design targets.

Carbon capture

Our MW-scale machines need to filter 7.5 m^3/s of regular air in order to concentrate enough CO2 to feed into the reactor. The air does not need to be heated, cooled, compressed, or otherwise harassed. It only needs to pass through a low pressure filter bed that scrubs the CO2 out of the stream. Later, the filter sorbent is thermally regenerated to release the CO2.

There are numerous ways to do this ranging from amines to zeolytes to metal-organic frameworks (MOFs), each of which offers a range of costs and energy efficiencies. In particular, some experimental MOFs may be able to selectively absorb and release CO2 for very close to the thermodynamic limit. Those same MOFs cost >$10k/g, and we would need a lot of them, as in millions of tonnes.

Instead, we’re using calcium carbonate/calcium oxide looping. Calcium carbonate is a very common material in the crust, laid down by ancient reefs and usually encountered as limestone. It is the primary ingredient in cement, and can be produced at a quarry for about $6/T. Thermal regeneration requires heating it to 900°C but in our system, we assume that power is cheap. Electric kilns are simple machines with no moving parts.

Rather than optimize our CO2 capture system for energy efficiency, volume, and weight, such as we might for a life support system on the International Space Station, we optimize aggressively for cost, delivering a simple, robust, reliable CO2 scrubber that we can readily scale as needed. It is literally a box with fans on it.

As an added bonus, our CO2 filter bed also captures water vapor from the air, so the addition of a condenser makes our system a net producer of pure water, despite some consumption of water by the electrolyzer. As most of our systems will ultimately be deployed in sunny, arid, and less populated regions net production of water will improve the value prop and permit some irrigation.

Our internal cost target for the CO2 capture system is $7500, which breaks down as $1500 for the kiln and material transport system, and $2000 for each of 3 8’x8’ horizontal absorption beds, with a roughly 50-50 split between materials and manufacturing labor. Each bed is to consume 3.51 kWh/T-CO2, of which 95% is used in a 50% efficient calcinator only during the day, with the balance used to move air through the bed 24 hours a day.

Since our bed is to capture 331 kg CO2/day (25% utilization), capital costs work out to $14700/T-day or $40.35/T-year. Given a raw solar DC electricity cost of $10/MWh, power works out to $35/T-CO2. Amortizing capital costs over five years of operation gives an unpressurized 2.6 L/s stream of >95% pure CO2 for $43/T.

Our 4’x4’ bed pathfinder prototype materials cost <$300, including instrumentation that won’t be present on a production system.

Our full scale 60 kW kiln prototype, composed of fireproof fiber board, heating element wire, and a control circuitry cost about $7000, which is 9x cheaper (per kW) than the commercially available pottery kilns used for early experiments. We have already identified several cost centers for removal in Version 2.0.

We expect several further speedbumps when it comes to the mechanics of material transport and solid/gas reactions, but at this point we’re confident that if we can’t make this work at near our planned costs then there’s something very wrong with humanity’s understanding of physics.

Electrolyzer

Many commercially available electrolyzers are optimized for purity of the gas stream, or high electrical efficiency. Taking this to an extreme, some electrolyzers cost more than $10,000/kW and operate at extremely high pressures and temperatures – all of which add cost to ensure safe operation, since no-one wants their lab to be dissected by a supersonic water jet stream of supercritical lye.

Terraform Industries’ electrolyzer is intended to be attached directly to a solar farm DC bus, and operate only during daylight hours. This means we plan to amortize its cost over <10000 hours of operation. What, then, does an electrolyzer intended to operate with the cheapest possible electricity look like?

First, we select the cheapest, most generic materials. An alkaline cell is slightly less efficient than systems that use bespoke membranes. The structure is chemically resistant ABS plastic – the same material as LEGO. The cells are operated in series at a relatively high voltage, increasing current density, simplifying electrical wiring, and trading efficiency for cost.

The cells are operated at atmospheric pressure, so there’s no need for any kind of pressure containment vessel. The oxygen stream is vented directly, while the hydrogen stream is moved through large, low pressure tubes directly to the adjacent reactor.

If we can think of a way to make the electrolyzer cheaper, we will do it. Our long term cost target is $20/kW, which is comparable to an electric kettle. At full scale, we plan to use twenty 50 kW electrolyzer units per system. Each 50 kW unit will cost $1000 and have ~250 cells in series. This works out to ~5000 cells at a unit cost of ~$3.50 per cell. Stack integration adds a small amount of additional cost for water provision and a gas collection manifold.

Our test cells have validated design ideas and a variety of candidate low cost electrode materials, while our 10 kW pathfinder is nearing completion.

At the relatively low electrical efficiency of 50%, our electrolyzer is intended to consume 6.47 kWh/Nm3, or 78.89 kWh/kg-H2. At $10/MWh for pure solar daytime DC power, we produce H2 at $0.78/kg for electricity opex, or just $0.89/kg including capex amortized over five years. How can we produce hydrogen so cheaply despite our callous indifference to electrical efficiency? We have exploited the cheap abundance of solar power at the array.

Chemical reactor

The reactor’s purpose is to convert incoming streams of CO2 and hydrogen into natural gas (CH4). This process, the Sabatier reaction, was discovered in 1897 and has been used industrially for more than 100 years. While extremely effective catalysts do exist, our preference is to use the simplest, cheapest catalyst that will get the job done: nickel. It is also more robust and significantly less toxic than other alternatives.

The Sabatier reaction is an equilibrium reaction, so two stages with an intermediate condenser are required to achieve pipeline-grade purity of CH4. Unlike traditional gas wells, we don’t have to worry about contamination of the stream with sulfur, propane, or other contaminants found underground.

We have also investigated an ethylene reactor which, ingesting the same raw input gasses of CO2 and H2, produces C2H4 instead of CH4. Ethylene is a chemical widely used in industry as an essential precursor to plastics, a fuel, an anesthetic, and fruit ripening agent. Because it can be readily converted to polyethylene, a durable plastic often used in milk bottles and fuel tanks, the ethylene reactor enables durable storage of carbon in solid form. Producing ethylene is technically very achievable, but is not on the critical path at this point.

CO2 is a low value waste gas. It is non-trivial to filter from the atmosphere. It is expensive to store and transport. Hydrogen is also non-trivial to produce, expensive to store and transport, and rarely used as a generic industrial input. The Sabatier reactor combines these two gasses at the point of their generation (no storage or transport required) and produces natural gas, a generic commodity product that is used everywhere and readily transportable using existing infrastructure.

Our internal cost target for the reactor is $2500. Our experimental prototype, festooned with all kinds of sensors, mass flow controllers, and rapid prototyping fittings cost $7800. We think we can cut in half this cost in Version 2.0 without any major issues, at which point we’re on the glide slope.

Manufacturing

Successfully executing construction and testing of a development prototype is a necessary but not sufficient achievement. One isn’t enough. Our civilization will need between 300 and 400 million machines, manufactured at a rate of about 60 million per year, which is comparable in terms of numbers, mass, and capital flows (but not complexity, fortunately!) to the global automotive industry.

Our machines have been designed from day one with manufacturability in mind. Early machines will be tested and operated on our premises, which can supply up to 2 MW of electrical power. We will also operate pilot systems on nearby lots in collaboration with our customers. It is essential to gather several system-years of experience in operations while folding back knowledge into the design and production process, before we spool up mass manufacturing. Hard data on long term reliability makes our otherwise new and relatively untested product bankable for our customers. Our existing facility is sufficient to support pilot scale manufacturing as well as test activities.

We anticipate that we can go into production with a basic and inexpensive 10,000 sqft factory, and that we’ll need about 8000 such factories to support steady state replacement worldwide. Roughly speaking, that’s one per million people.

Cost Pressure

Our machine converts electricity at $10/MWh into natural gas at ~$10/kcf. Keeping the EROI short is essential to safeguard capital availability during the scale up, and to compete effectively with fracking, wherein successfully developed wells pay back their construction costs in just a few years of operation.

Progress

Terraform Industries incorporated in December 2021. We raised a seed round to build the team, construct a development prototype, and build key relationships with customers, suppliers, and regulators.

Expected near term milestones

- Sabatier reactor demo – completed July 2022.

- Lime calcite cycling – completed August 2022.

- Sales contract with offtaker – completed September 2022.

- CO2 sorbent regeneration – demonstrated November 2022

- Gen 2 reactor activated – completed January 2023

- 10 kg CO2 capture in completely closed cycle

- 10 kW electrolyzer pathfinder 24 hours operation

Team

Terraform has hired a team of world experts with a track record of success delivering the impossible. For most of them, the Terraform machine is the simplest thing they’ve ever built, which makes it possible for us to make them reliable, cheap, and in the millions.

Casey Handmer, PhD

Casey founded Terraform Industries in 2021. He triple majored in pure math, applied math, and physics at the University of Sydney, where he published two first author papers on optical microscopy and won the University Medal. Before beginning his PhD at Caltech, he took the opportunity to hitchhike 2000 km through north east Asia, eventually summiting several volcanos in Kamchatka. At Caltech, he published three first author papers on computational general relativity and earned a private pilot license. After completing the doctorate, he went into industry at Hyperloop, a hardware tech start up based on Elon Musk’s concept for supersonic vacuum trains. He was the levitation engineer, responsible for design and analysis on the passive magnetic levitation and braking systems, which worked flawlessly first try. He also contributed to more than 300 different projects and published three patents on novel levitation systems. After seeing the devloop full scale test article to completion he left for JPL, where he joined the GPS science and applications group. Over four years at JPL, he worked on mapping, AI, radar, and meteorology. He writes a popular blog on space and energy topics.

David Smyth

David’s role at Terraform is Business Operations. Drawn to extremely challenging roles and responsibilities, David has a lifetime of experience founding or purchasing and then operating successful companies. The spectrum of these companies is broad geographically and technically, and includes management information systems, arms trading, equipment leasing, a very fast growing grocery store chain in the UK (opened a store a week until being bought out by TESCO), a Swiss technology investment company, several technology development and consulting firms, and Westlawn Yacht Design Institute, a 501(c)3. Major projects where David played critical roles include managing, architecting and developing: Management information and workflow systems for clients including DirecTV, Siemens, Allianz, Deutsche Bank, and UBS; Flight software on several military and space systems including the SR-71, Space Shuttle, and Mars Rovers; Software technology development including robotics, software fault tolerance, and massively multithreaded distributed real-time systems, file systems and databases.

Stephanie Coronel, PhD

Stephanie is the Director of Research and Development at Terraform Industries. She was born in Loja, Ecuador and emigrated with her family to the United States in 2000. She received an M.S. and Ph.D. in Aeronautics from Caltech in 2010 and 2016, respectively. Her doctoral work focused on assessing ignition hazards of reactive gaseous mixtures in the context of aircraft safety through the development of novel experiments and laser-based diagnostics. After graduating from Caltech, she continued her studies in explosion hazards at the Boeing Company and more recently at Sandia National Laboratories (SNL). At SNL, she expanded her work in explosion hazards to include the response of explosives subjected to abnormal thermal environments. Stephanie has fourteen journal publications, including four first author papers, within the combustion field.

Lucie Nurdin, PhD

Lucie is our chemical engineer. Originally from France, she completed her MSs degree in Paris at the Ecole Normale Superieure (Ulm) before she moved to Calgary (Canada) where she completed her Ph.D. in 2020. At the University of Calgary, Lucie studied the role of earth-abundant metal complexes such as iron and cobalt in reactions related to the green energy sector. In particular, she investigated the role of zero-carbon fuels such as hydrogen and ammonia as alternatives to fossil fuels. Driven by her interest in the nitrogen cycle as a new avenue to the carbon cycle, she then worked at Caltech as a postdoctoral scholar on the development of electrocatalysts for the green synthesis of ammonia. Lucie is also leading the way to more sustainable habits and lifestyles. She is engaged in a variety of environmental activities such as being a zero-waste activist and informing the general public about the energy crisis we currently live in.

Ryan Okerson

Ryan is designing the carbon capture machinery. He was the responsible engineer for the SpaceX Starlink solar array, which currently holds the distinction as the most deployed space power by a factor of ten. Prior to SpaceX he was the responsible engineer for the Hyperloop One prototype vehicle. He has also built deployable mechanisms, thermal shock chambers, factory automation tooling, automated optical measurement machines all while being responsible for design, build, test, and manufacturing.

Crystal Dilworth, PhD

Dr. Crystal Dilworth runs the business team. As a communicator and consultant she has led creative initiatives, driven strategy, and supported executive teams in companies from start-ups to the Fortune 500. Her work has spanned a variety of industries including FinTech, automated driving, insurance, and utilities with a special emphasis on the brain and human behavior. A molecular neuroscientist by training, Dr. Dilworth received her Ph.D. in Chemistry from Caltech. She was the on-air expert on electronic cigarettes for the Al Jazeera America television network and has hosted video segments about science and technology for a variety of media outlets including CBS, Voice of America, and the Discovery Digital Network. In 2019 she was named one of the AAAS IF/THEN Ambassadors for STEM in recognition for her work in science communication and helping to diversify the face of science worldwide.

Kyle Cothern

Kyle studied mechanical engineering at Virginia Tech. He lead a team to develop the first autonomous humanoid robot in the US CHARLI-L. He built transport erectors at SpaceX for Falcon Heavy and Falcon 9, designing and performing analysis of the lift system, reaction fixture / launch mount and software tools used to design SLC-40 at Cape Canaveral, SLC-4E at Vandenberg and later SL-39A at Cape Canaveral. Kyle also developed the system architecture and tube structure for Hyperloop Dev Loop and set up the Hyperstructures team. He also set up the test site for Hyperloop and brought on-line the largest hardware development facility in the Las Vegas area. More recently he formed the concept and built out the team for an artificial gravity space station company called Vast. He is a former board member of Crashspace, an LA hackerspace, has a small machine shop and engineering development company: Swarf LLC designing and prototyping components for transportation, aerospace, and consumer product sectors.

Arun Johnson

Arun has had a lifelong interest in chemistry and environmentalism, and is currently studying chemical engineering at UC Berkeley. He’s worked at two labs at Berkeley and Stanford, publishing papers on catalyst sintering and novel nanomaterials for water purification. Arun has designed and built his own electrolysis cells, supercritical CO2 chamber, and other research equipment for independent research projects. He also won an Emergent Ventures Grant and the Pioneer Tournament for an independent research project on fusion energy, and attended Sea Ranch Camp three years ago. He’s also the VP of the Biofuel Technologies Club at Berkeley, where he’s managing construction of their pilot biodiesel plant in Richmond, CA. At Terraform, Arun designed and built the gen 1 Sabatier reactor in eight weeks, followed by the production pathfinder gen 2 reactor.

Graham Kersey

Graham studied aerospace engineering at University of Colorado Boulder. He has been involved in several extracurricular engineering projects. He built payloads for high altitude weather balloons, and an autonomous rover for the NASA Space Grant clubs, and has been a dedicated member of CU’s rocket team, the CU Sounding Rocket Lab. He has been involved with developing the team’s 4-axis filament winding machine, carbon fiber composite motors, and a rocket that was recently launched to 33,000 ft at Mach 2. Just before joining Terraform, Graham was elected to lead the rocket team. At Terraform, Graham defined the calcination process where he is the responsible engineer for the 60kW prototype kiln.

Tiana Wong

Tiana’s role at TI is marketing and research. She’s studying Environmental Sciences and History at UC Berkeley and most recently was executing no-code operations, communications, and re-engagement strategies at On Deck Scale, On Deck’s fellowship for seed-stage to IPO startup CEOs. Previously, she conducted venture analytics, due diligence, and market research research at cleantech startup accelerators (Cleantech Open, SVG Ventures). She also spent time doing market research, customer interviews, and qualitative analytics at FREDsense Technologies, a water sensor startup.

Future Growth

Terraform Industries intends to continue to organically grow the team through and after Series A as we ready our product for market and mass production. Our present team of twelve covers our core competencies of technical definition and development, and business development. As we scale, we will need to add a variety of specialist technical roles, including manufacturing engineers, chemical engineers, and certified electrical engineers, as well as manufacturing technicians. On the business side, we will add MBA/finance expertise and operations with specialists in contracting, regulatory affairs, HR, facilities, OH&S, and project development.

Technology

Reactor test rig

The gen 1 reactor test rig chemically converts CO2 and hydrogen (H2) into natural gas (CH4), which we flared through a Bunsen burner. Unlike a hydrogen flame, which is almost invisible, this fuel rich flame is fat and yellow – full of incandescently glowing soot. The Sabatier reaction was the one part of the process the founder did not test before starting the company, and our chemical engineer Arun Johnson built and tested this rig in eight weeks.

We commissioned our own gas chromatograph and confirmed 96.7% CO2 conversion to CH4, confirming the validity of our numerical models.

This photo shows the reactor connected to cylinders of CO2, hydrogen, and nitrogen, which is used for purging and cooling. The successful testing of this reactor informs design changes as we build the gen 2 reactor, which is a production pathfinder.

The gen 2 reactor has 100x higher throughput and a much more capable thermal management system.

Electrolysis test rigs

Electrolysis is a well understood chemical process but hitherto industrial development has focused primarily on electrical efficiency, rather than capital efficiency. Below, we built this test rig for characterizing the longevity and effectiveness of several lower cost electrode materials and testing our mechanical design.

CO2 absorption rigs

The lime-calcite CO2 absorption cycle is well understood, so we proceeded directly to this flow test bed. Here we can control flow rate, humidity, and sorbent material. Sensors above and below the bed allow constant logging of data on flow speed, temperature, humidity, CO2 content, and pressure drop across the bed.

We built a 4’ pathfinder fixed bed rig. The 1 MW bed is composed of three 8’ x 8’ sections, so this rig allows us to understand large scale air flow and sorbent properties. It is built mostly from oriented strand board (OSB), an inexpensive wood composite material that is close, in cost and behavior, to a production system.

Image from a fluidization test.

Calcination rigs

In the kiln area we have 5 kW and 15 kW commercial grade pottery kilns, as well as a production prototype 60 kW calcination oven (“the toaster”). Its design differs substantially from the kilns as its material can be contained in long, flat shapes that have better heat transfer properties.

We’ve also built expertise in sorbent regeneration, including cheap and effective rehydration and repelletization processes.

Facility

After an exhaustive search, we leased a 35000 square foot facility in Burbank. It has 2600 amps of electrical service (2 MW!), secure outdoor spaces to test machinery, noise tolerant neighbors, and friendly city administration.

This photo shows the first of four large bays, here used for engineering work and prototyping.

Strategic alignment

Exit Strategy

Terraform’s long term plan is to grow the entire industry as quickly as possible by unlocking new ways to create wealth and increase productivity. We don’t plan to exit as early as possible but we are, of course, rational capitalists.

Intellectual Property Plan

What is the value of IP to a company that pioneers a new, simple, and scalable way to produce hydrocarbons? (The People’s Republic of) China rightly gets a bad rap for its practice of stealing IP from international partners, but when it comes to strategic access to hydrocarbons, there isn’t a nation on Earth that will choose starvation and political unrest over foreign IP rights. The history of Haber-Bosch and BASF bears this out. To us, this is understandable, so the question becomes: How do we leverage human desperation for cheap energy to our advantage? Is it really such a bad thing if China, India, and all the rest spend a decade of economic effort building out solar farms and CO2 scrubbers? Long term, these actions will have several positive side effects, including improved international security, reductions in poverty, economic growth, and enormous reductions in the cost of solar electricity.

We do not intend to waste much effort attempting to discover processes obscure enough to be patentable and yet useful enough that they could somehow help us scale faster. The tools are at our disposal. The patents expired 50 years ago. This process is not particularly difficult, it’s just been historically unprofitable because electricity wasn’t cheap enough back then. It is now.

Industry Catalysis

Terraform Industries is prepared to vertically integrate to the extent necessary to win. We see our main competition as legacy fossil hydrocarbon production, not other carbon capture start ups. We believe that a worldwide ecosystem of innovators will be able to iterate and help us grow faster than we could as a single company, no matter how well run our company happens to be. Competition is healthy. We think the far future of this industry will involve tens of thousands of companies with technology and geographic specialization serving local customers. Our job is to look ahead, identify, and profitably remove roadblocks that prevent the rapid exponential growth of the entire industry.

We will always operate our machines, but long term we think ownership and operation is better shared with companies with a different capital structure, just as Engineering/Procurement/Construction (EPC) contractors today don’t generally own all the projects they build. The same goes for our factories, which we also intend to package as bond-like products and sell to investors looking for steady and predictable low risk returns. Terraform’s long term business is in finding high leverage pain points and monetizing high margin solutions.

Solar Manufacturing

In 2021, steady rates of solar photovoltaic (PV) price reduction anticipated our process would break even on cost in the south west US by 2025. Since Russia’s invasion of Ukraine, oil and gas prices in Europe and East Asia are now high enough that Terraform’s process would be profitable there now. Indeed, at current European solar prices we could undercut oil and gas imports, if there was enough solar power available, which currently there is not. Build solar panels!

This means that Terraform’s growth is already potentially limited by solar PV manufacturing rate. Given a (historically conservative) 30% cost improvement per doubling of PV production, solar PV build out will never be able to catch up with increases in demand as cost improvements unlock new markets, until the success condition is reached. Complete displacement of European gas imports by solar power would require 15 TW of new generation, covering an area comparable to Belgium. If German PV tooling manufacturers were crash building PV plants right now, they would operate profitably at least until 15 TW of synthetic fuel production was deployed, so the only question is how quickly they can scale up to this rather large number, and how quickly they can convert already ravenous levels of demand into wealth.

Presently, solar PV manufacturing doubles roughly every three years. If this trend continues, there will be as much as a 12 year backlog in demand for solar in markets where natural gas would be cheaper by Terraform’s process, until global demand is saturated some time in the 2040s. Reducing this doubling time from 36 months to 24 months or even 16 months would substantially reduce this backlog, hastening the global displacement by as much as 8 years, saving 400 GT of CO2 from being emitted, and tens of millions of lives from the effects of climate change. It goes without saying that any solar company able to profitably increase production growth rates will stand to make a LOT of money in the coming decades. By the time we hit the success condition, we will have built enough solar (300-400 TW) to generate about 20x more electrical power than we currently do from all forms combined.

The Plan Going Forward

We raised a seed round to buy down technical and market risk before we scaled production. At this point we have effectively derisked all the key questions we articulated in Whitepaper 1.0 and have line-of-sight to completion of a development prototype well within our current runway. Next, we’re moving into production prototyping, in which we develop our factory to produce first dozens, then hundreds of machines and build early operational experience.

Since we began, the world has changed. We could not have planned on Russia invading Ukraine or Biden’s team getting what became the IRA over the line. What looked like an optimistic bet on cheap solar a year ago now looks so safe we could already be in profitable production. It’s time for Terraform to capitalize on its first mover advantage and rapidly scale its team and production capacity. We’re looking to grow from 12 people today to >60, building out our subsystem manufacturing teams as well as operational capacity in the field.

Our preference for cheaper, low efficiency technology means that our tech stack is proven. In most cases, everything we’re doing has been done in some form for more than a century. Our preference for uncomplicated commodity products means our market approach is already mature, underscored by our signed offtake agreements. Key uncertainty lies in the intersection of our plunging cost trajectory with industrial-scale photovoltaic power’s plunging cost trajectory, but our biggest miss so far is that demand for synthetic natural gas has strengthened a lot faster than we thought it could. Our primary constraint is still our ability to scale to meet market demand.

Terraform is constituted as a maximally pure bet on lowest cost solar power. If there’s a way to make more money from cheaper solar, we would like to hear about it.

We expect to be profitable with fewer than 500 units (< 500 MW) deployed.

The global natural gas market is worth $1.1T/year, while all fossil fuels earn $6.8T/year. With Terraform Industries improving access to cheaper fuel and supercharging global economic growth, we see gross revenue in synthetic fuels climbing to $13T/year by 2045.

Join the Terraform Journey

Follow them on Twitter @TerraformIndies and CEO/Founder @CJHandmer

LinkedIn Terraform Industries and Casey Handmer

Join their mailing list for updates mailinglist@terraformindustries.com

Korea's first electric aviation service MintAir purchases 30 Odys VTOL aircraft.

MintAir's eVTOL service will initially cover existing domestic routes and leverage regional airports, later expanding to new infrastructure and longer routes made accessible by Odys's vertical take-off and landing capability.

MintAir, an advanced air mobility (AAM) service provider in South Korea, has signed a letter of intent with US-based developer Odys Aviation to purchase its hybrid-electric VTOL aircraft. Under the agreement, MintAir will add 30 of Odys's aircraft to its fleet for regional air mobility operations in South Korea.

MintAir's service will initially cover existing domestic routes and leverage regional airports, later expanding to new infrastructure and longer routes made accessible by Odys's vertical take off and landing capability and extended range of 750 miles (1,200 km). Odys's hybrid-electric propulsion system produces zero CO2 on routes less than 200 miles (321 km). Mobius.energy Corporation, an aircraft battery manufacturer headquartered in southern California, will be supplying its high-voltage battery (800V).

The agreement between MintAir and Odys has attracted the support of Sejong City, located 75 miles (121 km) south of Seoul. MintAir has engaged city officials to build an advanced air mobility hub there; the regional air mobility service between Sejong City and Seoul will provide an easier commuting alternative, saving travellers valuable time by avoiding long drives. Sejong City is a new ‘smart city’ designed to serve as the administrative and government capital of South Korea and located in the centre of the Korean peninsula.

“MintAir is focused on creating the safest advanced air mobility service in both urban and regional routes,” explains CEO Eugene Choi. “We selected the Odys hybrid-electric VTOL because of its long range capability of 750 miles, the energy-saving efficiency of its high-lift flap technology, lower operating costs and the clear path to certification."

“We are excited to team up with MintAir to bring a faster and more convenient way to travel and connect cities large and small throughout the Korean peninsula,” adds Odys co-founder and CEO James Dorris. “We look forward to working with MintAir to make regional travel more efficient and create an exceptional flight experience for all travellers, starting with government officials commuting between Sejong City and Seoul.”

The Odys Aviation hybrid-electric VTOL aircraft has room for up to nine passengers and two pilots. Diverse seating options for both commercial and executive use are available including club seating and capacity for baggage. It will have a maximum speed of 345 mph (555 km/h), a range of 750 miles and a cruise altitude of 30,000 ft. This design, which allows the aircraft to take off and land at city helipads, municipal airports and future vertiports, cuts travel time in half on the world's busiest travel corridors and offers a total trip cost that is competitive with existing travel options.

Aadya closes $5m Series A to scale their Judy AI cybersecurity platform for small to midsize businesses

Aadya plans to grow its channel program and SMB market share for thier Judy AI, an accessible, affordable, artificial intelligence automated all-in-one cybersecurity platform.

ALSO READ:

US-based CyberTech platform AaDya Security secures $5m - FintechGlobal

AaDya, a cybersecurity startup for small and midsized businesses, raises $5M - SiliconAngle

April 26, 2023, Detroit, Michigan - AaDya Security, a software company founded by cybersecurity veteran Raffaele Mautone in March of 2019, announced the close of a $5 million Series A funding round. Led by Mautone as AaDya’s CEO, the new funding will enable the company to fill a key leadership position in finance and expand its sales team to accelerate the growth of its channel program for managed service providers, resellers and referral partners serving small and midsize business customers.

New York-based Left Lane Capital led the funding round with participation from current investors 645 Ventures, Firebrand Ventures, Gaingels and Invest Detroit.

Along with the funding round, AaDya is also announcing its new board of directors which includes a majority of experienced female cybersecurity executives–a rare occurrence in what is typically a male-centric industry. Board members include Julie Cullivan, Didi Dayton, Laura Sillman, Tom Lazay and Raffaele Mautone. Cybersecurity and channel veteran, Lisa Matherly will serve as an advisor for the marketing and channel teams.

“The majority of small business owners lack the resources to protect their businesses against rising cyber security threats as they have been overlooked and underserved by existing offerings. This leaves tens of millions of small business owners vulnerable to phishing, malware, and ransomware attacks that can be catastrophic to operations. We are excited to partner with Raffaele & the AaDya team of industry veterans, who share our mission to empower SMBs against this growing existential risk,” said Laura Sillman, Vice President of Left Lane Capital.

Judy, AaDya Security's all-in-one, cybersecurity solution was designed specifically for the needs of small and midsize business customers and the service providers that support them, a market segment that is often overlooked and underserved by established software vendors. The software platform is easy-to-use and manage, without compromising on security. This empowers SMB customers to easily protect their businesses from threats and meet increasingly strict regulations and compliance requirements related to data security and access. It also helps managed service providers (MSPs) and managed security service providers (MSSPs) looking to scale or streamline their security offerings by automating and streamlining security tasks and monitoring.

“The entire idea and mission behind AaDya Security is serving a population that many of the major players within the cybersecurity industry have avoided due to its cumbersome nature and revenue potential,” said Mautone. “We see this differently. With the combination of a vast universe of SMBs who have been underserved and the rise in cybercrime against them, we saw an opportunity to not only create something innovative, but something that could truly help a segment that comprises the majority of economic activity, not just in North America, but across the globe.”

Mautone’s bold focus on the often-overlooked SMB customer is matched by his unique, female-forward approach with the company’s brand. He explains, “When I first sketched out the idea for our all-in-one platform, I knew that leading with fear, technical imagery and industry jargon was not the best way to serve them. I’ve been lucky in my life to be surrounded by strong, smart, successful women who have helped guide my career, so Judy as the heart and brains of our platform and our brand was very intentional.”

About AaDya Security

Headquartered in Detroit, Michigan, AaDya Security provides smart, simple, effective and affordable cybersecurity software solutions for small and midsize businesses. Judy, our all-in-one cybersecurity platform, leverages AI and machine learning to deliver next-generation, 24/7 protection and support for companies who lack the time, expertise and capital to successfully implement these solutions on their own. For more information please visit our website, AaDyasecurity.com

About Left Lane Capital

Founded in 2019, Left Lane Capital is a New York-based global venture capital and growth equity firm investing in internet and technology companies with a consumer orientation. Left Lane’s mission is to partner with extraordinary entrepreneurs who create category-defining companies across growth sectors of the economy, including software, healthcare, e-commerce, consumer, fintech, edtech, and other industries. Today, Left Lane Capital has invested in more than 60 companies worldwide. Select investments include GoStudent, M1 Finance, Wayflyer, Bilt, Masterworks, Blank Street, Talkiatry, Tovala, and more. For more information, please visit https://www.leftlanecap.com/.

Natilus aerospace innovation takes flight test of autonomous cargo drone

Huge congratulations to the team and a big step forward as Natilus Aerospace successfully launched the first flight test of their autonomous cargo drone.

The Natilus Kona cargo drone remains on track for its first flight in 2024.

San Diego-based Natilus has begun flight testing of a scale-model prototype of its 4.3-tonne-capable Kona autonomous cargo drone. The series of flight tests occurred at a private airport in the southern California desert, Natilus told Air Cargo Next. During the test, the one-quarter-scale composite model reached speeds of 60 knots, validating the aerodynamic performance.

The first step for a new vision for air freight

Natilus is revolutionizing the 75-year-old status quo of freight transportation through innovation and advanced technologies, to make air freight costs competitive to cargo shipping and dramatically improve delivery times.

Natilus has designed and developed a blended-wing, autonomous global air freight system that can offer services at a fraction of the cost of today’s transport, while reducing negative impacts on our environment.

AI market intelligence startup AlphaSense valued at $1.8 billion after Alphabet's CapitalG leads fundraise

We are thrilled to see Alphabet's CapitalG leading the latest round in our portfolio Co AlphaSense to accelerate their global platform adoption and advancements in their AI technology as they prepare for an IPO when the markets open.

ALSO READ:

AlphaSense: The Emerging Leader in AI-Enabled Market Intelligence - CapitalG

"We’re excited to announce CapitalG’s investment in AlphaSense, the emerging leader in market intelligence and research. AlphaSense is disrupting the way knowledge professionals discover the data and insights their companies need to make strategic decisions more confidently.

AlphaSense Raises $100 Million Led By Alphabet's CapitalG - Entrepreneur

In addition to expanding value to customers through R&D, the new capital also furthers AlphaSense's capacity to make strategic acquisitions that expand its platform capabilities and increase the value it delivers to customers.

Alphabet’s A.I. frenzy hits startup scene as CapitalG unit leads $100 million investment in AlphaSense

- Alphabet’s CapitalG led a $100 million funding round in AlphaSense at a $1.8 billion valuation.

- AlphaSense competes with financial data companies like Bloomberg and FactSet.

- The money will, in part, help AlphaSense incorporate large language models into its products.

AlphaSense CEO Jack Kokko joins Caroline Hyde and Ed Ludlow to discuss how Alphabet's independent growth fund CapitalG led a $100M round in the AI-driven market intelligence and B2B research platform at a $1.8 billion valuation >>> WATCH HERE

AlphaSense the leading AI powered market intelligence and research platform announced it has raised $100 million in a fresh round of funding backed by Alphabet's venture capital arm CapitalG that valued the market intelligence platform at $1.8 billion.

"We're honoured to partner with CapitalG through this financing and to be recognized for our leadership in AI-driven search capabilities for the business world. Every company's enterprise value is a cumulative sum of the decisions they make - and our mission is to improve strategic decision-making for businesses worldwide. With the big leaps we are taking with AI to deliver even more precise data and insights to our customers, I am more excited than ever by our product roadmap and business momentum. This financing and partnership will help accelerate that even further," said Jack Kokko, CEO and founder of AlphaSense..

The current round is a $100 million addition to its $225 million Series D financing round at a $1.8 billion valuation through new investments by CapitalG, Alphabet's independent growth fund, and existing investors, including the Growth Equity business within Goldman Sachs Asset Management (Goldman Sachs) and Viking Global Investors. This investment will fuel the continued deployment of AlphaSense's advanced AI capabilities, including generative AI that dramatically speeds up the research process for business and financial professionals. In addition to expanding value to customers through R&D, the new capital also furthers AlphaSense's capacity to make strategic acquisitions that expand its platform capabilities and increase the value it delivers to customers.

New York-based AlphaSense said it will use the funds to further its advanced artificial intelligence capabilities. Last year, the company was valued at $1.7 billion after raising $225 million.

AlphaSense helps its customers extract relevant information from a trove of public and private content such as equity research, earnings calls, company filings and news.

Amazon Ads veteran Ed Dinichert joins TripleLift to lead as Chief Revenue Officer

Dinichert begins with TripleLift in April and will lead a 200+ person global team oversees customer success and direct a burgeoning commerce media offering

Ad industry veteran Ed Dinichert is joining TripleLift, the digital media platform on a mission to elevate advertising across every screen, as Chief Revenue Officer. The move comes at an inflection point for the company and the digital ad industry more broadly. New data privacy requirements, a shakeup in platform influence, and a shift in spending to connected television and retail media networks are signaling an immense level of current and future change.